Abstract:

The purpose of this research is to examine the relationship between corporate governance and earnings management in Asian emerging economies Pakistan, India, and Malaysia. The annual financial data of 196 listed non-financial firms for ten years (2010 - 2019) was used as a sample of the study. Panel data fixed-effect method was appropriate for this study. The findings of the current study established a negative association between corporate governance attributes (board of directors and the audit committee) and accrual earnings management. Boards and audit committees with the right characteristics boost stakeholder and shareholder loyalty and retention. Corporate governance is getting much significance in developing economies to establish the trust of regulators, investors, and economic analysts in emerging economies.

Key Words:

Corporate Governance, Audit Committee, Earnings Management, Asian Economies

Introduction

Healy and Wahlen (1999) defined earnings management "When managers use judgment in financial reporting and in structuring transactions to alter financial reports to either mislead some stakeholder about the underlying economic performance of the company or to influence contractual outcomes that depend on reported accounting numbers" (p.6). The recent world corporate scandals (e.g., WorldCom, Enron, Tyco, HealthSouth, Xerox, and Parmalat), especially in the developed economies like Europe, the United States, and East Asia, showed great concern in emerging economies. The scandals were due to financial manipulation (Goncharov, 2005). Earnings management (EM hereafter) is the method that gives the discretionary power to managers to manipulate the financial reports using the accounting procedures (Johari et al., 2009; Shah et al., 2009). There are various methods to manage the earnings, for example, changing accounting measures, managing accruals, revenues, expenses, and cash flows (C. Y. Yang, Lai, & Leing, 2008). Managers use these methods to manipulate the firm's financial results for various motives.

A strong corporate governance mechanism is considered to monitor and restrict the manager’s opportunistic decisions and actions to minimize the conflict of interest among managers and stakeholders (Idris et al., 2018b). More precisely, corporate governance is a system that effectively controls firms' operations to align the managers and shareholders incentives Huu Nguyen et al. (2020); (Boubaker et al., 2012). Effective corporate governance is the only way to have access to all the processes which enhance the stockholders' desired outcomes and to lower the information asymmetry Claessens and Yurtoglu (2013). Corporate governance has a significant role in controlling and assigning the responsibilities to the managers to protect the shareholder's rights and increase the firm's financial reporting quality. (Mehmood et al. 2019) emphasized that firms with strong corporate governance mechanisms can have more growth opportunities in this competitive world for favorable outcomes. Further, Agency theory states that owners and firms' management have different roles and interests, which leads to agency conflicts. Managers manipulate earnings for self-interest, so EM is seen as a potential agency cost. Because of this, corporate governance has a significant impact on the prevention and reduction of misleading information (Klein, 2002). Management's opportunistic behaviour can only be reined in by a strong corporate governance structure (Shleifer & Vishny, 1997; Gillan, 2006). Effective governance also reduces agency costs by limiting management and controlling authority’s discretionary conduct.

The basic reason to market imperfection for a firm's financial decision is asymmetric information which could be mitigated by applying effective corporate governance practices to increase the trust between investors and managers (Ahmad et al., 2021; Ali et al., 2017). Moreover, (Leuz et al. 2003) argued that financial transparency and opportunistic managerial behaviors in misrepresentations of financial results are restrained through a better governance system. Thus, the current study aims to explore the role of corporate governance in mitigating earnings management in Asian emerging economies. Three Asian economies such as Pakistan, India, and Malaysia are selected to analyze the influence of corporate governance on earnings management. These economies are in their growing stages as compared to developed economies. However, corporate governance systems are not so effective but progressing towards implementations (Hunjra et al. 2020). furthermore, (Boubaker and Nguyen 2014) highlighted that emerging economies are struggling to resolve the governance issues and attract investors to increase the market competition. On the basis of the above discussion, the problem statement of this study is that corporate governance can mitigate the earnings management in three Asian emerging economies Pakistan, India, and Malaysia. The objective of this study is to examine the role of corporate governance in investors' protection from misleading financial information using earnings management malpractices in Asian economies.

The rest of the report is structured as follows: The review of the literature is the focus of the second section. The third section explains the study's theoretical framework and methodological approaches. Section four contains the results of the data analysis. In the final section, the study results were summarised.

Review of Literature

Lev (1989) defines disposable (net) income as a distinct component of financial statements representing the bottom line of a company’s operations. To calculate a company's theoretical value, one looks at its projected future profits. Increased earnings indicate that the entity’s value has increased, whilst lower earnings indicate that the entity’s value has declined. Profitability management, described by Fischer and Rosenzweig (1995) as an effort to raise present earnings without boosting long-term profitability, is a set of actions made by a company’s management.

A collection of principles and rules defines corporate governance, followed by institutions to protect businesses against opportunism (Gillan, 2006; Shleifer & Vishny, 1997). Managing control within an organization is defined as corporate governance by Gillian and Starks (1998). Studies have looked at the connection between EM and corporate governance in great depth. Early studies (Beasley, 1996; Dechow et al., 1996) also found a strong correlation between corporate governance and EM. Numerous studies also suggested that weak governance structures allow for opportunistic earnings manipulation.

Hypothesis Development

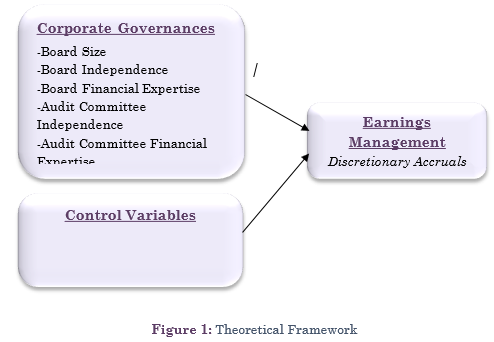

The current research focused on the five attributes of corporate governance (board size, independence, financial expertise, audit committee independence and financial expertise). The relationship of these attributes with EM in previous studies is discussed below.

