Abstract:

The purpose of this paper is to investigate the effect of Microfinance Services and Networking relationship on Micro Small and Medium Enterprises Performance with the mediating role of Social capital. This study was a descriptive survey design. The target population was 584,572 MSMEs in the province, and owner-managers of MSMEs were the unit of analysis and were targeted for information because they are likely to be the decision-makers in these businesses and are actively involved in their day to day operations. 356 MSME owner-managers were sampled. Data were obtained through adapted construct and measured from a five-point Likert scale, and interview schedules were used to collect data from the field. Qualitative data analyzed by using Statistical Package for Social Sciences (SPSS). The study found that there was a positive effect on MSME performance by Microcredit and Networking with the mediating effect of Social capital.

Key Words:

Social Capital, Value Creation, Microcredit, MSME

Introduction

Micro, Small and Medium Enterprises (MSMEs) throughout the world are recognized by the Government, especially in developing countries, so they contribute to economic growth and stability in the form of employment, creation of new jobs, social cohesion and development (Hashim, Raza&Miani, 2018; Ratten, 2014). In most of the developing and developed states, Micro, Small and Medium Enterprises recognized as a central part of any industrial structure (Umar, Sasongko&Aguzman, 2018; Ahmad &Pirzada, 2014). The MSME sector is important for surviving the economic recession. Globally, small scale enterprises represent 90 to 95% of companies and generate between 60% and 70% of employment opportunities in most countries Ibrahim & Mahmood (2016) and, mainly, in developing countries. MSMEs are of great importance (Rao, 2014). The vital role of small-scale enterprises was not being considered before. Only large organizations were supposed to be part of the country's economic growth, as well as an integral part of obtaining huge foreign exchange reserves. Economist believes in the potential of MSMEs, especially in different Asian countries, including Taiwan, Korea and Japan, whose economy is growing based on their MSMEs (Khattak, Arslan & Umair, 2011).

Pakistan and MSMEs Profile

The owners of MSMEs ran a wide range of companies in various sectors of Pakistan. In Pakistan, there are mainly three sectors where MSMEs operates, including agricultural, light industries and service sectors. The agricultural sector consists of small farmers, ranchers, poultry farmers, nurseries, vegetable suppliers and basic resources suppliers like fertilizers and rental tractors suppliers. Light industries consist of toys, plastic products, shoe papers, handicrafts, bottles, spare parts and artificial jewellery etc. The service sector consists of the services providers in the field of restaurants, beauty salons, hairdressings, cybercafé, mobile shops, medical shops, schools, shipping companies and mechanics. Majority of business organizations are the sole-proprietorship form of business organizations. Majority of companies are informal and unregistered companies and are owned mostly by the male. Also, male-owned companies are larger in size as compare to female-owned companies. According to (Ullah, Mahmud &Yousuf, 2013) “Women-owned companies are generally tended to be smaller as compare to male-owned companies in terms of a number of employees, physical capital, sales generation and costs”. Generally, the payment mechanism adopted by MSMEs’ in Pakistan is effective only a few used credit payments mechanism.

According to the World Bank Business Survey from 2006 to 2009, small businesses in developing countries face plenty of problems including access to credit, energy crises, lack of access to market, technological and technical deficiencies. Thus, limited access to funding remains an important factor in slowing the MSME’sperformance in Pakistan and particularly in KP.

The emergence of the Problem

Pakistan is equipped with an incredible capacity to improve the economy and people's living standards. In any case, the main problem or difficulty hinders the development of MSMEs. By the late 90s, the corporate sector, particularly in large manufacturing units, was largely concentrated and the MSME was ignored. Khawaja (2006) reported in his article that Pakistan does not significantly help MSMEs grow according to their regulatory and policy environment, and that government effort is still focused on the development of large corporations. This is why MSMEs do not have adequate access to resources on a large industrial scale. The strength and success of MSMEs lie in access to finance, innovation, original technology, good network and fast communication, reduction of bureaucracy, external and internal contact and market trends.

Access to finance is one of the biggest challenges for MSMEs, and most of MSMEs do not have the collateral needed for collateral, making loan sanctions from banks and lenders seem very difficult. Most small businesses lack accounting and financial information, which prevents them from obtaining information-based or financial statement-based loans and corresponding credit scores. The majority rely on personal finances, supplier credit, loans from friends and relatives. Taxes, corruption, high interest and price are the major complaints that limit the bank's role. The main problem for MSMEs is the lack of access to formal funding sources, including banks and lenders, as well as entrepreneurial Networking. Following questions facilitated researcher to take this topic to conduct current research.

