Abstract:

This paper is an attempt to analyze the practices of Mudarabah and Musharakah been held by the existing Islamic banking. This paper aims to explore the different aspects where Islamic banks were found to be violating the basic rules in these two primary modes of Islamic finance. This paper denies the current practices of Mudarabah and Musharakah at many grounds, like its existence with the concept of limited liability, absentee as a partner, supervisory role of the state bank, and its role as sleeping Mudarib. Similarly, the expense and profit estimation techniques and the acquired procedure to maintain the minimum account balance requirement were also inappropriate with the basic tenets of Shari’ah Principles. This article argues that the structure of overall Islamic banking is purely based on interest bearing investment and financing. It further argues that they deal only in money; they are not involved in any kind of business or trade. According to the authors, the contemporary Islamic banks are inconsistent with Shari'ah in their practices.

Key Words:

Islamic Finance, Mudarabah, Musharakah, Shari’ah

Introduction

The bank is a financial institution that is established for the purpose of accepting deposits and advancing loans. The conventional banks accept these deposits from the depositors who well to deposit their surplus money in their bank accounts and then advance these deposits in the form of loans to the borrowers who well to pay a specified interest to these banks. These banks earn interest as a reward of their agency services being financial intermediaries. Due to the interest-bearing nature of their operations, the Islamic Jurists are unanimous about the invalidity of these banks (Goyal & Joshi, 2011).

In order to get rid of the despised and vile interest-bearing conventional banking system, it was injected by the experts of “Islamic economics & finance” with red syrup of Islamic finance and, therefore, they succeeded in bringing its alternative in the form of so-called "Islamic Banking". The primary function of any Islamic bank was, however, declared to be the acceptance of deposits in the form of Mudarabah and Musharakah. The advancement of these deposits to a third party in the form of Bay Murabaha (cost plus profit), Ijarah-was-Iqtina (lease purchase scheme), and Musharakah Mutanaqisha (diminishing partnership) was considered to be its secondary functions (Ahmad, 1994). Being a partner, the Islamic banks were awarded so-called “profit” as a reward of their services as Islamic financial intermediaries.

The supporters of Islamic banking argue that the existing Islamic baking is consistent, both in its objectives and practices, to the laid down principles of Shari’ah (Moin, 2008; Noor mohamed, 2019; Bhutto & Siddiqui, 2020; Mulli, 2020). Such scholars have written many books and articles for the validity and authenticity of the operations been held by the existing Islamic banking. In order to convince the general public about its legality and Islamic acceptability, these scholars have also issued many “Fatawa” from different “Mufthees” across the country. The legendary role is, however, been played by Mufti M. Taqi Usmani, who has written several books like "An Introduction to Islamic Finance", “Jadeed Tijarat was Maeeshat," and “Ghair Soodi Benkari” on legitimacy and support of the existing Islamic banking. Besides the intellectual involvement, the majority of these scholars have also shared their professional experiences as Shari’ah advisors to different Islamic banks, which has led the scenario towards further strength, potency, and growth of the system.

However, the critics to the existing Islamic banking argue that the practices and its existence as a juristic person are totally contradictory to the Islamic Jurisprudence. In support of their stance, they have composed many books which deny the basis of Islamic banking in the aforesaid grounds. Books like “Murawija Islami Bankari” [Traditional Islamic Banking], “Muraawija Islami Bankari ki Chand Kharabiyan” [Some defects in the traditional Islamic Banking], Islami Nizam-i-Maishat kay Tanazur main Mawjoodah Islamic Banking par aik Tahqiqi Fatwa” [A research fatwaon current Islamic Banking in the context of Islamic Economic System], Dawr Hadir ke Mali Muamlat ka Shari Hukam” [Sharia’h ruling on the contemporary financial matters], and "Maisha was Tijarat kay Islami Ahkam" [Islamic rule on economics and trade] , with many others, are considered by them as “Unanimous Fatwa” against the existence and practices of the contemporary Islamic banking. In their views, these banks are just manipulating or Islamizing the conventional banking products by using Shari’ah terminologies for capturing the attention of those customers who are thirsty for a transparent ideal Islamic system (Shaikh, 2011). To them, the Islamic banking is “Haram or illegal” because it is based on illegal tricks & devices. To them, the case of Islamic banking is the same as that of conventional banks. For working in Islamic banks, the directions are the same as for working in conventional interest-bearing banks (Shaikh, 2013).

This article is an attempt to explore the legitimacy of the primary modes of Islamic finance, i.e., the practice of Mudarabah & Musharakah being held by the existing Islamic Banking. Its legitimacy as an artificial person having limited liability, and the authenticity of its secondary modes of financing, like Murabaha, Musharakah Mutanaqisha & Ijarah-was-Iqtina are also intended to be explored in some other articles. Before moving towards the Sharia’h legitimacy of the primary modes of Islamic finance, it stands vital to present a hypothetical sketch of these two modes of financing.