Board Size

Board size is measured by the presence of executive and non-executive board members on the board. A larger board ensures financial reporting quality due to its more diverse managerial and financial experience (Laksmana et al., 2012). Barako et al. (2006) found that board size negatively impacts firm disclosures. In addition, Klein (2002) supported and extended this argument that larger boards are positively connected to board monitoring as tasks can be dispersed to all members. Additionally, Habbash (2010) stated that larger boards are more likely to limit EM in UK companies. It was concluded by Lipton and Lorsch in 1992 that larger boards spent a greater amount of time and effort overseeing management compared to smaller boards.

Additionally, numerous studies demonstrated an inverse relationship of board size with EM (Yu, 2008). A board with four to six members can effectively oversee management operations and make effective choices (Yermack,1996). Xie et al. (2003) used current discretionary accruals to investigate the role of the board in the development of EM. Findings highlighted the inverse relationship of board size with EM. Zahra and Pearce (1989) argued that company stockholders are more likely to dominate smaller boards. In contrast, Yu (2008) asserted that smaller boards are more likely to reduce EM. Hypothesis can be formulated as;

H1: Board size negatively influence EM in Asian economies.

Board Independence

Providing better operational and financial reporting disclosures is a key responsibility of the board of directors. Levitt (1998) suggested that a sound governance mechanism impacts financial reporting and, as a result, increases investor trust. Agency theory states that the board of directors’ responsibilities increases to safeguard shareholders’ interests through close supervision of the company’s management. There may be an effect on the willingness of a company to engage in EM malpractices due to the composition of the board. It was found that board independence could help prevent financial manipulation in the United States (He et al., 2009). For their reputation, Fama and Jensen (1983) argued that independent directors always focus on maximising shareholder value by extensively monitoring the management process.

Incorporate governance literature, board independence is seen as an indicator of financial reporting transparency. In the board's composition, researchers propose that outsider members should exceed insiders. Transparency and clarity on board composition are critical for a successful monitoring system (Patelli & Prencipe, 2007). Researchers have looked into how independent directors affect financial reporting, and they've discovered a strong correlation between their presence and more limited use of EM (Jaggi et al., 2009). This study offers the following hypothesis based on the preceding research and while bearing in view the perspective of the agency problem;

H2: Board independence has a negative influence on EM in Asian economies.

Board Financial Expertise

Board members financial expertise and skills are perceived as an additional board attribute that may impact the management of earnings. Directors must have the accounting expertise to keep an eye on the financial reporting process and prevent manipulation. Financial competence has been given significant importance in managing the financial statement quality in empirical research. According to (Barton & Wong, 2004) boards must ask management tough questions, actively participate in setting the company’s strategic direction, assess the risk of the company’s operations, and contribute to the CEO succession plan effectively carry out their responsibilities. That’s only possible thus far if the board is well-equipped to take on these responsibilities in its entirety. It is claimed that outside directors with financial expertise can reduce the likelihood of earnings manipulation by having knowledge in the US. (Agrawal & Chadha, 2005).

In contrast to the audit committee’s financial competence, very few studies have examined a board’s financial expertise. That’s why research relating board financial knowledge to EM are few and far between. The board composition with financial experts disheartens the earnings manipulations (Xie et al., 2003). Furthermore, (Park & Shin, 2004) suggested that financial experts on the board might restrict abnormal accruals since managed earnings are within the baseline. According to them, experienced outsider directors have a greater understanding of the company and its employees, which improves their governance skills. (Carcello et al., 2002) asserted that directors with more experience are more likely to demand high-quality audit work. Based on data from nearly 48 empirical studies, (Lin and Hwang, 2010) found an opposite relationship between board financial knowledge and the EM. In contrast, Metawee (2013) demonstrate a favourable link between board financial knowledge and EM.

H3: Board financial expertise has a negative influence on earning management in Asian economies.

Audit Committee Independence

Audit committees protect the interests of shareholders and management as part of corporate governance. According to research (Lai & Liu, 2018), the independence and skill of the audit committee can help minimize EM. Numerous researches on this relationship have been done in a variety of nations, with varying conclusions. Based on a meta-analysis of 48 research from 1997-2007, Lin and Hwang (2010) proposed that an audit committee independence have negative correlation with EM. In contrast, Maria and Alves (2011) findings revealed no indication that audit committee existence may alter EM in Portugal between 2002 and 2007. Kang, Kilgore, and Wright (2011) discovered a strong link between the audit committee and EM in Australia. They used Jones model to calculate discretionary accruals (EM proxy) and audit committee characteristics in their analysis (percentage of independent directors, financial knowledge and expertise and number of meetings). In another investigation, Kasipillai and Mahenthiran (2013) argued that an independent audit committee should limit Malaysian public limited companies’ EM practices.

Additionally, the Middle East and North Africa is a region where EM is predominant, which requires the significant role of the audit committee to reduce such mismanagements. Alzoubi (2016) validated that independent audit committee members’ size and regular meetings considerably reduce EM activities. In contrast, (Al-Thuneibat. 2016) determined that the board of directors, audit committee, and internal audit do not significantly impact EM. Independent and internal audits are unfavourable to EM practices. Research by Safari (2017) reveals that compliance with board and audit committee principles influences reduced EM practises in the Australian stock market.

