Abstract:

This paper studies the legitimacy of existing Islamic banking as an artificial person with the element of limited liability. This paper aims to analyze those arguments which are presented in favor of Islamic banking in the aforesaid ground. It examines these arguments to see whether the role of Islamic banks as an artificial person with the element of limited liability is consistent with the laid down principles of Shari’ah or not. This paper denies those arguments and declares the present Islamic banking un-Islamic. The prospectus of the bank was also found inconsistent with the basic rules of Mudarabah. The transactions of Islamic banks with their clients were also found contradictorily with the basic conditions of a valid contract. The role of the director as a paid shareholder was also found contravening the injunctions of Islam. According to the author, the presence of an Islamic bank as an artificial person with tag of limited liability on its brow has no evidence in the literature of Islamic Jurisprudence

Key Words:

Shari’ah Legitimacy, Islamic Banks, Artificial Person, Mudarabah

Introduction

A company is a voluntary association that acts like an artificial person created by law, having the limited liability of its members and a perpetual succession with its capital divided into transferable shares and which has a common seal, and registered and incorporated in Pakistan under the Companies ordinance, 1984 (Suryawnshi, 2013). The role of these two principles, artificial person and limited liability, in a bank is similar to that of backbones possessed by a human body. The concept of a company can't even be imagined without these two key pillars.

This artificial person acts as an actual person who can sue, can use its name, can make a deal, and can even enter into a contract. It is also responsible for dealing, making expenses, and doing everything related to company affairs, but it has no physical or real shape (Wolgast, 1992). Similarly, the directors/promoters and administrators involved in the company affairs are the organs and members of the company. These organs and members become the eyes, brains, and hands of the company when it enters into a deal or a contract with its clients. The difference between an actual person and the artificial one, developed by corporate law authority, is that the liability of an actual person is unlimited while that of an artificial person is limited (Mark, 1987).

The bank is also a company, whether Islamic or un-Islamic. Its attributes are similar to that of a general company. However, the modern Islamic Jurists have tried and trying their level best to link the roots of Islamic bank with the traditional Islamic terminologies used in Islamic Jurisprudence as evidence from Islamic Fiqh, so that they can provide a solid Islamic base for the existence and validity of the existing Islamic banking system. These Jurists have left no stone unturned for providing a "solid Islamic base" for the modes of financing pursued by the existing Islamic banks. They have also tried their level best in order to motivate and convince the general public for their practical involvement in these banks as investors by issuing different “Fatawa” from different “Muftees” across the country. They also proclaim it as a Shari’ah obligation upon the Muslim community to invest their money in Islamic banks and become a part of its potency and growth, for which they will be definitely entitled to two types of rewards, Ribh (profit) in this world while Ajr-i-Azeem (huge reward) in the life hereafter.

This article is an attempt to emphasize on the legitimacy of Islamic banks, while analyzing their arguments presented in favor of Islamic banking as evidence from Islamic Fiqh. This article is focused on that segment of their arguments which is presented for its legality as an artificial person having limited liability.

Before we scrutinize its legitimacy on the aforesaid grounds, let us start our discussion from some basic rules and conditions of a contract related to economic activities. The Islamic Jurists have illustrated various conditions for a valid contract; a contract that is sound both in its pillars (positive proposal & acceptance) and characteristics (conditions). Followings are the conditions to be fulfilled by the parties before having any contract related to Mu’amlat:

i. They must be free, not a slave,

ii. They must be rational not saint,

iii. They must be adult not child, and

iv. They must also have a sense to differentiate between what is wrong and what is beneficial in the course of business.

Similarly, conditions of confirmation developed by Islamic Jurists (Kharofa, 1997) for a valid contract are also listed below:

i. The existence of two contracting parties;

ii. The format and the subject; and

iii. Particular conditions for certain contracts to be valid.

These conditions will be used as reference materials in the discussion ahead. The arguments presented for the legality of Islamic Banks are analyzed from two different dimensions, first, legitimacy of Islamic Bank as artificial person and, second, legitimacy of Islamic Bank as limited liability.