The Practices of Musharakah & Mudarabah: A Hypothetical Sketch

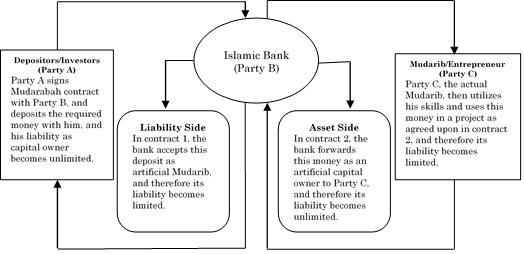

As discussed earlier, the Islamic banks receive deposits in the name of Mudarabah from the general public and then inject these deposits in Bay Murabaha (cost plus profit), Ijarah-was-Iqtina (lease purchase scheme), and Musharakah Mutanaqisha (diminishing partnership). The bank signs two different contracts with its clients, one with depositors as Mudarib and the other with entrepreneur (Mudarib) as capital owner. In the first contract, the bank records its liability to be limited at the liability side of the balance sheet, whereas the bank in its second contract declares its liability to be unlimited at the asset side of the balance sheet. This relationship between bank and clients can be enlisted in the following hypothetical diagram.

Figure 1: The Practice of Musharakah & Mudarabah

The outer circular flow in Figure 1 represents the flow of capital and return among these parties. With these fundamental concepts, the Islamic banks were found to be violating the conditions and rules of Mudarabah and Musharakah contracts, been established by Islamic Jurisprudence, on the following grounds.

Liability: the Basic Rule of Partnership

As we know, the share of liability in any kind of partnership related to business affairs is subjected to the capital contribution of the engaged parties. The Fiqhi instructions related to sharing in profit or loss in a general partnership is that “the share in profit depends upon the mutual consent of the parties, whereas, the share in loss totally depends upon the capital invested by each partner” (Ali, 2008). Following this rule, the Islamic jurists are unanimous of the view that the liability of the capital owner in general Mudarabah contract should be unlimited because he is the sole investor of the whole project. If there is a loss to the business, then the capital owner will be totally held responsible for that loss. The Mudarib will enjoy “Zero Share” in the financial loss with a condition that the incurred loss should not be due to his negligence, dishonesty, misconduct, or involvement in a breach of terms. However, the wastage of skills, labor, time, and professional experiences will be considered as a loss to the Mudarib in the aforementioned scenario (Sapuan, 2016; Rahman, 2018). On the other hand, if Mudarib takes loans for business with permission on behalf of the capital owner, then the liability will be borne by the capital owner, and if the loan has been taken by Mudarib on his own behalf, with or without permission of the capital owner, then the liability will be completely borne by the Mudarib.

Similarly, for the provision of legal support to contemporary Islamic banking, some of the Islamic jurists have tried to present the prospectus of an Islamic bank as evidence for the concept of liability to be limited or unlimited. Following their arguments, however, the prospectus of Islamic bank was found to be performing a dual role in the quantification of liability. On the one hand, these scholars are declaring the signature of the depositor on the deeds of agreement as evidence for the liability of depositors to be unlimited. The transfer of the "loan taking right" from the depositor to the Islamic bank is declared to be the reason of his unlimited liability. On the other hand, the word "limited liability," written on the brow of Islamic banks, is declared as evidence for the liabilities of all the parties, including the bank, to be limited. If Shari’ah has explored the concept and quantity of liability in a contract, then how these banks can randomize it through their prospectus?

With reference to contract 1, if loans have been taken by the Islamic bank (Mudarib) on its own behalf, then why its share in liability should not be unlimited? What is the logic to limit its liability? And if this loan has been taken on behalf of the depositors, then what is the reason or logic to limit the liability of the capital owner (depositor) through the prospectus of the bank? Is it not against the laid down principles of Mudarabah contract? Since Islamic bank is a financial intermediary, therefore, his role should be limited to the agency services only. The concept of liability is totally linked with either "capital owner" or "Mudarib." Therefore, the bank is not entitled to quantify the limit of liability. Whatever he invests, that is the money of either shareholders or depositors, and the liability of the investors is always unlimited, irrespective of the nature of the modes of finance.

Even if we accept the presence of a bank as a juristic person and accept him as a partner, then how one can limit its liability? Who should be held responsible for the incurred debt if losses exceed the capital invested? With the further extension, if liabilities of all the partners were assumed to be limited, then who will be held responsible for the settlement of debts/loans been taken from the general public? From here, one can easily conclude that the concept of limited liability by the Islamic bank is not justifiable at any ground.

While solving the problem of liability and control of some other factors like risk of default, trust deficit, agency problem, documentation, and adverse selection, Shaikh (2013) has given a proposal that the entrepreneur (the Mudarib), in contract 2, can be asked to share the equity and loss to some extent. The problem with this proposal is that this contract will not remain a Mudarabah contract anymore; rather, it will become a Musharakah contract, having sleeping partners elsewhere. Restricting Mudarib to share the incurred financial loss is also against the laid down principles of Mudarabah contract. In Mudarabah, the Mudarib is neither asked to participate in equity, nor to guarantee the capital invested, nor to share the financial loss. His participation in the project takes the form of human capital (i.e. his skills and labor), for which he entitles himself to share the profit of the business. His share in the loss, if any, will be the wastage of his skills, labor, time, and professional experiences.