H4: Board financial expertise has a negative influence on earning management in Asian economies.

Audit Committee Financial Expertise

Expertise in accounting is necessary to

perform the tasks of the audit committee effectively. Audit committee members’ accounting and financial expertise help them better oversee management’s preparation of financial statements. Audit committees with accounting competence can decrease opportunistic earnings from an efficiency standpoint. According to Nelson and Devi (2013), the amount of EM practises in Malaysia can be significantly reduced by the participation of accounting professionals in audit committee. According to Mohammad et al. (2016), the audit committee in Malaysia had a positive relationship with EM. Researchers in the United States, Badolato et al. (2014), conducted research and proposed that members of the audit committee have the relative position and financial knowledge necessary to guard against earnings manipulation. The latest research (Mansour et al., 2018) examined the proportion of audit committee financial expertise and gender effect on EM. The result of this study described that EM practises were shown to be drastically reduced when the audit committee was independent and had a higher percentage of female members. Committee audit independence affects accrual practises, as evidenced by (Xie et al., 2003; Klein, 2002). Audit committees frequently support conservative accounting standards. Conservative accounting plays an essential function in limiting managerial opportunism (Habbash et al., 2013). Because audit committee members with accounting knowledge may reduce EM, earlier research findings support this conclusion (Dhaliwal et al., 2010). To oversee management’s financial statements and accounting procedures, the audit committee extends the board’s responsibilities.

H5: Audit committee financial expertise has a negative influence on earning management in Asian economies.

Methodology Sample Selection

This study examined the impact of corporate governance attributes board size, board independence, board financial expertise, audit committee independence and audit committee financial expertise) on EM in three Asian emerging economies Pakistan, India and Malaysia. Pakistan, India and Malaysia are emerging economies and also have almost have similar corporate governance and financial structures. Convenient sampling method was applied to select the sample. In total 196 non-financial listed firms included in 100 indices from Pakistan, India, and Malaysia formed the study's sample. The firms of 100 index almost represent every industry and high in market value too. For the ten fiscal years from 2010 to 2019, data was collected. Each firm's published annual financial statements were used to gather financial and corporate governance data. The firms were dropped which have missing or less than ten years or insufficient financial and corporate governance-specific data. The final sample consisted of 196 non-financial firms (1960 ?rm-years observation) comprising of different sectors.

Measurement of EM

Following previous research (Campa, 2019; Harakeh et al., 2019), EM is calculated using the modified Jones model proposed by Kothari et al., (2005). Total accruals of the firm have to components non-discretionary and discretional accruals. Non-discretionary accruals reflect changes in revenue, receivables, and the magnitude of property, plant, and equipment that affect Depreciation, working capital, and return on assets.

The balance sheet method is used to calculate a firm's total accruals (equation 1) following (Pavlopoulos et al., 2019; Dechow et al., 1995).

TACCit = (?CASTit - ?Cashit) - (?CLBit - ?SHTDit) - DEPit (1)

The terms used in the above equation are described here;

TACC = firm’s total accrual; ?CAST = Change in current assets; ?Cash = Change in Cash; ?CLB = Change in current liabilities; ?SHTB = Change in short term debt; DEP = Depreciation and amortization for ‘i’ firm and ‘t’ year.

Kothari et al., (2005) model are presented in equation 2. Residual of eq 2 is the non-discretionary accruals. The residuals are obtained applying panel data regression using the year and industry effects of the sampled data.

?TACC?_(i,t)/?TAst?_(i,t-1) =?_(1,t) 1/?TAst?_(i,t-1) +?_(2,t) (??REV?_(i,t )-??REC?_(i,t ))/?TAst?_(i,t-1) + ?_(3,t) PPE_(i,t )/?TAst?_(i,t-1) +?_(4,t) ?ROA?_(i,t-1 ) ab+µ_(i,t) (2)

Here in the above equation, TACC is for total accruals; TAst for total assets; REV change in revenue; REC account receivables change; PPE property, plant, and equipment; and ROA is the return on assets. Total accruals (TACC) are further decomposed into (i) non-discretionary accruals (NDACR) (residuals of Eq. 2) and (ii) discretionary accruals (DACR) calculated using Eq. (3). Discretionary accrual is used as a proxy for accrual-based EM (AEM) in absolute value |DACR|. Discretionary accruals are taken in absolute value as corporate executives can use the discretionary power to increase or decrease earnings (Hribar and Nichols, 2007).

DACRit =TACCit ?NDACRit (3)

Corporate Governance

Corporate governance five attributes were taken in this study. Board size (BSZ) is measured as the total number of directors on the board. Board independence (BIND) as the ratio of independent to total board members. Board financial expertise (BSKIL) is the ratio of directors having financial knowledge to the total board of directors. Audit committee independence (AUDIND) is the proportion of independent board members in the audit committee. Finally, audit committee expertise (AUDEXP) is the proportion of members with financial skills in the audit committee.

Control Variables

In prior researches, firm-specific control variables link between corporate governance and EM was also examined. In current research, firm size, market to book value, operating cash flow, and return on assets are the control variables.