Legitimacy of Islamic Bank as “Artificial Person”

The arguments presented by modern Islamic Jurists in favor of its role as an artificial person are listed below.

Argument 1

They argue that the role of “Waqf” and “Bait-ul-Maal” in Islam, is just like an artificial person, which is similar to that of company, where each of them are responsible for everything related to their activities and dealing with their clients/members (Usmani, 2003).

Analysis of the Argument

This argument contains two main contents: one is the role of “Waqf and Bait-ul-Maal” as artificial person, while the other is their similarity in responsibilities with the Islamic bank in dealing with their clients. The Islamic Jurists have denied their judgment of “bank over Waqf and Bait-ul-Maal” as a baseless judgment on the following grounds:

a. The property and assets of the “Waqf” and “Bait-ul-Maal” are not owned by any individual in Muslim society at individual capacity. The owner of the property is itself the bait-ul-maal. They are not entitled to any among them. However, these individuals are allowed to their beneficiary rights (usufruct right) only. The purpose of these institutions is the general welfare of the society, not to build a business empire on the basis of illegal devices like that of Islamic Banking. The general public is neither the owner nor investor of/in any among them and, therefore, they are not entitled to any claim. In contrast, the so-called "Islamic Bank” property and assets are owned by the ultimate shareholders (its promoters, directors, and investors).

b. The property and assets of “Waqf and Bait-ul-Maal” can’t be sold, or inherited, or it can’t be even gifted to anybody else. Similarly, there is no concept of insolvency or bankruptcy in either of these two institutions in Islam because neither they are involved in business activities and nor they are the property of someone who can be made corrupted through miss-management. In contrast, the position of the Islamic bank in these lines is totally different. The property of a bank can be sold, can be inherited, and also can be gifted with the mutual consent of its members. In case of bankruptcy or failure, the bank is dissolved through the law, and its assets and property are divided and returned to the shareholders, even among the deceased shareholders.

c. In general Waqf, the beneficiaries are not known to the director of Waqf. He can neither fix the quantity nor the beneficiaries. Whereas, in the case of bank, both the quantity (rate of return) and the beneficiaries (investors) are fixed and known to the directors of the company.

d. The responsibility of the directors in these institutions, in actuality, is like that of “mutaba’ri”. He is responsible for preserving the individual and collective human needs/rights of the society. They are not seated over there to preserve their own interests or the interests of their families, friends, and relatives. On the other hand, the breads of the directors in Islamic banks are buttered on both sides. On one hand, they entertain unlimited benefits in the form of salaries, allowances, bonuses, and perquisites on behalf of their services, while on the other hand, they receive profit as shareholders. They are also involved in activities which protect their interests at the cost of shareholders, like nepotism, and the aforesaid financial reliefs, which are the main causes of the decrease in the net value of overall business profit. Higher the values of these incentives and privileges, the lower will be the value of profit to the rest of the shareholders.

With these differences, the provision of a route on behalf of the given evidence towards validity of Islamic bank as an artificial person seems to be irrational. The critics of this argument have clearly confirmed their 1st judgment as a "Qis Ma'a-al Fariq".

Argument 2

The second argument presented by the supporters of Islamic bank for its legality is the terminology of “Inheritance under debt” used in Islamic Jurisprudence (Usmani, 2003). If the inheritance of a deceased debtor is less than the amount he borrowed, while alive, then the property and assets he left will become debtor, instead of the deceased one, and will become an artificial person (acting as an actual person on behalf of the deceased one).