Absence of Bank as a Party at the Time of Contract

Islamic Jurists have described various conditions about a valid business contract. The existence of two contracting parties at the time of the contract is one of the main conditions to be fulfilled before confirmation of the contract. We know that a bank is a registered company having two distinct characteristics, first, artificial person and, second, limited liability. The non-existence of the artificial person (Islamic bank) at the time of contract is another problem with the Islamic bank, which violates the aforesaid condition of a valid contract. It is impossible to make the bank present at the time of contract because it does not exist in any shape in the universe. Therefore, its absence as a party at the time of contract leads the Mudarabah contract towards its disqualification right before its confirmation and commencement.

Illegal Oath from clIents

Taking an un-Islamic oath from their clients is another problem with the existing Islamic banking. The form to be filled and countersigned by the clients clearly states that the bank will be regulated by the rules of the state bank of Pakistan, the reality of which is not hidden from the eyes of any rational person. SBP is the driving force of all economic evils who assumes itself free from every Islamic principle related to the regulation of the economic affairs of our country, and where the majority of its rules and regulations are contradictory with the established principles of Shari’ah. How can an Islamic bank take Oath from its clients on the prescribed rules of an institution who is abundantly betrothed in interest-bearing transactions? How an Islamic institution can go under the shed of an institution where he is forced to obey all of his illegal and unlawful directives?

The Supervisory Role of the State Bank

As discussed earlier, the Islamic bank is a company that is incorporated under the company ordinance 1984. Just like conventional banks, Islamic banks are also supervised and controlled by the State Bank of Pakistan. The primary function of a state bank is to control the money supply and cost of the credit. In other words, quantifying the availability of money (liquidity) at a specific price (interest rate) is the basic function of any central bank across the world. The SBP uses many tools in order to control these two. Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) are two of them. Under CRR, a certain percentage of the total bank deposits (whether Islamic or un-Islamic) have to be kept in the current account with SBP or in the current account with its representative bank like NBP. The SBP doesn’t pay any interest on these balances to the Islamic banks. However, it uses these funds in interest bearing transactions like purchase of securities in open market operation and lending it either to the government or other banks. The CRR for Islamic banks in these days is 5%. In SLR, the Islamic bank is imposed to maintain certain amount of total demand liabilities (including time deposits with tenure of more than one year) either in the form of cash in hand, balance with NBP in the current account, balance with SBP in current account or invest it in unencumbered approved securities as notified by SBP from time to time. The Islamic banks earn some amount of interest/profit, depending upon the situation, on these balances. If these balances were kept with the NBP or SBP, then there is no doubt that the reward on these balances will be Haram from an Islamic point of view. The SLR for Islamic banks in these days is 19%. A matter of concern is that the SLR for conventional and Islamic banks is the same.

One can easily conclude from the above discussion that due to the supervisory role of the SBP, the Islamic banks are bound to keep a specific amount of their total deposits with the SBP. Even if we assume that the SBP doesn’t pay anything as return on these deposits to the Islamic banks, still the role of Islamic banks as architects for the extension and development of the SBP can neither be cornered and nor acceptable to even a pathetic individual of our society. Further, if we also assume that the existing Islamic banking is not directly involved in any sort of illegal trades or investments, still its role and contribution in the expansion of the capitalist system is enough for its invalidity. The money has been kept by the depositor in his Mudarabah account with the hope of earning some halal profit were actually been partially utilized by the Islamic banks for the potency, growth, and development of the “father of economic evils”. The paradox of the theory is that with all these evils, the Islamic banks still declare themselves to be consistent with the laid down principles of Shari’ah.

Sleeping Mudarib: Zero Risk Taker

For a valid Mudarabah contract, it is necessary to have an active Mudarib who manages the Mudarabah fund by utilizing his skills and timing to the best of his extent. He should also bear the risk (profit or loss) of the business. His active participation in the business, surrounded by many risks, is the only reason which allows him to share the profit of the business. Islamic banks, on the other hand, neither participate practically as actual Mudarib in the Mudarabah contract and nor bear the risk of the business. As mentioned earlier, these banks simply take money from depositors in the name of Mudarabah or Musharakah and then forward it to a third party in the shape of different contracts, like Mudarabah, Murabaha, Diminishing Musharakah, and Ijara-was-Iqtina. In Mudarabah & Musharakah, the third party then utilizes his labor and skills while bearing all risks of the business. The profit generated from these agreements is then shared with the Islamic bank, who shares it further with actual capital owners, i.e. the depositors.