The prior study's findings showed that large firms in terms of assets have more internal operational control. These firms are always facing market scrutiny (Gul et al., 2009; Ghosh & Moon, 2010). In contrast, (Wang 2014; Saleh & Ahmed, 2005) found a positive influence of firm size (FSIZE) on EM. Return on assets (ROA) is a proxy to measure firm performance. Kothari et al. (2005) also recommended using firm performance as a controlled variable. (Habbash, 2010; Ahn and Choi, 2009; Ashbaugh et al.,2003) found a negative association between firm performance and EM. Some prior studies emphasized that firm's having more growth opportunities were found to be keen on EM (Jelinek, 2007; Gerayli et al., 2011; Chung & Kallapur, 2003). The firm growth measure is the market-to-book ratio (PTBR). This research also controls operating cash flows (FCFO). Firms having high cash flow from operations are found less likely in earnings manipulations (Gul et al. 2009). Operating cash flow was scaled by total assets.

Econometric Model Specification

Baltagi (2008) asserted that panel data is more useful in controlling data variability, more efficient, and reducing collinearity of variables in different cross-sections. There are two methods of estimating panel data i) fixed effect and ii) random effect models. Fixed effect captures each firm, individual effect but slope coefficients remain persistent of all sample units. In comparison, random effect describes no relationship between individual effects or groups. The Hausman (1978) test is used to select appropriate panel data methods among fixed or random effects.

The econometric model specification is;

EM i,t = ?0 + ?1i, t BSZ + ?2 i,t BIND + ?3i,t BSKIL + ?4i,t AUDIND + ?5i,t AUDEXP + ?6i,t FirmSpci,t + ?i,t (4)

EM is the absolute value of discretionary accrual, ?o represents the scalar. ?1 to ?5 are the coefficients of corporate governance determinants. The five corporate governance determinants are used as board size (BSZ), board independence (BIND), Board financial skills (BSKIL), audit committee independence (AUDIND), and audit committee financial expertise (AUDEXP). FirmSpc is the firm-specific control variable.

Results and Discussion Descriptive Statistics

Table 1 shows the descriptive statistic of the pooled data. There were 1960

observations of a full data sample. EM (proxied by absolute discretionary accruals) has an average score of 0.087 (STD=0.092). The minimum value was 0, and the maximum was 0.887. Board size measure in natural logarithm has the mean value of 2.264 with a standard deviation of 0.276. Board independence showed that, on average, 48.3% of boards were composed of independent directors. Board skills/expertise average score was 0.49 (STD=0.196). At an average of 50%, directors have accounting and finance knowledge. Audit committee independence descriptive statistics revealed that about 77% of audit committees members were independent directors overall (STD= 0.21). The audit committee member's average expertise score was 0.503, with a standard deviation of 0.228.

Further, Control variables descriptive statistics were also calculated. Return on assets has an average return value of 0.079 (STD=0.09). The natural log of assets has an average score of 17.87 with a standard deviation of 1.869. Cash flow from operating activities mean value was 0.098 (STD=0.108). The average value of the price to book ratio was 1.985 (STD=2.126).

Table 1. Descriptive Statistics of Pooled Sample

|

Variables |

Ober |

Avg |

Std. Dev. |

Min |

Max |

|

EM |

1960 |

.087 |

.092 |

0 |

.887 |

|

BSZ |

1960 |

2.264 |

.276 |

1.386 |

3.296 |

|

BIND |

1960 |

.483 |

.144 |

.091 |

.933 |

|

BSKIL |

1960 |

.49 |

.196 |

0 |

1 |

|

AUDIND |

1960 |

.771 |

.21 |

.167 |

1 |

|

AUDEXP |

1960 |

.503 |

.228 |

0 |

1 |

|

ROA |

1960 |

.079 |

.09 |

-.421 |

.774 |

|

SIZE |

1960 |

17.87 |

1.869 |

11.468 |

23.023 |

|

FCFO |

1960 |

.098 |

.108 |

-.664 |

.827 |

|

PTB |

1960 |

1.985 |

2.126 |

-9.13 |

14.238 |

Correlation Analysis

Correlation analysis was performed using pooled sample of three countries data (table 2). The pooled sample correlation analysis captures the overall picture of variables relationship. The EM have negative correlation with board size (r = - 0.108), board independence (r = - 0.031), board financial expertise (r = - 0.444), audit committee independence (r = - 0.458) and firm size (r = - 0.276). While audit committee expertise (r = 0.027), return on asset (r = 0.366), operating free cash flows (r = 0.353) and market to book ratio (r = 0.105) were positively associated with EM. Board size have the positive relationship with board independence (r = 0.111), audit committee independence (r = 0.188) and audit committee expertise (r = 0.045) while negative with board skills (r = - 0.039). Board independence was positively associated with audit committee independence (r = 0.153) while negatively related to board skills (r = - 0.124) and audit expertise (r = - 0.031). Board skill correlation with audit committee independence (r = 0.672) and audit committee financial expertise (r = - 0.250) was positive and negative respectively. The relationship of audit committee independence and audit expertise was negative (r = - 0.214). The control variables have mixed relationships with board characteristics.