Analysis of the Argument

This argument is also denied by the Islamic Jurists on the following grounds.

a. The term “inheritance under debt" is an exceptional case used in Islamic jurisprudence for a situation when the liability (debts) of the deceased person (debtor) is less than the legacy he left. In this situation some of the Islamic Jurists have held the bait-ul-maal responsible for the repayment of remaining loans/debts. Debt is a liability upon the shoulders of every Muslim, whether alive or dead, which can be meet only either through repayment or its exemption from the creditor. Declaring the property left by a deceased person as a debtor, instead of the deceased one, and declaring the deceased one free from his liability, is against the laid down principles of Islamic Jurisprudence. In Shari’ah, if a person is killed in the way of Allah, and then returned to this world and again killed in the way of Allah and then returned and killed, but if he is entitled to liability (whether this liability is in cash or in asset, i.e., monetary or non-monetary liability), then this person can’t enter into Jannah (Paradise) without repayment of the unpaid liability.

This principle clearly indicates that debtor is the deceased person, not the property he left, though the repayment of loan will be made out of his legacy, if not repaid, then the deceased person will be held responsible by Almighty Allah in the Day of Judgment. So if we declare the inheritance as artificial person and make its liability limited, then why will this person not enter into Jannah if the debt is not been repaid, (no matter whether the debt is less than his legacy or equal to legacy or more than his legacy)? The punishment in the life hereafter clearly indicates that the debtor is the deceased person, not the inheritance he left, and that his liability is unlimited.

b. Suppose that the debtor has no legacy/inheritance then, to whom we will call the debtor if we become agree with the concept of artificial person? In this situation, nobody can notify the presence/role of an artificial person. On the other hand, if the debtor has left an insufficient legacy, then how these debts will be settled by this artificial person? From where will it repay the debt of the deceased person?

c. Another aspect of the stated argument is that, even if we accept the role of legacy as an artificial person on behalf of the deceased person, then can anybody identify the person (died) on behalf of which a company play its role as an artificial person and become responsible for the repayment of his liability? The answer is a big "NO". Bank is actually an artificial person who is been put into artificial death by his organs (i.e. who suicides) at the time of dissolution. The absence of deceased party put an obdurate question mark over the legitimacy of Islamic banking.

d. If the debtor (alive) becomes insolvent, and he has nothing to repay his loan, then the creditors had been given the authority by Shari’ah to dissolve his property only, if any, for the collection of their debts. They can’t force him to pay his liability, because there is no concept of loan other than benevolent loan in Islam, which can neither be fixed in time frame and nor enforced to be repaid, if he is not able to pay. However, the liability of the debtor remains there if not repaid. However, the claim of the creditors prolongs with the enrichment of his financial conditions in the future. Extension in time period for the repayment of the loan clearly substantiates our stance of unlimited liability.

From this discussion, one can easily conclude that the provision of an “Islamic Base” for the establishment and legitimacy of so-called "Islamic Banking” with the tag of limited liability on its brow is not permissible at any ground.

Argument 3

The Zakat on the joint venture will be collected from the collective property as a whole, not from the individual share of each partner, which is a proof for the existence of an artificial person (i.e. joint venture) on behalf of its members (Usmani, 2003).

Analysis of the Argument

In this argument, Taqi Usmani has tried to derive an evidence for the existence of an artificial person (i.e. joint venture) working on behalf of its members, who are alive, as a "Zakat Payer". Whereas, the purpose of the second argument was to originate an evidence from the Islamic Jurisprudence for the existence of an artificial person (i.e. inheritance) working on behalf of his member, who is dead, as a "Debt Payer”. The problem with this proposition is the role of law in the manufacturing of artificial persons. Because banks can't be produced without law, the creation of joint venture and inheritance is not subjected to legal constraints. A joint venture can be made everywhere by any two or more than two parties with mutual consent, while the inheritance is totally subjected to the death of the concerned person. So, how a base on behalf of these two distinct concepts can be provided for the existence of a baseless institution like a bank?

He has also pointed out that the company is based on the concept of double taxation, whereas the joint venture pays it Zakat once from its collective property. It doesn't pay Zakat from the individual shares of the partners. These scholars should have used the argument of collective Zakat on joint venture as evidence from the Islamic jurisprudence for the rejection of taxation and company in Shari’ah, because the company is not legally responsible to pay Zakat on its assets and profit. He is only liable to taxes in the form of double taxation. Instead of doing so, they extended this evidence as a base for the existence and so-called “Islamization” of the banking system.

