Abstract:

Taxation plays a very vital role in the development of any state it is the backbone of financial progress and strengthens the country economically. In Pakistan, the matter of Tax is multifarious and Government levies many taxes on individuals in different capacities. There are different departments regulating and dealing with tax-related matters. In past, the lack of tax paying affected the economy of Pakistan. But for many years, the government of Pakistan offered specific immunities to increase the revenue of Pakistan through tax collection. This policy of the Government was very successful. Despite all these efforts, immunities, tax collection and increase in revenue, the economy of Pakistan did not improve. This research can improve it by different methods and studies. This study was conducted to assess the problems and causes of low tax paying in Pakistan. The outcomes will recommend suggestions and different solutions to overcome these problems.

Key Words:

Pakistan, Causes, Problems, Assessment, Low Tax, Direct Tax, Indirect Tax

JEL Classification:

Introduction

Objective of Study

The main objective of this research was to determine the main factors for causing low tax paying in Pakistan, the study also observed the tax collection methods of FBR department, types of tax levied on corporations and individuals directly or indirectly and the performance of FBR department in Pakistan how quick they are dealing with the matters pending in their offices for reconciliation. (Chaudhry & Munir, 2010). Hence, keeping in view the above statements, research has been conducted with the following three main objectives;

? To study the causes and problems of low tax paying in Pakistan

? To determine the flaws of the tax system in Pakistan.

? To suggest the improvements in the existing system.

Methodology

Research methodology for the purpose of data collection and writing of this article was used explanatory and qualitative, and primary as well as secondary sources were also part of this study. Interviews of tax payers and personals of Tax authorities were conducted in the Pakistan regarding data collection of tax. It is also based on evaluation of Tax Laws and practices of Tax for collection of revenue in Pakistan. The research is based on qualitative studies and at the end study recommends some suggestions to reform the situation as well as laws in Pakistan.

Individual Income Tax: Issues and Problems

After studying the review of literature and other primary sources, it is notable that there are many issues and problems which the taxpayer has to face during this whole process of tax paying because it is so much complicated process for most of the individuals, every persons is not system user and neither can use the portal of FBR to file his or her income tax return. It can be categorized in two sectors;

All the individuals who are salaried persons, receiving wages on daily basis or are working on contract and even non-wages and people belonging to business community at small level or large level are at same footing. It has been noted that the during the previous years and currently; the FBR department was not so much successful in collecting the individual income tax and it was collected lower than the targeted estimate because at present the individual income tax (IIT) injudiciously is levying more taxes rates as per total income of an individual (taxpayer). This is a very serious issue which can create not only a huge financial crisis in the country but will be proved a huge obstacle in future for collecting the tax which must be addressed to the government and other related departments on priority basis. At present, the individual income tax (IIT) has been made flexible up to some extent with regard to the judgements and also to overcome the variances. However, the instant individual income tax (IIT) provides some exemptions and some concessions in the process of tax paying.

The second important sector is Corporate Income Tax which is also facing the same issues and problems as the individuals or business community and it is deeply reviewed, examining the whole process pf FBR and studying the scholarly articles, it is to be stated that two main issues are very much important to be highlighted and these are very prominent in this sector.

The first issue is the complication in the compliance process which is very poor and inappropriate resource allocation which is required to be reformed and implemented in the department immediately.

The second issue is the mode of tax payment and tax collection from industries at small and large level. The corporations working at small level such as the small corporations which is giving good results in generating income more than the turnover of previous year is also a good source of increase in revenue. But departments are at failure to impose tax on small corporations on their income taxable in an appropriate manner and to benefit these small corporations but these corporations which are giving positive results are also facing more confiscatory tax regime; the small corporations are also facing many problems in the area of withholding tax and advance tax which is again important to be addressed (Thirsk, 2008).

If the situation is examined in Pakistan, then Tax-to-GDP is very low about 10% was recorded during the previous years which is gradually falling which is an alarming situation but the Government is targeting and is making efforts to stable the macroeconomic situation and more efforts have also been made on increasing the revenue as well as budget so that the deficit rate may be reduced and the inflation rate may be controlled.

Due to reduction in the collection of tax on the part of FBR, the Government is facing many huge problems in the development of country and is also facing severe financial crisis in different progressive projects and in terms of expenditures (Alm, J. 2003), and such financial crisis and low progress in collecting the revenue; it is also effecting the energy growth and to increase the import and export and make this sector more successful, specifically the manufacturing area is being effected at large scale. The most important is that it is causing a great loss to the revenue sector from average to tax-to-GDP ratio and it also needs some reforms seriously in this sector; if the process of business and tax collection system can be helpful in increasing the rate of tax-to-GDP ratio but it is necessary that the administration dealing with the tax collection and revenue matters be serious and sincere with their work otherwise this decline can collapse this system (Joel, S., & Shlomo, Y. 2000).