Table 2. Pairwise Correlations of Pooled Sample

|

Variables |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

|

(1) EM |

1.000 |

|

|

|

|

|

|

|

|

|

|

(2) BSZ |

-0.108** |

1.000 |

|

|

|

|

|

|

|

|

|

(3) BIND |

-0.031 |

0.111** |

1.000 |

|

|

|

|

|

|

|

|

(4) ESKIL |

-0.444** |

-0.039 |

-0.124** |

1.000 |

|

|

|

|

|

|

|

(5) AUDIND |

-0.458** |

0.188** |

0.153** |

0.672** |

1.000 |

|

|

|

|

|

|

(6) AUDEXP |

0.027 |

0.045* |

-0.031 |

-0.250** |

-0.214** |

1.000 |

|

|

|

|

|

(7) ROA |

0.366** |

-0.044 |

0.018 |

0.021 |

-0.026 |

-0.106** |

1.000 |

|

|

|

|

(8) SIZE |

-0.276* |

0.403* |

0.157* |

-0.098* |

0.101** |

0.111* |

-0.173* |

1.000 |

|

|

|

(9) FCFO |

0.353* |

-0.026 |

-0.015 |

0.038 |

-0.011 |

-0.143* |

0.671** |

-0.161* |

1.000 |

|

|

(10) PTBR |

0.105* |

-0.026 |

0.036 |

-0.031 |

-0.041 |

-0.009 |

0.549* |

-0.135* |

0.456* |

1.000 |

*** p<0.01, ** p<0.05, *

p<0.1

Correlation

analysis also confirms no issue of discriminant validity in the data. It also

explained that there was no multicollinearity problem among the variables as

the correlation values were less than 0.80.

Multivariate Analysis

Panel data analysis methods were used to analyze the data. The panel data techniques such as pooled OLS, fixed effect, and random effect were conducted for three countries. Hausman test is used to select the appropriate method from fixed or random effect. The results are reported in table 3. Hausman test confirmed that fixed-effect models were appropriate for three countries Pakistan (?2 = 79.75, ?-Val < 0.01), India (?2 = 50.91, ?-Val < 0.01) and Malaysia (?2 = 68.42, ?-Val < 0.01). The model’s significance was further confirmed through F-statistics and Akaike criteria presented in the lower part of table 3. R-square values described the 62.7%, 82.8%, and 69.4% variations due to exogenous variables in Pakistan, India, and Malaysia respectively.

Table 3. Multivariate Analysis of Pakistan Data

|

|

Pakistan |

India |

Malaysia |

|

VARIABLES |

EM |

EM |

EM |

|

|

Panel A |

Panel B |

Panel C |

|

BSZ |

-0.00435 |

-0.00567** |

-0.00406** |

|

(0.0169) |

(0.00253) |

(0.00204) |

|

|

BIND |

-0.0801*** |

-0.0409** |

0.000107 |

|

(0.0267) |

(0.0197) |

(0.0158) |

|

|

BSKIL |

0.293*** |

-0.282*** |

-0.0273*** |

|

(0.0522) |

(0.0253) |

(0.0103) |

|

|

AUDIND |

-0.636*** |

-0.333*** |

-0.0163 |

|

(0.0638) |

(0.0207) |

(0.0145 |

|

|

AUDEXP |

-0.0288** |

-0.131*** |

-0.207*** |

|

(0.014) |

(0.0173) |

(0.0155) |

|

|

ROA |

0.0274 |

0.0412** |

0.182*** |

|

(0.0435) |

(0.0206) |

(0.0285) |

|

|

FSIZE |

0.0101 |

0.00355 |

-0.00866** |

|

(0.00654) |

(0.00232) |

(0.00343) |

|

|

FCFO |

0.0694*** |

-0.025 |

0.315*** |

|

(0.0223) |

(0.0197) |

(0.0261) |

|

|

PTBR |

0.00197 |

-0.0067 |

-0.00215 |

|

(0.00154) |

(0.00101) |

(0.00187) |

|

|

Constant |

0.107 |

0.489*** |

0.355*** |

|

(0.118) |

(0.0582) |

(0.059) |

|

|

Observations |

660 |

800 |

500 |

|

R-squared |

0.627 |

0.828 |

0.694 |

|

Number of ids |

66 |

80 |

50 |

|

F-test |

110. 927 |

380.328 |

110. 927 |

|

Prob>F |

0 |

0 |

0 |

|

Akaike crit. (AIC) |

-2349.778 |

-3688.668 |

-2349.778 |

|

Bayesian crit. (BIC) |

-2307.632 |

-3641.822 |

-2307.632 |

The current study’s findings indicate that board size has a considerable negative influence on EM in Malaysia (? = -0.00406, ?-Val < 0.05) and India (? = -0.00567, ?-Val < 0.05) but has insignificant effect in Pakistan’s (? = -0.00435, ?-Val > 0.05) sampled data. H1 is only supported for Malaysia and India. The findings were consistent with (Ebrahim, 2007; Xie et al., 2003). Earnings control mechanisms can be improved with a larger board of directors. Board members consistently monitor the firms' operations and access all types of information, which helps to reduce the earnings manipulations. The results were also in line with (Pearce & Zahra, 1992). The board size is considered to have better supervision and an effective team to make quality corporate decision making.

The effect of board independence on EM in India (? = -0.0801, ?-Val < 0.01) and Pakistan (? = -0.0409, ?-Val < 0.01) was significant. Results supported H2. The findings matched (Peasnell et al., 2005; Duh et al., 2009). An organization’s ability to manipulate earnings can be curtailed by having a large percentage of its members be independent. Independent board members who do not want to jeopardize their reputation actively scrutinize the firm’s activity. In addition, the results were also in agreement with (Xie et al., 2003). Board independence has a favourable but insignificant impact on EM in Malaysia (? = 0.000107, ?-Val > 0.05). These results were consistent with (Soliman & Ragab, 2013) studies. The reason for this might be that the independent board members of a certain firm abandon EM to portray the company favourably to its investors. Alternatively, they may be doing it to retain their jobs and positions. Additionally, it received support from (Tian & Lau, 2001) too.