Moreover, tax and Zakat are two different tools used by too different economic systems for their stability and growth. The first one is used by capitalism, while the other one is used by the Islamic economic system. The question arises over here is that is there any registered company in Pakistan who pays its obligations in the form of Zakat, not in the form of taxes, or even in the form of both? Where is the collective obligation of these joint ventures in the form of Zakat? Tax is an obligation imposed by the state to strengthen his system, whereas, Zakat is an obligation imposed of Almighty Allah to be collected and used by the Islamic state for the general welfare of the society (Sarifeen-i-Zakat). So the obligation of the state in the form of taxes is duly performed by the company, while the obligations of Allah have been kept in the corner by the company.

With all these differences, how we can derive a rule from Islamic Jurisprudence while making a judgment on the attributes of an Islamic concept/phenomenon for the provision and establishment of a baseless capitalist concept of bank, which are far different from each other in multi-dimensions?

Legitimacy of Islamic Bank as “Limited Liability”

The second most important and assigned attribute of a bank as a company is its limited liability. The arguments presented in favor of its limited liability as evidence from Islamic Jurisprudence seems to be valid to the supporters of Islamic banking for its legitimacy, but they are not acceptable to even a pathetic student and follower of Shari’ah. Before we analyze those arguments and discuss its consistency with the laid down principles of Shari’ah, let us start our discussion from the actual role of Islamic bank in the process of its funds generation and investment.