The Islamic bank, as Mudarib, is neither involved in the conduct of business operations nor in sharing risk of the business. Therefore, his share in the profit as a sleeping Mudarib with “zero risk," except documentation, is not justifiable on any ground. The Islamic Jurists have clearly declared it against the two well-known principles of Islamic Jurisprudence; "Al-Khiraj Bizzaman” and “Al-Gharamo Bil-Ghanami”.

Penalizing the Low-balance Accounts

In order to deal with the unproductive low-balance accounts, the Islamic banks have adopted the practice of putting penalties on these accounts by taking them as a stick yard from the conventional banks. Any account which fails to maintain the required balance is either deprived of share in the profit of the bank or penalized for a specific amount or sometimes converted immediately from PLS to the current account. In order to be eligible for a share in the bank's profit, Dubai Islamic Bank requires a minimum amount of $500 US to be maintained in a foreign currency account (Ahmad et al., 2012). On the other hand, it charges Rs. 50/- on saving plus & special saving accounts, it went below the minimum limit. On the locker facility, this bank charges Rs. 100/- per month as locker late payment charges (Dubai Islamic Bank, 2014). Similarly, Barkat Islamic Bank- a subsidiary of Faysal Bank- charges Rs. 100/- on all its low-balance saving accounts (Ahmad et al., 2012).

The Islamic verdicts are very much clear about these issues. Islam is too much sensitive and carries about the wealth of Muslims, where even killing of a person doesn't make the wealth of someone permissible to others. Islamic foundations are lying over physical punishment of the culprit in the form of Qisas, Ta’azir and imprisonment. The Islamic Jurists are strictly opposed to any sort of financial punishment. According to Imam Shafi (RH), “punishment is only physically not financially”. Hanfi sect has also denied its origin by saying that "financial punishment is invalid.". Further, punishment in Islam is subjected to crime. What is the crime of the depositor? Is it his crime that he was unable to maintain the lower limit of balance in his account?

Sharing of profit is a Shari’a-granted right of every partner in Musharakah and Mudarabah based deposit accounts (Ibid). He can never be deprived from his share in profit. If any Islamic bank does so, then it will make the contract invalid, the profit of which is also invalid or haram. Conversion of the initially signed agreement, i.e., Musharakah/Mudarabah, into the current account also requires a new agreement. Otherwise, this conversion will be void.

Invalid Expense Estimation Techniques

Deduction of expenses from the account of capital owner (depositor) by the Mudarib (bank) in Mudarabah contract is another problem with the contemporary Islamic banking. Expenses of the Islamic bank takes either of the two forms, first, expenses in the form of salaries to employees including paid shareholders (i.e., the directors) and, second, expenses in the form of fees, utility bills, commission, taxes, duties, rent, and other charges. These expenses are deducted either from the overall profit of the partnership-based businesses like Musharakah, Mudarabah, Murabaha, and Ijara-was-Iqtina or from the principal amount of capital invested in Mudarabah account. The form to be filled by the client as an agreement with the Islamic bank is the recognition of our stance which clearly states that the bank may, without any further express authorization from the customer, debit any account of the customer maintained with the bank for: "all expenses, fees, commissions, taxes, duties or other charges and losses incurred, suffered or sustained by the bank in connection with the opening/operation/maintenance of the account and/or providing the services and/or for any other banking services which the bank may extend to the customer.".

The Islamic Jurists are unanimous of the view that Mudarib is not entitled to any claim other than his share in profit. He is not allowed to take any sort of fee or commission on behalf of his services in Mudarabah contract. The provision of his services is the only reason which entitles him to share the profit of the business. Moreover, if Mudarib hires the services of any employee for the conduct of business affairs, then the incurred wages or salary will be deducted from the Mudarib’s share in profit. The Islamic bank, due to its artificial nature, is also unable to involve itself directly in the Mudarabah contract, that’s why it hires paid employees to look after the business operations. Jurists, who support the existing Islamic banking, are also of the view that the Islamic bank, as a Mudarib, will be solely responsible for expenses like salaries, commissions, bonuses, and allowances. Instead of deducing these expenses from the overall profit of the business, these deductions should be made from the bank’s share in profit. On the contrary, the bank deducts these expenses from the overall profit of the business, which, apparently, reduces the overall share in the profit of the capital owner. This act of bank is resembled with that of “a’akl bil-batil”, by majority of the Islamic Jurists.

Further, the Islamic Jurists are also unanimously of the view that one partner can’t become remunerator for the other partner in a partnership. Therefore, the Mudarib is not allowed to claim any periodical salary or a fee or remuneration for his services in the Mudarabah contract (Usmani, 2004). In partnership, if a partner is physically contributing with its capital in the business, then his services and capital can be compensated through a higher ratio in profit only. His services are not remunerable at any circumstances. On the contrary, the directors of Islamic banks not only earn a profit on their investments as shareholders, but they are also compensated in the form of salaries, allowances, bonuses, commissions, and perquisites on behalf of their practical & intellectual involvement in the conduct of banking operations. These payments are then considered as the expense of the business and therefore deducted from the overall profit of the business. These invalid expense estimation techniques indicate that the present Islamic banking has manipulated their activities with the exact procedures and illegal tricks of conventional banks.