Literature Review

Micro, Small and Medium Enterprises have great importance in promoting economic growth, the progress of technological innovation, the supply to large enterprises, the artisan industry, economic redevelopment and social development. These small-scale businesses are among the basic sources used for decreasing poverty and strengthening the economy. Unemployment can be reduced with these small-scale businesses, and the same can be used for social uplifting. Like other developing countries, the Pakistan economy is directly reflected in the small sector businesses (Khalique, Isa & Nasir, 2011).

MSMEs Definitions in other Countries

The definition of MSMEs that apply in many countries is based on considering several aspects like organizational size, personnel number, sales volume and also may be output sometimes (Cunningham & Rowley, 2008).

Definition of MSMEs in the context of Pakistan

In Pakistan, no cohesive definition of MSMEs is available (Dar, Ahmed, & Raziq, 2017). Banks defined small scale businesses in different ways. Just like, SMEDA defines small scale businesses on the bases of a number of employees employed and also on the total number of output whereas SME banks used only total value of assets employed as a basic criterion for defining small scale businesses. In Pakistan, businesses having working force up to 250 and assets valuation having 25 million rupees’ wealth lies under the small businesses sector (kureshi, Mann, Khan & Qureshi, 2009).

Core Problems Faced by MSMEs in Pakistan

Pakistan has incredible development potential to improve economic development and people's standard of living. However, the main problem or challenge delays the development of SMEs. SMEs have been neglected until the late 1990s, with particular emphasis on the corporate sector in large manufacturing facilities. Governments, financial institutions and banks mostly focus on large scale businesses as compared to small businesses. Pakistan's normative and political circumstances do not show any valuable measures for the advancement of small-scale businesses, but they are actually concentrating mostly on large scale businesses (Khwaja, 2009).