Another significant quality that inhibits manipulation is the board’s competence in financial matters. The board’s financial expertise was negatively associated with EM in the sample data from India (? = -0.282, ?-Val < 0.01) and Malaysia (? = -0.0273, ?-Val < 0.01). H3 is accepted in these countries. The results reinforced the previous studies (Park & Shin, 2004) that members having accounting and finance knowledge in the boards can constrain the EM activities. The board’s financial expertise demand high-quality financial statements and audit. In contrast, the Boards financial expertise was positively related to EM in Pakistan (? = 0.293, ?-Val < 0.01) which did not support H3. The findings were consistent with the (Metawee. 2013) as board’s expertise have a mixed relationship with EM in different economies. Pakistan is a developing economy. Families own most businesses. So, board’s expertise can help them to enhance the earning manipulation to show good firm performance.

The association between audit committee independence and EM was significant for Pakistan (? = -0.636, ?-Val < 0.01) and India (? = -0.333, ?-Val < 0.01) but was insignificant for Malaysia (? = -0163, ?-Val < 0.01). H4 accepted for Pakistan and India but rejected for Malaysia. The results support the prior research findings (Xie et al., 2003). Kasipillai and Mahenthiran (2013) observed similar findings for Malaysia. Earnings manipulation is discouraged by the independent audit committee. The audit committee composed of independent directors can deeply investigates the financial records at the firms.

Audit committee’s financial competence was detrimental to EM in Pakistan (? = -0.0288, ?-Val < 0.05), India (? = -0.131, ?-Val < 0.01), and Malaysia (? = -0.207, ?-Val < 0.01) respectively. H5 supported three countries. The findings were replicated (Al-Thuneibat et al., 2016). The member’s financial expertise and knowledge preclude firms from engaging in EM strategies. These individuals are capable of conducting thorough evaluations of financial statements. Additionally, this study verified Alzoubi’s (2016) findings.

The control variables effect on EM was further assessed. Firm performance has positive and significant effect on EM in India (? = 0.0412, ?-val < 0.05) and Malaysia (? = 0.182, ?-val < 0.01). The results opposite to (Habbash, 2010). Firm size influence on EM was negative and significant only in Malaysia (? = - 0.00866, ?-val < 0.05). Findings were in line to (Gul et al. 2009). Operating cash flows were positively associated in Malaysia (? = 0.315, ?-val < 0.01) and Pakistan (? = 0.0694, ?-val < 0.01) only. There was no significant impact of market to book ratio on EM in three of countries Pakistan (? = 0.00197, ?-val > 0.05), India (? = -0.0067, ?-val > 0.05) and Malaysia (? = 0.00187, ?-val > 0.05). These did not support (Jelinck, 2007). The overall findings were consistent to the previous researches and it also provides insight to compare the results within Asian economies.

Conclusion

The research tried to figure out how corporate governance and EM were linked in Pakistan, India, and Malaysia. Asian economies exhibit distinct economic and governance characteristics in comparison to developed economies’ robust governance systems. It is observed that companies with larger boards of directors and board members with more financial skill and independence have better control over their operations and financial information. They have the potential to significantly minimize managers’ fabrication of financial performance. Moreover, the audit committee plays a vital role in reining EM strategies. The financial reporting to stakeholders is improved when the internal audit committee is composed of independent members with financial expertise backgrounds.

Corporate governance is usually the most prudent technique for minimizing principal-agent relationships. Therefore, regulatory bodies can effectively implement the strong corporate governance systems to diminish the EM practices in business. This will help to protect the rights of the stakeholders to get accurate financial information's and discourage the use of managerial discretionary powers. Effective corporate governance systems implementations are the basic requirement of countries such as Pakistan, India, and Malaysia, where most businesses are family-owned. Thus, accountability issues have great importance for the existing stakeholders as well as increases opportunities to attract local and foreign investors.

Limitations and Future Recommendations

This study contributes in a number of ways. First, it contributed to current literature on Asian economies, which has been missing in this area of research. Second, comparative research was conducted to investigate the aforementioned link in Asian nations where most firms are family-owned, and corporate governance plays a limited role compared to industrialized economies. Additionally, this study has some limitations that need to be explored in future research. This study was conducted using only post-financial crisis ten years data for 196 firms in total. Data can be increased by taking pre-financial crises period with more firms and countries. EM is assessed using a variety of different proxies, such as discretionary and real EM. This study may be expanded by adopting a real earning management approach and corporate governance. Corporate governance was limited to five characteristics that were associated with EM. Additional areas of corporate governance, including board meetings, CEO duality, and the effect of ownership structure on discretionary or real EM, can be addressed in future studies.

References

- Agrawal, A., & Chadha, S. (2005). Corporate governance and accounting scandals. The Journal of Law and Economics, 48(2), 371-406

- Ahmad, M. M., Hunjra, A. I., Islam, F., & Zureigat, Q. (2021). Does asymmetric information affect firm's financing decisions? International Journal of Emerging Markets.

- Ahn, S., & Choi, W. (2009). The role of bank monitoring in corporate governance: Evidence from borrowers' earnings management behavior. Journal of Banking & Finance, 33(2), 425-434.

- Ali, S., Liu, B., & Su, J. J. (2017). Corporate governance and stock liquidity dimensions: Panel evidence from pure order-driven Australian market. International Review of Economics & Finance, 50, 275-304.

- Al-Thuneibat, A. A., Al-Angari, H. A., & Al-Saad, S. A. (2016). The effect of corporate governance mechanisms on earnings management: Saudi Arabia. Review of International Business and Strategy.