Uncertain Nature of the Mudarabah Fund

One of the main conditions of Mudarabah contract is the confirmation of quantity and use of the principal amount before the commencement of the Mudarabah contract. The partners must be clear/sure about the quantity of money been invested or to be invested by all of them before the commencement of the Mudarabah contract. The route of using this fund should also be designed and made certain in advance. The project where this money should be invested must also be known to all of them. If the nature (quantity and use) of Mudarabah fund was not certain before the commencement of Mudarabah contract then, according to the Islamic Jurisprudence, this contract will become invalid.

The Islamic banks were, however, been found inconsistent to these principles of Shari’ah. Volatility in Mudarabah fund due to withdrawal and depositing of money in different intervals during the tenure of the contract is the basic problem been faced by the contemporary Islamic banking. Islamic Jurists are unanimous of the view that any change (i.e., withdrawal or depositing) in Mudarabah fund is subjected to the renewal of the contract, because this change will automatically dissolve the existing contract. However, the Islamic banks neither fix the principal amount nor renew the contract after a change in Mudarabah fund, which is the essential part of a valid contract. This attitude and practice of Islamic banking put serious questions over the legitimacy of its operations.

Furthermore, the majority of the clients of Islamic banks even don’t know where the money they deposit will be invested by these banks. The Islamic banks also don’t clarify whether this money will be invested in Musharakah, Mudarabah, or Murabaha contracts.. The uncertainty of its use is enough as evidence for the invalidity of the contract been held by Islamic banks with their clients.

Discrimination in Profit Estimation Technique

Just like conventional banks, Islamic banks also deploy the weightage technique towards the incurred profit and then distribute it among the shareholders of the banks with a factious rate of return in an unlawful way. Following this technique, these banks assign different weights to a different amounts of deposits been kept in Mudarabah accounts. For example, in April 2008, the Meezan Bank assigned 0.31 weightage to public deposits of amount between ten thousand (10,000) and hundred thousand (100,000), and 0.36 weightage to deposits of above hundred thousand (100,00) but below one million (10,00,000). Conversely, the Meezan Bank has assigned a weightage of 1.7 to its own deposits in the aforementioned month, which was much larger than that of its partners (Zubair & Caudhary, 2014). While discussing the consequences of this method, Hafiz Zulfiqar Ali writes: “this mean that keeping less amount of capital in an Islamic bank is a crime and the punishment for this is lower weightage”. Tagging the assigned weightage with the amount of capital is unfair (Ali, 2008)”.

The question at issue is the participation of Islamic banks as capital owners in the Mudarabah contract. If it takes money as Mudarib from the general public by signing a Mudarabah contract, and then adds its own capital in the Mudarabah fund, the contract will then not remain a Mudarabah contract anymore rather, it will become a Musharakah contract. And for that, the dissolution of the previous contract and its renewal as Musharakah contract with mutual consent of all the partners is mandatory.

Factious Rate of Return: The Daily Production

The Islamic banks use the daily production technique for paying return of a project to the depositors, who continue to withdraw and deposit their money with different intervals during its tenure. Following this method, the bank first quantifies the per day average use of money and then it calculates the per day per rupee profit of the business. At last, the Islamic bank multiplies the per day value of profit by the number of days for calculating the profit to be paid (Ahmed, 2013; Zubair & Chaudary, 2014). In other words, we can say that the estimated rate of return is factious in the sense that it is totally based on unrealistic and imaginary values because the bank doesn't take into account the duration of money been kept in the account. The money that has been withdrawn by the depositor from his account is of the same worth to the Islamic bank like that of lying in his account. Further, the real share in the profit of one party, who have the full amount in his bank account, is unlawfully transferred to another party, who has withdrawn partial or full amount from his account during the tenure of the project. Further, even if we assume this procedure is acceptable, then is it acceptable in the distribution of losses, especially in a situation when there was no money in the account of the depositors in that particular month? The answer is "NO" because in partnership, the loss of one partner can never be borne by the other one. According to Hazrat Ali (RA), "profit depends upon the mutual consent of the partners, whereas, the loss is subjected to capital participation only” (Ali, 2008). Due to these drawbacks, the Islamic Jurists have resembled this act of bank with that of "all-bil-bathil" (eating one's wealth unlawfully).

On the other hand, Islamic banks were also found addicted to using the daily interest rate of conventional banks as a benchmark in the determination of daily product rate. And we know that in Islam, the resemblance with non-believers in even a lawful activity (like fasting on 10th of Muharram) is not permissible to a Muslim, then how it can allow the resemblance in an unlawful activity (like the use of interest as a benchmark)?

Volatility is the Rate of Return

We know that the partners must agree on a specific and certain rate of return before the commencement of the contract. None of the partners is authorized to charge this rate during the tenure of the contract. However, if they are willing to change this rate with mutual consent, then renewal of the contract with new rates will become mandatory.