Hypothesis

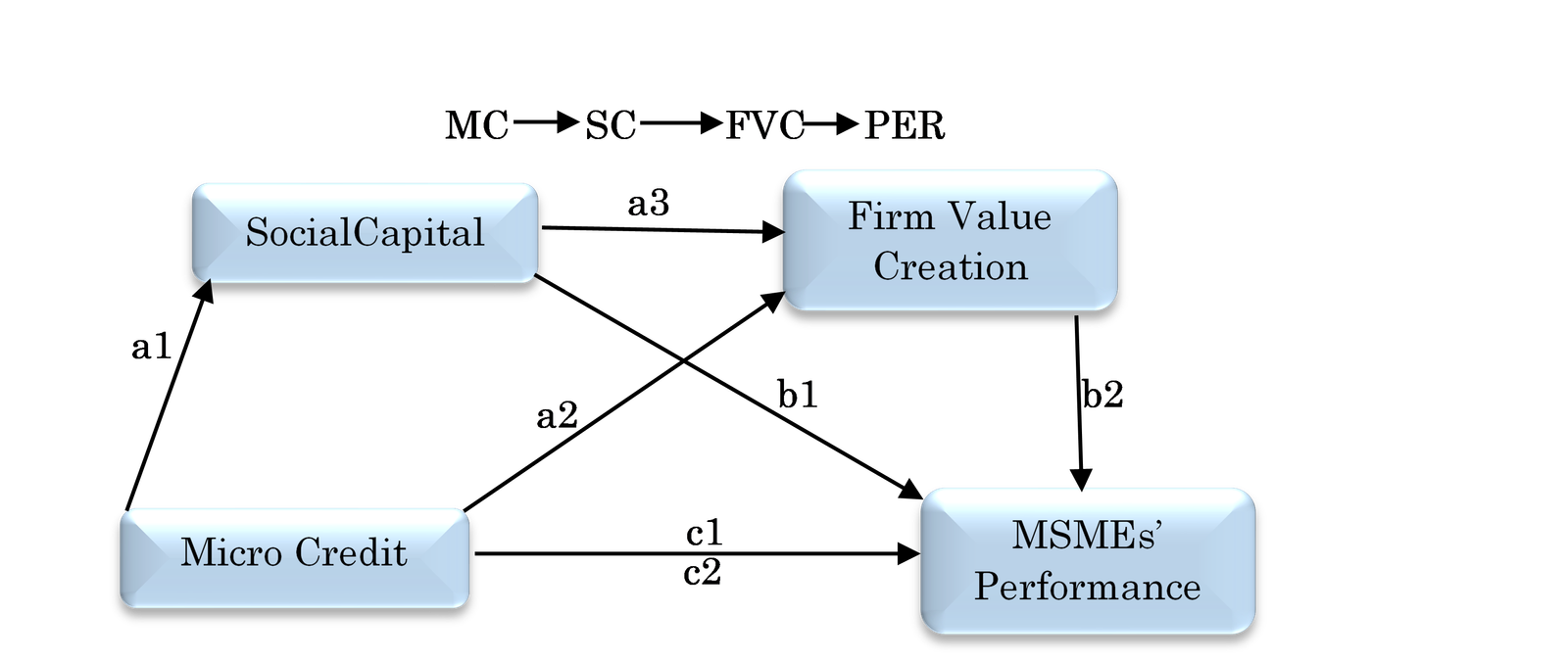

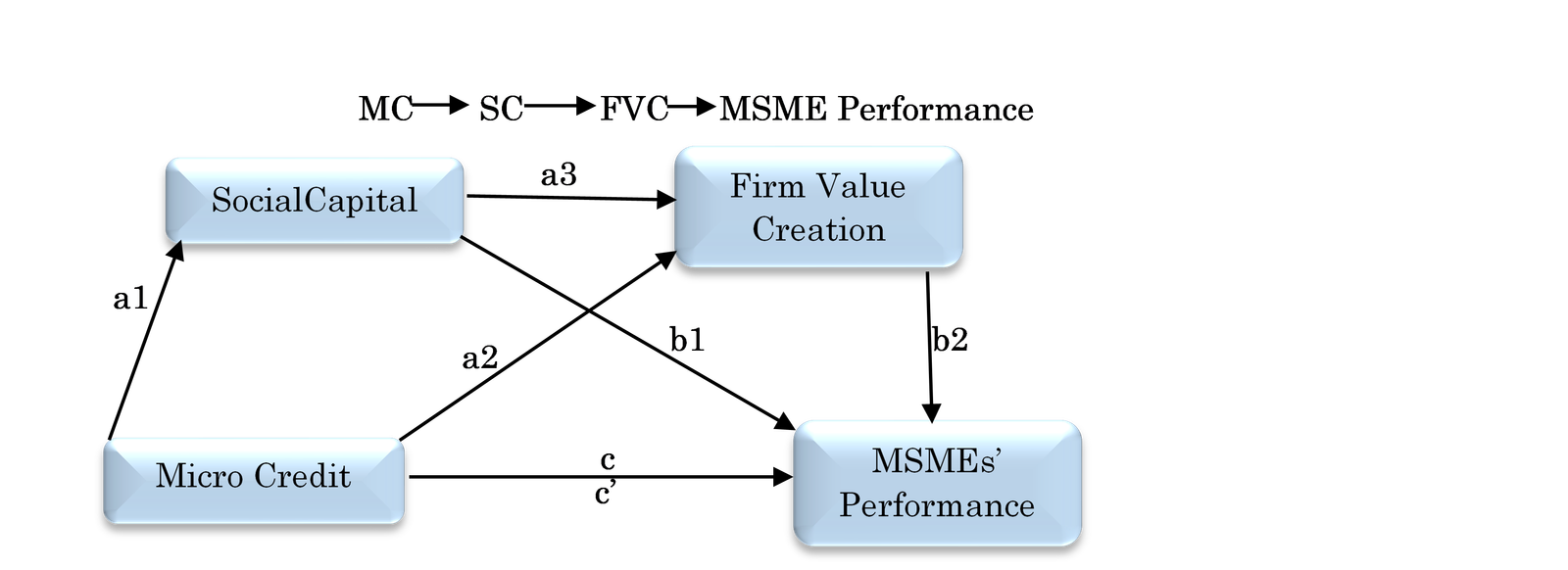

H1: Social capital and Firm value creation mediate the association of Microcredit with MSMEs’ performance as serial mediators.

Hypothesis 1 is developed to examine the role of Social capital and firm value creation as serial mediators between the effect of microcredit on MSMEs’ performance.