- Alves, S. M. G. (2011). The effect of the board structure on earnings management: evidence from Portugal. Journal of Financial Reporting and Accounting, 9(2), 141- 160.

- Ashbaugh, H., LaFond, R., & Mayhew, B. W. (2003). Do nonaudit services compromise auditor independence? Further evidence. The Accounting Review, 78(3), 611-639.

- Barako, D. G., Hancock, P., & Izan, H. Y. (2006). Factors influencing voluntary corporate disclosure by Kenyan companies. Corporate Governance: An International Review, 14(2), 107-125.

- Barton, D., & Wong, S. C. (2004). Asia's governance challenge.

- Becker, C. L., DeFond, M. L., Jiambalvo, J., & Subramanyam, K. R. (1998). The effect of audit quality on earnings management. Contemporary Accounting Research, 15(1), 1-24.

- Boubaker, S., & Nguyen, D. K. (2012). Board directors and corporate social responsibility. Palgrave Macmillan.

- Boubaker, S., & Nguyen, D. K. (2014). Corporate governance and corporate social responsibility: Emerging markets focus. World Scientific.

- Chung, H., & Kallapur, S. (2003). Client importance, nonaudit services, and abnormal accruals. The Accounting Review, 78(4), 931-955.

- Claessens, S., & Yurtoglu, B. B. (2013). Corporate governance in emerging markets: A survey. Emerging Markets Review, 15, 1-33.

- Cohen, J., Krishnamoorthy, G., & Wright, A. M. (2002). Corporate governance and the audit process. Contemporary Accounting Research, 19(4), 573-594.

- Davidson III, W. N., Xie, B., & Xu, W. (2004). Market reaction to voluntary announcements of audit committee appointments: The effect of financial expertise. Journal of Accounting and Public Policy, 23(4), 279-293.

- Davidson, R., Goodwin-Stewart, J., & Kent, P. (2005). Internal governance structures and earnings management. Accounting & Finance, 45(2), 241-267.

- de Andrés-Alonso, P., Cruz, N. M., & Romero-Merino, M. E. (2006). The governance of nonprofit organizations: Empirical evidence from nongovernmental development organizations in Spain. Nonprofit and Voluntary Sector Quarterly, 35(4), 588-604.

- Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. Accounting Review, 193-225

- Dhaliwal, D. A. N., Naiker, V. I. C., & Navissi, F. (2010). The association between accruals quality and the characteristics of accounting experts and mix of expertise on audit committees. Contemporary Accounting Research, 27(3), 787-827.

- Duh, R.-R., Lee, W.-C., & Lin, C.-C. (2009). Reversing an impairment loss and earnings management: The role of corporate governance. The International Journal of Accounting, 44(2), 113-137.

- Ebrahim, A. (2007). Earnings management and board activity: An additional evidence. Review of Accounting and Finance.

- Fama, E. F., & Jensen, M. C. (1983). Agency problems and residual claims. The Journal of Law and Economics, 26(2), 327-349.

- Ghosh, A., & Moon, D. (2010). Corporate debt financing and earnings quality. Journal of Business Finance & Accounting, 37(5-6), 538-559.

- Gillan, S. L. (2006). Recent developments in corporate governance: An overview. Elsevier.

- Glaum, M., Lichtblau, K., & Lindemann, J. (2004). The extent of earnings management in the US and Germany. Journal of International Accounting Research, 3(2), 45-77.

- Goncharov, I. (2005). Earnings management and its determinants: Closing gaps in empirical accounting research (Vol. 5). Peter Lang Pub Incorporated

- Gul, F. A., Fung, S. Y. K., & Jaggi, B. (2009). Earnings quality: Some evidence on the role of auditor tenure and auditors' industry expertise. Journal of Accounting and Economics, 47(3), 265-287.

- Habbash, M., Sindezingue, C., & Salama, A. (2013). The effect of audit committee characteristics on earnings management: Evidence from the United Kingdom. International Journal of Disclosure and Governance, 10(1), 13-38.

- He, L., Labelle, R., Piot, C., & Thornton, D. B. (2009). Board monitoring, audit committee effectiveness, and financial reporting quality: Review and synthesis of empirical evidence. Journal of Forensic & Investigative Accounting, 1(2).

- Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

- Hunjra, A. I., Mehmood, R., & Tayachi, T. (2020). How Do Corporate Social Responsibility and Corporate Governance Affect Stock Price Crash Risk? Journal of Risk and Financial Management, 13(2), 30.

- Huu Nguyen, A., Minh Thi Vu, T., & Truc Thi Doan, Q. (2020). Corporate governance and stock price synchronicity: Empirical evidence from Vietnam. International Journal of Financial Studies, 8(2), 22.

- Idris, M., Abu Siam, Y., & Nassar, M. (2018). Board independence, earnings management and the moderating effect of family ownership in Jordan. Management & Marketing, 13(2).

- Jaggi, B., Leung, S., & Gul, F. (2009). Family control, board independence and earnings management: Evidence- based on Hong Kong firms. Journal of Accounting and Public Policy, 28(4), 281-300.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Johari, N. H., Saleh, N. M., Jaffar, R., & Hassan, M. S. (2009a). The influence of board independence, competency and ownership on earnings management in Malaysia. International Journal of Economics and Management, 2 (2), 281-306.

- Kang, W. S., Kilgore, A., & Wright, S. (2011). The effectiveness of audit committees for low†and midâ€Âcap firms. Managerial Auditing Journal, 26(7), 623-650.