The form to be filled by the depositors clearly states that "the bank is authorized to bring a change in the ratio of profit. However, in this case, the bank is liable to display the changed ratio either on its website or on its notice board (Ali, 2008). It means that, in banking Mudarabah, the Mudarib (i.e. Islamic bank) is free to determine the return of his own choice. The bank is not liable to consult its partners regarding major decisions of the business operation. The degree of freedom can be quantified through his sovereignty in the determination of the rate of return, profit, and even in loss. They neither assume themselves liable to change this ratio by consulting their partners through the renewal of contract nor to communicate it properly to their partners. The uncertainty of the rate of return acts as evidence that denies the basis of Islamic banking in the aforesaid lines.

Withdrawal of Money before Maturity

Dissolution of Musharakah contract before its maturity is another problem with the existing Islamic banking. In Musharakah, the partner has the right to withdraw his principal amount with his share in profit, gained so far, at any time during the tenure of the contract by giving advance notice to the concerned party. The amount (principal plus profit) to be returned may take any shape like cash or assets, depending upon the demand and well of the concerned partner. In Musharakah, this partner can neither be forced to sell his share to the other party (whether discounted or compounded) nor to take his share in cash only. On the contrary, the Islamic banks impose such partners to sell his share either to the company (the bank) or to any other investor at a discount rate. His share in profit, generated so far, is also being swallowed by the banks partially because the worth of his share in profit at the time of dissolution is based on imaginary and factious rate of return.

These banks also don’t identify the partners to whom they are supposed to sell their shares. Sale of shares to the bank, artificial person having no real existence in this word, is another issue which puts serious questions on the validity of transferring the shares to the bank, because the existence of party at the time of contract is the basic condition of a valid contract. The question at issue is that why Islamic banks bound their partners to sell their shares in cash? The answer is very simple. The Islamic banks bound their partners to sell their shares in cash due to the fact that these banks are not involved in any real business or productive economic activities, so that these banks were able to transfer the assets of the business to those who want to withdraw their capital even before or after its maturity in the form of assets. That’s why these banks bound their clients, right from the beginning in the form of a contract, that they will sell their shares in cash to the banks or partners at the time of unilateral dissolution of the contract.

Engaging Mudarabah Fund in Interest Bearing Investment & Financing

The major problem with the existing Islamic banking is their involvement in interest bearing investment and financing. Evidences reveal that Islamic banks are investing a major portion of their deposits in the purchase of KSE100, KSE30 common and preferred stocks, Pakistan investment bonds, GOP treasury certificates and bonds, mutual funds and term finance certificates. The Islamic banks have invested Rs. 240 billons in federal government securities during Oct-Dec 2014, which constitutes 67 percent share in the overall investment of the Islamic banking sector.

These banks have hired expert professionals for the conduct of these kinds of operations. Deposits collected under schemes of “Halal Munafa” are also used for such impermissible activities in the name of Islam. Approximately 22.47% of total deposits (i.e. Rs. 240.5 billion out of Rs. 1070 billion) were invested in federal governments’ securities by the Islamic Banks, as of Oct-Dec 2014 (see Table 1 and Table 2).

Table 1. Investments of Islamic Banks (Million Rupees)

|

Nature of Investment |

|||||

|

Dec-13 |

Sep-14 |

Dec-14 |

YoY |

QoQ |

|

|

Federal government

securities |

266,687.2 |

244,265.7 |

240,451.1 |

(9.8) |

(1.6) |

|

Fully paid up ordinary

shares |

4,334.8 |

5,845.9 |

5,350.1 |

23.4 |

(8.5) |

|

TFCs, Debentures, Bonds,

& PTCs |

34,000.1 |

42,376.7 |

45,066.6 |

32.5 |

6.3 |

|

Other investments |

90,869.6 |

63,038.3 |

67,349.0 |

(25.9) |

6.8 |

|

Investments by type |

|||||

|

Held for Trading |

2,183.66 |

2,205.65 |

4,028.15 |

84.5 |

82.6 |

|

Available for Sale |

368,089.8 |

328,632.0 |

331,233.4 |

(10.0) |

0.8 |

|

Held to Maturity |

15,383.5 |

16,573.8 |

18,297.2 |

18.9 |

10.4 |

|

Surplus /(deficit) on

revaluation |

2,714.9 |

3,102.0 |

650.3 |

(76.0) |

(79.0) |

|

Net

Investments |

394,372.0 |

354,047.0 |

356,731.5 |

(9.5) |

0.8 |

Source: State Bank of Pakistan, Islamic Banking Bulletin (2014)

Table 2. Investments of Islamic Banks in FDS/GOP Sukuk (Million Rupees)

|

Nature of Investment |

Dec-13 |

Dec-14 |

Dec-15 |

Dec-16 |

Dec-17 |

Dec-18 |

Dec-19 |

Sep-20 |

|

Federal government

securities |

266,687 |

240,451 |

|

490000 |

|

515000 |

|

170900 |

Source: State Bank of Pakistan, Islamic Banking Bulletin (2014)

On the other hand, 81% of the remaining

deposits (i.e 32.10% of the total deposits) have been invested by the Islamic

banks to finance the Murabaha, Diminishing Musharakah, and Ijara-was-Iqtina

transactions (see Table 3). If we add the 24% requirement of the state bank as

SLR and CRR with these two, then this ratio will reach nearer to 80’s figure.