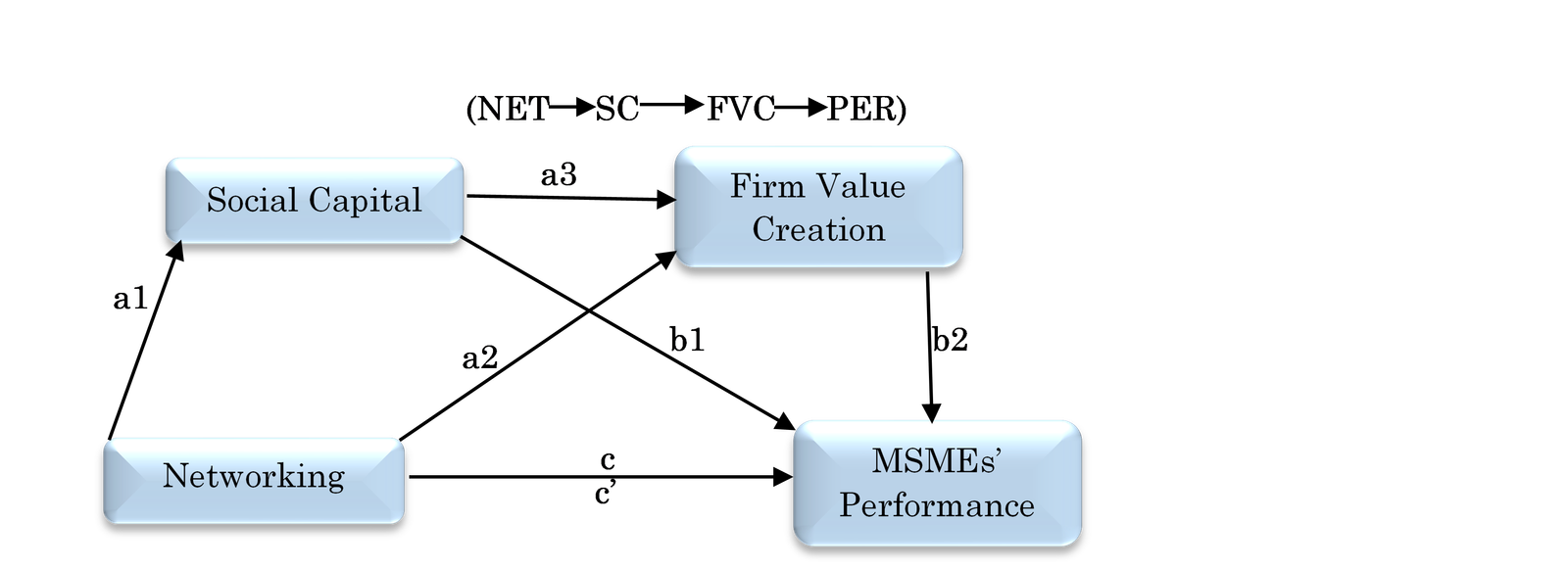

H2: Social capital and Firm value creation mediate the relationship of Networking with MSME performance as sequential mediators.

Hypothesis 2 is developed to examine the role of Social capital and firm value creation as serial mediators between the effect of Networking on MSMEs’ performance.

RQ 1: Is there any relationship of Microcredit and Networking with Social capital?

RQ 2: Is there any relationship of Social capital with Firm value creation and MSME performance?

RQ 3: Is Social capital mediating the relationship between Microcredit and MSME performance?

RQ 4: Is Social capital mediating the relationship between Networking and MSMEs’ performance?

RQ 5: Are Social capital mediating the effect of Microcredit on Performance of MSME as serial mediators?

RQ 6: Are Social capital mediating the effect of Networking on MSME performance as serial mediators?

Research Methodology

This study utilized a quantitative strategy suggesting that which research design was adopted. The quantitative investigation gave a numerical point of view to MSME's estimation by streamlining the experience of Entrepreneurs into numerical information appropriate for measurable statistical analysis. The information from the study was as rich and definite portrayals that caught the scientist's significant experience.

The present study population comprised all MSME’s of KP, which incorporates Micro Small and Medium Enterprises from different enterprises, for example, business, fabricating, both retail and wholesale. Sample size to have the option to get a more extensive picture and more extensive information of the study, (400) MSMEs were sent research questionnaire. However, just (356 MSMEs) had the option to react to the surveys.

Hair, Anderson, Tatham & Black (1998) suggested that if the sample is representative than almost fifteen to twenty observations per independent variable of the study is enough. By following Hair’s formula, the sample drawn for the current study is too small. Hence, by focusing the statistical analysis to be adopted here, the researcher applied Yamane, (1967) formula for extracting sample size from the target population and derived a 400-sample size for the current study.