Basic Structure of Tax System in Pakistan

After studying the Income Tax Ordinance, 2001, Pakistan imposes tax on resident companies and non-resident companies. Resident company means the companies which are situated in Pakistan and they are controlled and administered in Pakistan while a branch working in Pakistan is taken as non-resident. In fact, tax is the commercial revenue which is generated from different department and individuals.

Income Tax

Income tax means the tax which is collected directly from the people and tax is imposed on their income irrespective of business income, salaries income, rental income etc., now Pakistan has taken initiative personal income tax to increase the revenue which is as per the econometric models.

The Income Tax ratio with regard to personal income and payment of tax in Pakistan, the tax which is collected from the individuals and then is then is fixed for different projects and is spent on different projects such as for the welfare of labors, payment of gratuity and pensions etc. The Top Marginal Tax Rate which is mostly used for the individuals is the scale to achieve the targeted amount and generate revenue for the state. The revenue collected from people is vital source to generate and increase the income for the country like Pakistan.

Sales Tax

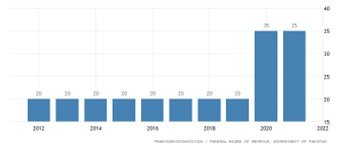

When a consumer purchases a product or service at a retail outlet, sales tax is an amount of money determined as a percentage that is applied to the cost of the goods or service. Every time a consumer makes a purchase, they pay the total state and local tax rate. During the previous years and this year, it was expected that the rate of sales tax in Pakistan, will increase at highest level and it was also expected to reach to 17.00% by 2021. It has been observed at world level that the Trading Economics Global Macro Models were successful techniques to generate and increase the income of the country than the expert potentials. In the long-term, the Pakistan had also made serious efforts to increase this ratio in sales tax by 2022 by adopting this model.

All the four provinces are receiving tax on services at the ratio of 13% to 16%. However, the federal tax which is levied on goods and the federal tax collected in term of federal excise duty can be adjusted against each other. Sales Tax is the tax which is levied according to the value of goods purchased mostly it is a standard rate and the revenue collected from sales tax is again an important factor to enhance the revenue of the government of Pakistan which is necessary for the development of the country.

Pakistan Launches Single Sales Tax Return Portal

Federal Board of Revenue (FBR), has started a very easy and single sales tax portal and return to make it more easy and convenient for the people. Now, the taxpayers can easily file single sales tax return and almost all the provinces are collecting at same footing. The positive thing in this system is that it provides an opportunity to the taxpayer for reconciliation and to pay the tax payable after success of reconciliation. Under this new system, the first time return was submitted in January 2021.

Direct and Indirect Taxes

Taxes can be categorized in two form such as direct tax and indirect tax to be paid in the form of services/ labour or money. Government of Pakistan has been trying to reform and modernize this tax paying system. Currently, many changes have taken place as mentioned above and many are in progress such as the application of self-assessment for filing income tax is new introduction in this system which was very important to develop this system. The tax-to-GDP reduced and fall in present times (Martinez-Vazquez, Jorge 2006).

Structural performances of Federal Taxes

In the year of 2001 and 2020, the Federal Board of Revenue and government of Pakistan raised the collection of tax and revenue elevated to a higher level than expected and in the fiscal year of 2019 to 2020, the taxes which were collected directly from the taxpayers resulted a huge rise in the revenue and almost 70% increase was recorded which was helpful and for the development of tax sector.

IMF provided many opportunities, facilitated and funded in financial year 2021 and 2022, reforms were ensured and encouraged by the IMF-Extended Fund Facility (IMF-EFF). It also includes the domestic revenue mobilization, subsidy in electricity, reduction in arrears of power sector and autonomy of central banks to operate as per their convenience. Such reforms were helpful in increasing revenue at domestic level through recovery of funds at domestic level.

Causes for Relatively Low Tax Efforts

There are a few points worth noting; budget deficits in the 1980s and 1990s were approximately 7% of GDP, in 1980; the owing to rising military funds were raised up to 6.5% of the GDP, which was applied to increase the interest rate on different types of loans for obtaining to finance the deficit (6.8% of GDP) in the 1990s. Despite the fact that government spending has decreased in recent years, the deficits have persisted. After declining to 4.4 percent of GDP in the early 2000s, the deficits increased to 6.7 percent in the 2010s, peaking at 9.1 percent in 2019. The 2020s aren't off to a great start, either, with some predictions predicting an 8.1 percent budget deficit. The fall in productivity (Pre-COVID) is one of the key causes of the huge deficits.

Several Critical Tax Administration issues

In Pakistan, more than 60 percent of the revenue is received from the people through indirect tax which is a big source to generate the revenue. Import and domestic sources are comprising the sales tax in terms of indirect taxes such as on goods imported from other countries are liable to pay the federal excise duty and custom duties.