It means that, on average, every Islamic bank has used 78.57% of their deposits

(i.e. Rs. 840.6 billion out of Rs. 1070 billion) in illegal activities or

transactions during the tenure under analysis. This analysis also illustrates

that the structure of Islamic banking is purely based on interest bearing

investment and financing.

Table 3. Financing Mix of Islamic Banks (Billion Rupees)

|

Dec-13 |

Sep-14 |

Dec-14 |

|

|

Murabaha |

134.2 |

105.7 |

127.2 |

|

Ijarah |

25.4 |

29.8 |

32.3 |

|

Musharaka |

22.0 |

35.0 |

46.5 |

|

Mudaraba |

0.5 |

0.5 |

0.2 |

|

Diminishing Musharaka |

101.8 |

122.5 |

137.7 |

|

Salam |

13.3 |

9.0 |

19.2 |

|

Istisna |

18.5 |

27.5 |

35.2 |

|

Qarz/Qarz-e-Hasna |

0.0 |

0.0 |

0.0 |

|

Others |

14.5 |

18.4 |

23.8 |

|

Total

|

330.2 |

348.5 |

422.1 |

Source: State Bank of Pakistan, Islamic Banking Bulletin (2014)

No Involvement in Real Business or Trade

As mentioned earlier, Islamic banks simply transfer the deposits to the fund managers in the form of Mudarabah, Musharakah, Murabaha, Ijara-was-Iqtina, and Musharakah Mutanaqisha. In Mudarabah and Musharakah, fund managers are solely responsible to manage the business and bear its risk. In rest of the three types of contract, fund managers are solely responsible to make a purchase of the desired product and bear its risk. Banks are the inactive or sleeping partners in these contracts. They are only involved in paper work and documentation of these contracts, for which they entitle themselves to commission, fee and return. Whether there are interest free banks or conventional interest banks, in fact, they are not involved in trade or any kind of business; they only deal in money (Zubair & Chaudary, 2014). They are only involved in the use of these funds in interest bearing transactions.

From the perspective of primary modes of Islamic finance, no one can tell us about the place or investment unit where Islamic banks have invested this money and have deployed their skills (i.e., skills of their paid workers) as active Mudarib or partner. Are they engaged in any real business? If the answer is “NO”, then at what grounds they collect money from the general public in the name of Mudarabah and Musharakah? They actually deal in money, but they use the shadow of these tricky devices for deceiving the general public of our society. They do so in order to maximize their own wealth, which is later on disbursed among the creators and shareholders of these banks. Islam has defined a universal rule for the creation of money, “that money cannot beget money”. If one is interested in generating money, then he is supposed to convert that money into some real profitable and lawful trading activities. However, the Islamic banks are purely involved in the creation of money, which is backed by deposit creation technique of the conventional banking system. Their engagement in such activities shows that the contracts been held by Islamic banks with their clients are totally invalid, and Jurists are unanimously of the view that the profit of an "invalid contract" is also Haram.

Conclusion

This paper explains that how an Islamic bank uses the shed of different artificial tricks and deceives its customers in tricky ways. These banks have adopted a duel role in quantification of liability by declaring it to be limited for all the partners, including bank. Islamic bank is not entitled to decide and limit the nature of business liability, because bank is only a financial intermediary and a "zero-risk taker". He has no concern with business ownership and its liability. Islamic banks are not only controlled and supervised by the state bank of Pakistan, but they are also liable to obey all its directives and commands, including SLR and CRR. These banks are neither involved in any real business operation and nor in sharing the risk of the business. So his share in profit as a zero risk-taker can't be justified, because it violates the two well-known principles of Islamic economics; "al-khiraj bizzaman" and "al-gharamo bil ghanami".

Their techniques regarding the maintenance of low balance account, expense estimation, remuneration to shareholders, and profit estimation with daily production mechanism were found tricky in a sense that they are resembled with that of conventional banks in each and every aspect. The volatility in rate of return during the tenure of the project is also unlawful. On the other hand, the procedure towards unilateral dissolution of the contract with the element of binding cash payment at a discounted rate to the company shareholders is also a major issue of a special concern. The most sensitive and an eye-opening issue with the Islamic banks is their involvement in interest bearing investment and financing. Evidences reveal that more than 75 percent transactions of Islamic banking sector are illegal and “haram”. Moreover, these banks are not involved in any trading activities, they only deal in money.

References

- Adnan, M. A., & Muhamad, M. (2007). Agency problems in mudarabah financing: the case of sharia (rural) banks, Indonesia. International Journal of Economics, Management and Accounting, 15(2).