Formula:

n = ____N____

1 + N (e) ²

n=584572/ (1+584572(0.05)2)

Where

n = size of sample (required responses),

N = Total population

I= 95 % confidence level, e = level of precision or error limit in results equals to 0.05

n=400

Summary of Target Population and Sample Size

|

Category |

Target Population |

Sample Size |

% |

|

Groceries and

Food outlets |

13232 |

11 |

0.05 |

|

Clothing only |

128902 |

88 |

21 |

|

Electrical and

Furniture |

204914 |

141 |

35 |

|

Combination of

groceries, clothing, furniture and electrical |

237524 |

160 |

38 |

|

Total |

584572 |

400 |

100 |

The questionnaire was used

as a data collecting instrument in the present study. Questionnaire accumulates

concise and solid information as well as valid data due to objective-oriented,

standardized and identical responses (Sekaran & Bougie,

2010). Simple and fair words containing questionnaire was designed so

that respondents can better understand and give better responses to all the

questions. The questionnaire was distributed mainly into two main parts.

Beginning part contained basic demographic information about the respondents

while the second part of the questionnaire contained questions about study

constructs, i.e. Microcredit, Networking, Social capital, Firm value creation

and MSME’s performance were placed.

Findings of the Study Serial Mediation Analysis

the present study is different from previous studies also with the methodological approach employed for checking the mediating role of both mediators simultaneously. In this approach, two or more mediators influence each other in the same model. Here the indirect effect of the predictor on a criterion is checked through mediator one and mediator two in a sequence. This approach is known as serial or sequential mediation and was introduced by Preacher and Hayes (2008).

An indirect effect of criterion on predictor through mediators in serial mediation analysis is split into several indirect effects. When two mediators are used in a study, three particular indirect paths may be calculated. First, the indirect path takes into account the first mediator. The second indirect path goes through both the mediators by following long-way mediation. This long-way mediation indicates a causal chain of mediators which provide a base for serial mediation. The third indirect path goes through the second mediator.

For the conduct of serial mediation analysis Model 6 presented by Hayes (2013) in PROCESS, macros are generally applicable. Two hypotheses, i.e. H1 and H2 are developed containing serial or sequential mediation by taking both the mediators of the present study in a sequence, hence, the same model is used for analyzing this specific long-way mediation analysis.

Model 1: Serial Mediation

Serial model # 1 is derived for testing hypothesis 1 which was developed for checking the mediating role of Social capital and Firm value creation as serial or sequential mediators in the association of microcredit and MSMEs’ performance. Following table shows the results obtained from analyzing this model.

Summary of Serial Mediation Model 1: (MC?SC?FVC?PER)

|

Microcredit (MC) n= 356 |

|||||||||

|

Model Summary |

|||||||||

|

R |

R-sq. |

Se |

F |

Df1 |

Df2 |

p |

|||

|

.7702 |

.5932 |

.3827 |

516.2856 |

1.0000 |

354.000 |

0.000 |

|||

|

|

|||||||||

|

Path |

Coefficient |

p value |

|||||||

|

MC

? SC (a1) |

.7101 |

.0000 |

|||||||

|

MC

? FVC (a2) |

.6993 |

.0000 |

|||||||

|

SC

? FVC (a3) |

.1662 |

.0000 |

|||||||

|

SC

? PER (b1) |

. 3163 |

.0000 |

|||||||

|

FVC

? PER (b2) |

. 2239 |

.0000 |

|||||||

|

MC

? PER (c) |

. 6717 |

.0000 |

|||||||

|

MC

? SC ? FVC ? PER (c`) |

1.0793 |

.0000 |

|||||||

|

|

Effect |

95CI |

|||||||

|

LLCI |

ULCI |

||||||||

|

Total |

1.0793 |

1.0302 |

1.1284 |

||||||

|

Direct |

.6717 |

.5809 |

.7625 |

||||||

|

Indirect

(total) |

.4076 |

.3160 |

.5110 |

||||||

|

Ind1:

(MC ?SC?PER) (a1b1) |

.2247 |

.1688 |

.2909 |

||||||

|

Ind2:

(MC ?SC?FVC?PER) (a1a3b2) |

.1565 |

.0860 |

.2331 |

||||||

|

Ind3:

(MC ?FVC?PER) (a2b2) |

.0264 |

.0100 |

.0508 |

||||||

MC=Microcredit, SC=Social

capital, FVC=Firm Value Creation, PER=MSMEs’ performance, LLCI=Lower Level

Confidence Interval, ULCI=Upper Level Confidence Interval, Ind =Indirect path

Hypothesis 1

Results showing in the above table that the overall model predicting MSME’s performance through Social capital and Firm value creation by microcredit is significant by securing F=516.2856 with p-value 0.000, whereas recorded a significant variation in MSME’s performance (R2= 0.5932). The path leading from microcredit to Social capital shows the significant positive effect of microcredit on Social capital (M1), i.e. a1=0.7101with p-value 0.000. The path leading from microcredit to Firm value creation (M2) reveals the significant positive effect of microcredit on Firm value creation, i.e. a2=.6993 with p-value .000. The path leading from Social capital (M1) to Firm value creation (M2) also shows a significant positive effect of Social capital on Firm value creation, i.e. a3= .1662 with p-value 0.000. The path leading from Social capital to MSMEs’ performance reveals a significant positive effect of Social capital on MSMEs’ performance, i.e. b1= .6717 with p-value 0.000. Also, the path leading from Firm value creation to MSMEs’ performance reveals the significant positive effect of Firm value creation on MSMEs’ performance, i.e. b2= .3163 with p-value 0.000. The direct path from microcredit to MSMEs’ performance without taking Social capital and Firm value creation as mediators also shows the significant positive effect of microcredit on MSMEs’ performance, i.e. c= 0.2239 with p-value 0.000. Furthermore, the path leading from microcredit to MSMEs’ performance through Social capital and firm value creation, adding as serial mediators, also shows the significant positive effect of microcredit on MSMEs’ performance through long-way mediation by taking Social capital and Firm value creation as serial or sequential mediators into account, i.e. c`=1.0793 with p-value 0.000.

The total effect, i.e. 1.0793 of microcredit on MSMEs’ performance with 1.0302 Lower Limit Confidence Interval (LLCI, at 95% CI) and 1.284 Upper Limit Confidence Interval (ULCI, at 95% CI). This total effect is the aggregate of direct effect i.e. 0.6717 (.5809 LLCI, .7625 ULCI) and indirect effect i.e. .4076 (.3160 LLCI, .5110 ULCI).

When two mediators are involved in the serial or sequential model, then the indirect effect of the predictor on a criterion is the sum of three specific indirect path effects.

First, indirect path, i.e. taking only Social capital (M1) into account shows the indirect effect of microcredit on MSMEs’ performance through Social capital, i.e. a1b1= .2246 (.1688 LLCI, .2909, ULCI). Second indirect path, i.e. taking both Social capital (M1) and Firm value creation (M2) into account as serial mediators show the indirect effect of microcredit on MSMEs’ performance through Social capital and Firm value creation, i.e. a1a3b2=.1565 (.0860 LLCI, .2331 ULCI). Third indirect path, i.e. taking only Firm value creation (M2) into consideration shows the indirect effect of microcredit on MSMEs’ performance through Firm value creation, i.e. a2b2= .0264 (.0100 LLCI, .0508 ULCI). As discussed earlier that for confirming the mediating role of mediator or mediators between predictor and criterion, the lower and upper limits of confidence intervals must not cross zero. Hence, in the present analysis, results also reveal none of the lower and upper confidence intervals of any of the direct and indirect effect is crossing zero which confirming the mediating role of Social capital and Firm value creation in the relationship of microcredit and MSMEs’ performance. However, as both the c and c` paths have got a level of significance by obtaining p-value 0.000 so the mediation is of partial nature not of full nature.

Model 2: Serial Mediation

Above model is considering Social capital and Firm value creation as sequential or serial mediators between Networking and MSME performance. Results revealed are showing in the following table.

Summary of Serial Mediation Model 2: (NET?SC?FVC?PER)

|

Networking (NET) n= 356 |

|||||||||

|

Model Summary |

|||||||||

|

R |

R-sq. |

MSe |

F |

Df1 |

Df2 |

p |

|||

|

.5030 |

.2530 |

.7029 |

119.926 |

1.000 |

354.000 |

0.000 |

|||

|

|

|||||||||

|

Path |

Coefficient |

p value |

|||||||

|

NETWOR

? SC (a1) |

.4516 |

.0000 |

|||||||

|

NETWOR

?FVC (a2) |

.1287 |

.0011 |

|||||||

|

SC

?FVC (a3) |

.6783 |

.0000 |

|||||||

|

NETWOR

? PER (b1) |

.0971 |

.0019 |

|||||||

|

NETWOR

? PER (b2) |

.5108 |

.0000 |

|||||||

|

NETWOR

? PER (c) |

.6401 |

.0000 |

|||||||

|

NETWOR

? SC ? FVC ? PER (c`) |

.6062 |

.0000 |

|||||||

|

|

Effect |

95CI |

|||||||

|

LLCI |

ULCI |

||||||||

|

Total |

.6062 |

.5045 |

.7079 |

||||||

|

Direct |

.0971 |

.0361 |

.1580 |

||||||

|

Indirect

(total) |

.5091 |

.4151 |

.6041 |

||||||

|

Ind1:

(NETWOR ?SC?PER) (a1b1) |

.2307 |

.1643 |

.3083 |

||||||

|

Ind2(NETWOK?SC?FVC?PER)

(a1a3b2) |

.0824 |

.0251 |

.1465 |

||||||

|

Ind3:

(NETWOR ?FVC?PER) (a2b2) |

.1961 |

.1524 |

.2427 |

||||||

NETWOR=Networking, SC=Social

capital, FVC=Firm Value Creation, PER=MSMEs’ performance, LLCI=Lower Level

Confidence Interval, ULCI=Upper Level Confidence Interval, Ind =Indirect path

Hypothesis 2

the overall model predicting MSME’s performance through Social capital and Firm value creation by Networking is significant by securing F=119.926 with p-value 0.000, whereas recorded a significant variation in MSME’s performance (R2= 0.2530). The path leading from Networking to Social capital shows a significant positive effect of Microcredit on Social capital (M1), i.e. a1=0.4516 with p-value 0.000. The path leading from Networking to Firm value creation (M2) reveals the significant positive effect of Microcredit on Firm value creation, i.e. a2=.1287 with p-value .001. The path leading from Social capital (M1) to Firm value creation (M2) also shows the significant positive effect of Social capital on Firm value creation, i.e. a3= .6783 with p-value 0.000. The path leading from Social capital to MSMEs’ performance reveals a significant positive effect of Social capital on MSMEs’ performance, i.e. b1= .0971 with p-value 0.001. Also, the path leading from Firm value creation to MSMEs’ performance reveals the significant positive effect of Firm value creation on MSMEs’ performance, i.e. b2= .5108 with p-value 0.000. The direct path from Networking to MSMEs’ performance without taking Social capital and Firm value creation as mediators also shows the significant positive effect of Networking on MSMEs’ performance, i.e. c= 0.6401 with p-value 0.000. Furthermore, the path leading from Microcredit to MSMEs’ performance through Social capital and firm value creation, adding as serial mediators, also shows the significant positive effect of Microcredit on MSMEs’ performance through long-way mediation by taking Social capital and Firm value creation as serial or sequential mediators into account, i.e. c`=.6062 with p-value 0.000.

the total effect, i.e. .6062 of Networking on MSMEs’ performance with .5045 Lower Limit Confidence Interval (LLCI, at 95% CI) and .7090 Upper Limit Confidence Interval (ULCI, at 95% CI). This total effect is the aggregate of direct effect i.e. 0.0971 (.0361 LLCI, .1580 ULCI) and indirect effect i.e. .5091 (.4151 LLCI, .6041 ULCI).

when two mediators are involved in the serial or sequential model, then the indirect effect of the predictor on a criterion is the sum of three specific indirect path effects. So, the last portion of above table 4.34 shows the three indirect paths effects. First, indirect path, i.e. taking only Social capital (M1) into account shows the indirect effect of Networking on MSMEs’ performance through Social capital, i.e. a1b1= .2307 (.1643 LLCI, .3083, ULCI). Second indirect path, i.e. taking both Social capital (M1) and Firm value creation (M2) into account as serial mediators show the indirect effect of Networking on MSMEs’ performance through Social capital and Firm value creation, i.e. a1a3b2=.0824 (.0251 LLCI, .1465 ULCI). Third indirect path, i.e. taking only Firm value creation (M2) into consideration shows the indirect effect of Networking on MSMEs’ performance through Firm value creation, i.e. a2b2= .1961 (.1524 LLCI, .2427 ULCI). As discussed earlier that for confirming the mediating role of mediator or mediators between predictor and criterion, the lower and upper limits of confidence intervals must not cross zero. Hence, in the present analysis, results also reveal none of the lower and upper confidence intervals of any of the direct and indirect effect is crossing zero which confirming the mediating role of Social capital and Firm value creation in the relationship of Networking and MSMEs’ performance. However, as both the c and c` paths have got a level of significance by obtaining p-value 0.000 so the mediation is of partial nature not of full nature.