- Kao, L., & Chen, A. (2004). The effects of board characteristics on earnings management. Corporate Ownership & Control, 1(3), 96-107.

- Kasipillai, J., & Mahenthiran, S. (2013). Deferred taxes, earnings management, and corporate governance: Malaysian evidence. Journal of Contemporary Accounting & Economics, 9(1), 1-18.

- Klien, A. (2002). Economic determinants of audit committee. The Accounting Review, 77(2), 30-56.

- Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005a). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163-197.

- Laksmana, I., Tietz, W., & Yang, Y.-W. (2012). Compensation discussion and analysis (CD&A): Readability and management obfuscation. Journal of Accounting and Public Policy, 31(2), 185-203.

- Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69(3), 505-527.

- Li, W., & Li, Q. (2008). Board composition and earnings management. 2008 4th International Conference on Wireless Communications, Networking and Mobile Computing, 1-4.

- Lin, J. W., & Hwang, M. I. (2010). Audit quality, corporate governance, and earnings management: A meta-analysis. International Journal of Auditing, 14(1), 57-77.

- Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 59-77

- McNichols, M., & Wilson, G. P. (1988). Evidence of earnings management from the provision for bad debts. Journal of Accounting Research, 1- 31.

- Mehmood, R., Hunjra, A. I., & Chani, M. I. (2019). The impact of corporate diversification and financial structure on firm performance: Evidence from South Asian countries. Journal of Risk and Financial Management, 12(1), 49.

- Metawee, A. (2013). The relationship between characteristics of audit committee, board of directors and level of earning management, Evidence from Egypt. Journal of International Business and Finance, 6(1), 1-34.

- Minghua, G., & Shouli, M. (2002). An empirical analysis of the relationship between independent director system and corporate performance - Concurrently discusses the system environment for Chinese independent directors to exercise the right effectively. Nankai Economic Studies, 2, 64-68.

- Mohammad, W. M. W., Wasiuzzaman, S., & Salleh, N. M. Z. N. (2016). Board and audit committee effectiveness, ethnic diversification and earnings management: A study of the Malaysian manufacturing sector. Corporate Governance.

- Nelson, S. P., & Devi, S. (2013). Audit committee experts and earnings quality. Corporate Governance: The International Journal of Business in Society, 13(4), 335-351.

- Park, Y. W., & Shin, H.-H. (2004). Board composition and earnings management in Canada. Journal of Corporate Finance, 10(3), 431-457.

- Patelli, L., & Prencipe, A. (2007). The relationship between voluntary disclosure and independent directors in the presence of a dominant shareholder. European Accounting Review, 16(1), 5-33.

- Pearce, J. A., & Zahra, S. A. (1992). Board composition from a strategic contingency perspective. Journal of Management Studies, 29(4), 411-438.

- Piot, C., & Janin, R. (2007). External auditors, audit committees and earnings management in France. European Accounting Review, 16(2), 429-454.

- Saleh, N. M., & Ahmed, K. (2005). Earnings management of distressed firms during debt renegotiation. Accounting and Business Research, 35(1), 69-86.

- Shah, S. Z. A., Zafar, N., & Durrani, T. K. (2009). Board composition and earnings management an empirical evidence from Pakistani Listed Companies. Middle Eastern Finance and Economics, 3(29), 30-44

- Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737-783.

- Soliman, M., & Ragab, A. A. (2013). Board of director's attributes and earning management: Evidence from Egypt Proceedings of 6th International Business and Social Sciences Research Conference.

- Taylor, I., & Smith, K. (2007). United Nations Conference on Trade and Development (UNCTAD). Routledge.

- Tian, J. J., & Lau, C.-M. (2001). Board composition, leadership structure and performance in Chinese shareholding companies. Asia Pacific Journal of Management, 18(2), 245- 263.

- Wang, M. (2014). Which types of institutional investors constrain abnormal accruals? Corporate Governance: An International Review, 22(1), 43-67.

- Xie, B., Davidson III, W. N., & DaDalt, P. J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295-316.

- Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.

- Yu, F. F. (2008). Analyst coverage and earnings management. Journal of Financial Economics, 88(2), 245-271.

- Zahra, S. A., & Pearce, J. A. (1989). Boards of directors and corporate financial performance: A review and integrative model. Journal of Management, 15(2), 291-334.

Cite this article

-

APA : Abbas, Y., & Abbas, Z. (2021). Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies. Global Economics Review, VI(IV), 42-57. https://doi.org/10.31703/ger.2021(VI-IV).04

-

CHICAGO : Abbas, Yasar, and Zaheer Abbas. 2021. "Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies." Global Economics Review, VI (IV): 42-57 doi: 10.31703/ger.2021(VI-IV).04

-

HARVARD : ABBAS, Y. & ABBAS, Z. 2021. Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies. Global Economics Review, VI, 42-57.

-

MHRA : Abbas, Yasar, and Zaheer Abbas. 2021. "Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies." Global Economics Review, VI: 42-57

-

MLA : Abbas, Yasar, and Zaheer Abbas. "Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies." Global Economics Review, VI.IV (2021): 42-57 Print.

-

OXFORD : Abbas, Yasar and Abbas, Zaheer (2021), "Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies", Global Economics Review, VI (IV), 42-57

-

TURABIAN : Abbas, Yasar, and Zaheer Abbas. "Corporate Governance's Role in Mitigating Earnings Manipulations: Evidence from Asian Economies." Global Economics Review VI, no. IV (2021): 42-57. https://doi.org/10.31703/ger.2021(VI-IV).04