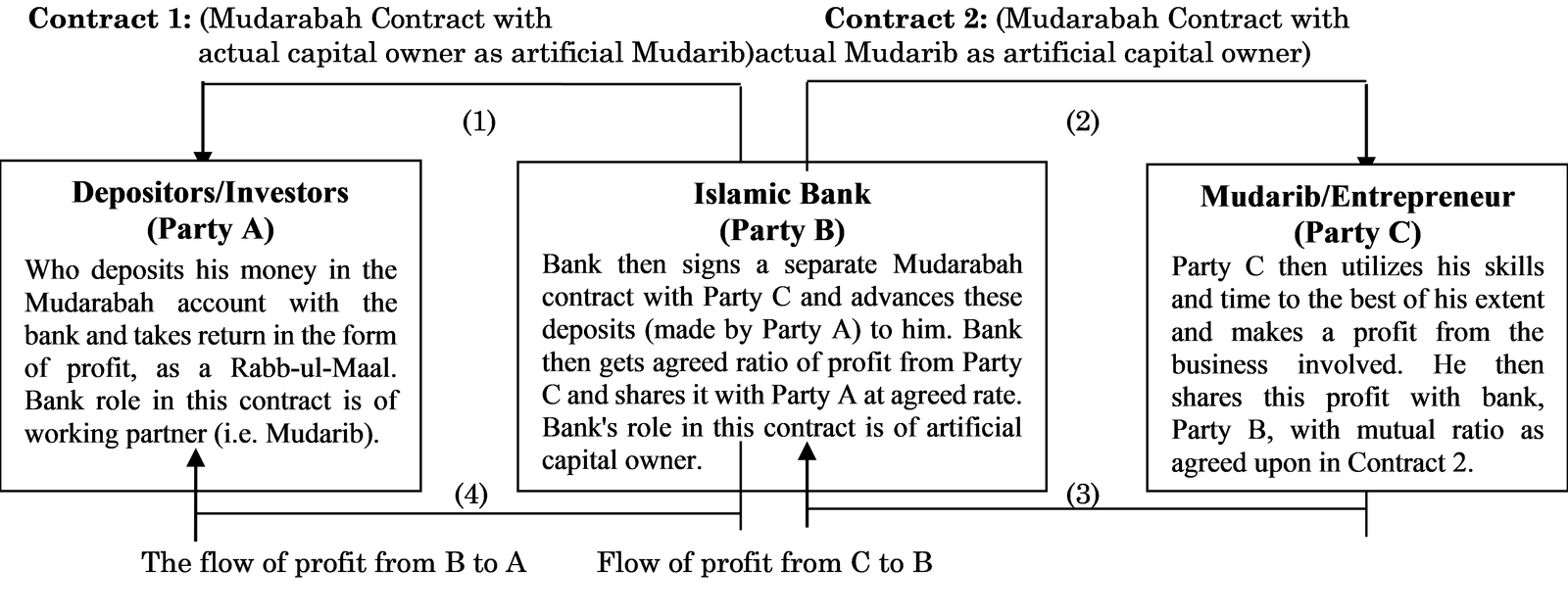

Islamic Bank normally performs a dual role, because it signs two different contracts with its clients, one with the actual capital owner as “Artificial Mudarib” and the other with actual Mudarib as “Artificial Capital Owner”. The sketch of these two contracts and the role of each party in the Mudarabah contract are listed in Figure 1.

Figure 1:

Hypothetical Sketch of the Contract being held in an Islamic Bank the Role of the Bank in the Aforementioned Sketch may take any of the Following two Possible Shapes

Possibility 1: Islamic Bank is an Intermediary

If we accept the role of the bank as an intermediary in its dealing with clients, where the bank provides agency services to his clients (Party A & Party C) by transferring money from the depositors (Party A) to actual investors (Party C) in Mudarabah shape, then his claim of commission on behalf of agency services is justifiable. However, his because the owner of the capital is Party A, not the bank. The bank should have signed the Mudarabah contract with Party A as an agent of Party C, the actual Mudarib. There is no role of bank as a Mudarib in contract 1. The bank (Party B) is simply providing agency services to both the parties by bringing Party C nearer to Party A for the Mudarabah contract. Therefore, his claim of profit as a Mudarib is not justifiable on any grounds. The question at issue is the permission from clients by the bank. Do they take permission from their clients that bank (artificial Mudarib in contract 1) will invest their money as artificial capital owner in a separate Mudarabah contract with Party C (the actual Mudarib)?

On the other hand, this bank performs two different roles in these contracts, one as artificial Mudarib and the other is the artificial capital owner. He is neither the actual Mudarib nor the actual capital owner. This artificial role is clear evidence of its role as an agent of the aforesaid parties. And if we accept his role as an agent, then liability is not a matter of concern to be discussed by him. There is even no need for the company to be established with tag of Islamic bank.

Possibility 2: Islamic Bank is a Borrower

On the contrary, if we accept the role of the bank as a borrower, where he borrows money from Party A, and invest it with Party C (actual Mudarib) by making a Mudarabah contract, then his share in profit with Party C is clear because he is the actual capital owner. Party C invests that money in a business as a Mudarib and shares the profit with Party B, if any, at agreed ratio. If this proposition is true, then what does this bank pay to the depositors, interest or profit, because there is no role of Party A in this deal? If the bank is paying interest on the money he borrowed from him, then there is no question about its invalidity, but if he claims that we are paying profit to them, then is there any proof of profit to be given on loan at the agreed ratio in Islamic Jurisprudence? Actually, they make them fool through tricky devices and take money from them in the name of Mudarabah, and then repay the interest as a return of their buffoonery, which is not justifiable on any ground. Islam has clearly prohibited any sort of benefit generated by debt while saying that “debt can’t generate benefit except interest”.