Conclusion

The unique contribution of the present paper is developing a theoretical model combining Microcredit, Networking, Social capital and Firm value creation as contributing factors to enhance micro, small and medium enterprises’ performance in developing countries particularly Pakistan with special reference to Khyber Pakhtunkhwa (KP) province. Two variables, i.e. Social capital and Firm value creation were incorporated as mediators in the present study, so for checking this indirect effect of predictors on criterion mediation analysis was also conducted. As in the present study, both simple and serial mediation is involved. So, for simple mediation model # 4 and for serial mediation model # 6 by Hayes (2013) was employed. Results revealed that Social capital and Firm value creation play role of mediators in the association of Microcredit and Micro, Small and Medium Enterprises’ Performance as well as in the association of Networking and micro, small and medium enterprises’ performance. Both the mediators partially mediate the association of predictors (Microcredit and Networking) and criterion (micro, small and medium enterprises’ performance) individually as serial or sequential mediators.

References

- Ahmad, Y., & Pirzada, D.S. (2014). Using the analytic hierarchy process for exploring prioritization of functional strategies in auto parts manufacturing SMEs of Pakistan. SAGE Open, 4(4).

- Cunningham, L. X., & Rowley, C. (2008). The development of Chinese small and medium enterprises and human resource management: A review. Asia Pacific Journal of Human Resources, 46(3), 353-379.

- Dar, M. S., Ahmed, S., & Raziq, A. (2017). Small and medium-sized enterprises in Pakistan: Definition and critical issues. Pakistan Business Review, 19(1), 46-70.

- Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (1998). Multivariate data analysis 5(3), 207-219.

- Hashim, N.A.B., Raza, S., & Minai, M.S. (2018). Relationship between EntrepreneurialCompetencies and Small Firm Performance: Are Dynamic Capabilities the Missing Link? Academy of Strategic Management Journal, 17(2).

- Hayes, J. R. (2013). The complete problem solver. Routledge.

- Ibrahim, N. M. N., & Mahmood, R. B. (2016). Factors influencing small and medium enterprises' performance. International Journal of Economics, Commerce and Management, 4(1).

- Khalique, M., Isa, A. H. B. M., Shaari, N., Abdul, J., & Ageel, A. (2011). Challenges faced by small and medium enterprises (SMEs) in Malaysia: An intellectual capital perspective. International Journal of current research, 3(6), 398

- Khattak, J.K., Arslan, M. & Umair, M. (2011). SMEs' export problems in Pakistan. Journal of Business Management and Economics, 2(5), 192-199.

- Khawaja, S. (2006). Unleashing the Potential of the SME Sector with a Focus on Productivity Improvements. In the Pakistan Development Forum.

- Kureshi, N. I., Mann, R., Khan, M. R., & Qureshi, M. F. (2009). Quality management practices of SME in developing countries: A survey of manufacturing SME in Pakistan. Journal of Quality and Technology Management, 5(2), 63-89.

- Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behaviour research methods, 40(3), 879-891.

- Sekaran, U., & Bougie, R. (2010). Research for Business-A Skill Building Approach.

- Ullah, M. M., Mahmud, T. B., & Yousuf, F. (2013). Women entrepreneurship: an Islamic perspective. European Journal of Business and Management, 5(11), 44-52.

- Umar, A., Sasongko, A.H., & Aguzman, G. (2018). Business model canvas as a solution for the competing strategy of small business in Indonesia. International Journal of Entrepreneurship, 22(1), 1-9.

- Yamane, T. (1967). Elementary sampling theory.

Cite this article

-

APA : Habib, N., & Awan, Z. (2020). Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan. Global Economics Review, V(I), 234-244. https://doi.org/10.31703/ger.2020(V-I).19

-

CHICAGO : Habib, Nida, and Zahid Awan. 2020. "Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan." Global Economics Review, V (I): 234-244 doi: 10.31703/ger.2020(V-I).19

-

HARVARD : HABIB, N. & AWAN, Z. 2020. Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan. Global Economics Review, V, 234-244.

-

MHRA : Habib, Nida, and Zahid Awan. 2020. "Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan." Global Economics Review, V: 234-244

-

MLA : Habib, Nida, and Zahid Awan. "Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan." Global Economics Review, V.I (2020): 234-244 Print.

-

OXFORD : Habib, Nida and Awan, Zahid (2020), "Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan", Global Economics Review, V (I), 234-244

-

TURABIAN : Habib, Nida, and Zahid Awan. "Mediating Role of Social Capital and Firm Value Creation in Relationship Among Microcredit, Networking and MSME's Performance in Pakistan." Global Economics Review V, no. I (2020): 234-244. https://doi.org/10.31703/ger.2020(V-I).19