Suggestions

The following suggestions are recommended for the increase of tax collection in Pakistan;

? Simplify the tax collection to encourage formalization.

? Reduce tax rates in different clauses.

? Create external checks that enforce compliance.

? Communicate the benefits of tax and promote the benefits of paying taxes.

? Educating taxpayers about how to comply and increasing the perception of risk for non-compliance.

? Use electronic channels for simple transactions for tax.

? Ensure regular updates to the tax payer registry.

? Target collections in tax offices.

? Ensure mandatory the application of ADR in what so manner and in any form before starting

References

- Alm, J., Mir, J., & Khan, A. (2008). Assessing Enterprise Taxation and Assessing Enterprise Taxation and the Investment Climate in Pakistan.

- Alma, J., MartÃnez-Vázquez, J., & Schneiderb, F. (2004). ‘Sizing’ the problem of the Hard-to-Tax. In Contributions to economic analysis (pp. 11–75).

- Barbone, L. (1999). Reforming tax systems: the World Bank record in the 1990s. In World Bank policy research working paper.

- Baunsgaard, T., & Keen, M. (2010). Tax revenue and (or?) trade liberalization. Journal of Public Economics, 94(9–10), 563–577.

- Chaudhry, I. S., & Munir, F. (2010). Determinants of Low Tax Revenue in Pakistan. Pakistan Journal of Social Sciences.

- Fahey, J. E. (1939). Income tax definition of “Reorganization.†Columbia Law Review, 39(6), 933-969.

- Keen, M., & Baunsgaard, T. (2005). Tax Revenue and (or?) Trade Liberalization. IMF Working Papers, 05(112), 1.

- Kemal, M. A. (2003). Underground economy and tax evasion in Pakistan: A critical evaluation. RePEc: Research Papers in Economics.

- Kim, J. (2005). Tax reform issues in Korea. Journal of Asian Economics, 16(6), 973– 992.

- Lerman, R. I., & Yitzhaki, S. (1994). Effect of Marginal Changes in Income Sources On U.S. Income Inequality. Public Finance Quarterly, 22(4), 403–417.

- Margalioth, Y. (2003). Tax Competition, Foreign Direct Investments and Growth: Using the tax system to promote developing countries. Social Science Research Network.

- Martinez-Vazquez, J. (2006). Pakistan: A preliminary assessment of the federal tax system. RePEc: Research Papers in Economics.

- MartÃnez-Vázquez, J., & McNab, R. (2000). The tax reform experiment in transitional countries. National Tax Journal, 53(2), 273–298.

- Overview. (n.d.). World Bank.

- Slemrod, J., & Yitzhaki, S. (2000). Tax avoidance, evasion, and administration. RePEc: Research Papers in Economics, 3, 1423–1470.

- Thirsk, W. R. (2008). Tax Policy in Pakistan: An assessment of major taxes and options for reform. RePEc: Research Papers in Economics.

- TRADING ECONOMICS | 20 million INDICATORS FROM 196 COUNTRIES. (n.d.).

- World and regional statistics, national data, maps, rankings. (n.d.-b). Knoema.

Cite this article

-

APA : Hassan, A., Rao, S. S., & Abbas, M. (2023). An Assessment of Low Tax Paying in Pakistan: Causes and Problems. Global Economics Review, VIII(I), 267-273. https://doi.org/10.31703/ger.2023(VIII-I).23

-

CHICAGO : Hassan, Abida, Sadia Saeed Rao, and Muhammad Abbas. 2023. "An Assessment of Low Tax Paying in Pakistan: Causes and Problems." Global Economics Review, VIII (I): 267-273 doi: 10.31703/ger.2023(VIII-I).23

-

HARVARD : HASSAN, A., RAO, S. S. & ABBAS, M. 2023. An Assessment of Low Tax Paying in Pakistan: Causes and Problems. Global Economics Review, VIII, 267-273.

-

MHRA : Hassan, Abida, Sadia Saeed Rao, and Muhammad Abbas. 2023. "An Assessment of Low Tax Paying in Pakistan: Causes and Problems." Global Economics Review, VIII: 267-273

-

MLA : Hassan, Abida, Sadia Saeed Rao, and Muhammad Abbas. "An Assessment of Low Tax Paying in Pakistan: Causes and Problems." Global Economics Review, VIII.I (2023): 267-273 Print.

-

OXFORD : Hassan, Abida, Rao, Sadia Saeed, and Abbas, Muhammad (2023), "An Assessment of Low Tax Paying in Pakistan: Causes and Problems", Global Economics Review, VIII (I), 267-273

-

TURABIAN : Hassan, Abida, Sadia Saeed Rao, and Muhammad Abbas. "An Assessment of Low Tax Paying in Pakistan: Causes and Problems." Global Economics Review VIII, no. I (2023): 267-273. https://doi.org/10.31703/ger.2023(VIII-I).23