- Ahmad, A. (1994). Contemporary practices of Islamic financing techniques. Islamic Economic Studies, 2(1).

- Ahmed, M. M., Farooq, M., Muhammad N., & Shakirullah. (2012). A sharia'h perspective of minimum account balance requirement in Islamic banking, Al- Idah 25. 72-86.

- Ali, H. Z. (2008). Dore Hazir k Mali Mamlat ka Shari Hukam [Sharia Ruling on the Financial Matters of Present Era], Abu Hurayrah Academy Lahore

- Bhutto, I., & Siddiqui, D. A. (2020). Is Islamic Banking Ethical: An Inquiry-Based on SLO Framework (A Case of Meezan Bank). Available at SSRN 3641595.

- Dubai Islamic Bank. (2014). Schedule of bank charges.

- Goyal, K. A., & Joshi, V. (2011). A study of social and ethical issues in the banking industry. International Journal of Economics and Research, 2(5), 49-57

- Moin, M. S. (2008). Performance of Islamic banking and conventional banking in Pakistan: a comparative study.

- Mulli, Y. M. D. (2020). Factors Affecting Uptake of Islamic Banking Services In Kenya (Doctoral dissertation, United States International University-Africa).

- Noormohamed, S. I. (2019). The Inadequacy of the Legal Framework Governing Islamic Banking in Kenya (Doctoral dissertation, University of Nairobi).

- Rahman, M. H. (2018). Mudarabah and its applications in Islamic finance: an analysis. Asian Journal of Research in Banking and Finance, 8(6), 33-46.

- Rufaqa-i-Darul Iftha. (2008). Murawwija Islami Bankari [Contemporary Islamic Banking], Jamia Uloom Al-Islamia, Banoori Town Karachi

- Sapuan, N. M. (2016). An evolution of Mudarabah contract: a viewpoint from classical and contemporary Islamic scholars. Procedia Economics and Finance, 35, 349- 358.

- Shaikh, S. A. (2013). Islamic banking in Pakistan: a critical analysis. Journal of Islamic Economics, Banking and Finance, 9(2), 45-62.

- Shaikh, S. A. A. (2011). A critical analysis of Mudarabah & a new approach to equity financing in Islamic finance. Journal of Islamic Banking & Finance, Forthcoming.

- State Bank of Pakistan. (2011). DMMD Circular No. 3

- State Bank of Pakistan. (2014). Islamic Banking Bulletin

- Usmani, M. T. (2007). Ghair Soodi Bainkari [Interest Free Banking]. Karachi: Maktaba Ma'ariful Quran.

- Usmani, M. T. (2003). Islam Aur Jadid Maeeshat-o-Tijaraht, [Islam and Contemporary Economy and Trade]. Karachi: Maktaba ma'ariful Quran.

- Usmani, M. T. (2004). An Introduction to Islamic Finance, Karachi: Idaratul Ma'arif.

- Vadillo, U. I. (2006). Fatwa on Banking and the use of interest received on bank deposits.

- Zubair H. M., & Chaudhary, N. G. (2014). Islamic banking in Pakistan: a critical review, International Journal of Humanities and Social Science, 4(2), 161-176.

Cite this article

-

APA : Minhajuddin., Gul, B., & Khan, M. S. A. (2020). The Primary Modes of Islamic Finance: A Critical Analysis. Global Economics Review, V(III), 173 - 186. https://doi.org/10.31703/ger.2020(V-III).16

-

CHICAGO : Minhajuddin, , Brekhana Gul, and Muhammad Sohail Alam Khan. 2020. "The Primary Modes of Islamic Finance: A Critical Analysis." Global Economics Review, V (III): 173 - 186 doi: 10.31703/ger.2020(V-III).16

-

HARVARD : MINHAJUDDIN., GUL, B. & KHAN, M. S. A. 2020. The Primary Modes of Islamic Finance: A Critical Analysis. Global Economics Review, V, 173 - 186.

-

MHRA : Minhajuddin, , Brekhana Gul, and Muhammad Sohail Alam Khan. 2020. "The Primary Modes of Islamic Finance: A Critical Analysis." Global Economics Review, V: 173 - 186

-

MLA : Minhajuddin, , Brekhana Gul, and Muhammad Sohail Alam Khan. "The Primary Modes of Islamic Finance: A Critical Analysis." Global Economics Review, V.III (2020): 173 - 186 Print.

-

OXFORD : Minhajuddin, , Gul, Brekhana, and Khan, Muhammad Sohail Alam (2020), "The Primary Modes of Islamic Finance: A Critical Analysis", Global Economics Review, V (III), 173 - 186

-

TURABIAN : Minhajuddin, , Brekhana Gul, and Muhammad Sohail Alam Khan. "The Primary Modes of Islamic Finance: A Critical Analysis." Global Economics Review V, no. III (2020): 173 - 186. https://doi.org/10.31703/ger.2020(V-III).16