No other Possibility

There is no other possibility of role to be played by the bank. If we accept the proposition that the bank neither takes money from depositors as a commission agent and not is a borrower, and we assume it further that he is the real Mudarib, then why he doesn't perform his duty as a Mudarib in the Mudarabah contract assigned by Party A? Where are his skills and efforts on behalf of which he claims a share in the expected profit/loss of the business concerned? Is there any role of the bank as a real Mudarib in the above picture? If the answer is "NO", then how does he entitles himself to profit as a shareholder? Is it not a fraud? You made the bank limited while discussing its validity as limited liability, but what about its liability as a Mudarib (i.e., its skills and efforts, which were assumed to be involved in the business)? What about the so-called "Profit" generated by a Mudarib with "Zero" input in the overall process except documentation? A bank with these attributes clearly violates the two well-known principles of Islamic Jurisprudence; one is “Al-Khiraj Bizzaman” while the other is “Al-Gharamo Bil-Ghananmi”. Is there any justification of the aforesaid status held by the bank as artificial Mudarib in the literature of Islamic Jurisprudence? The answer you get will always be in “NO”. Following is the analysis of the remaining arguments presented by the supporters of Islamic banking in favor of limited liability.

As like the first attempt of modernists towards the legalization of the artificial person, they have also utilized their energies to the best of their capabilities for the validity of its limited liability. They struggled a lot to make a sense of its existence from their stipulated arguments taken as evidence from the Islamic Jurisprudence. Their arguments are:

Argument 1

The liability of the investor in the "Mudarabah contract" is limited to its working capital. If the working partner (Mudarib) has taken loans without the permission of investor (capital owner), then his liability will become unlimited, and if these loans are taken with his permission, then the liability of the investor will become unlimited. So the concept of limited liability for un-active shareholders of a company seems to be valid from the perspective of Mudarabah (Usmani, 2003).

Analysis of the Argument

a. While explaining his position, Taqi Usmani initially affirmed that liability of the capital owner Is unlimited due to his signature on the contract with the bank, which clearly states that the bank has the right to take loans from external sources (e.g., other banks) for business activities? This signature on the contract is the evidence that proves that the liability of the depositor should be unlimited. On the contrary, he presented the prospectus of the bank as an evidence for the liability of depositors to be limited because it is clearly mention in the prospectus that bank will take these loans on his own behalf. If loans have been taken by the Islamic bank (Mudarib) on its own behalf, then why its share in liability should not be unlimited? What is the logic to limit its liability? And if this loan has been taken on behalf of the depositors, then what is the reason or logic to limit the liability of the capital owner (depositor) through prospectus of the bank? It means that the decision about the determination of liability is been bestowed to the prospectus of the bank, not to the established rules of Shari’ah. In Shari’ah, if Mudarib takes loans for business with permission on behalf of the capital owner, then its liability will be borne by the capital owner not the mudarib, and if the loan has been taken by Mudarib on his own behalf, with or without permission of the capital owner, then its liability will be completely borne by the Mudarib. Therefore, if the bank claims that he has taken these loans on his own behalf, then how its liability can be limited through prospectus? What about the status of this prospectus which clearly violates the basic principles of Shari’ah?

b. According to the prospectus of the bank, the liabilities of all the parties involved in the Mudarabah contract are limited, i.e., the capital owner (depositor), the Mudarib (bank), and the directors (administrators & shareholders) as well. If we assume it correct, then who will be held responsible for the liability of the prescribed debt, whether taken from banks. or the general public? It doesn't mean to them that the debts of the actual person is drowned by an artificial person (bank), but it means a lot to them that the bank (artificial person) must not be held liable to the remaining debts of the creditors. Do they not play a game with the general public on the name of Mudarabah? Are they not developing a route intentionally for escape from the liability of debts in the name of limited liability? Can we resemble this act with that of Bani Israel, which was made against the clear notation of not catching fishes on Saturday?

c. Loan and debt are two different terms used for a different meanings. If Mudarib purchases goods/raw materials on a credit basis (debt), and due to some natural calamities/incidence these materials either became useless or even destroyed, then the rab-ul-mal will be held guarantor for the destroyed capital. This principle tells us that the liability of the capital owner may take its either form, depending upon the prevailing circumstances. It means that the concept of limited liability can’t be accepted everywhere for everyone as a “universal truth."

d. With reference to the conditions listed on page 2 of this article, if we execute the strength of these conditions in a contract held by the Islamic Bank with its client, then one can easily conclude that this contract is totally a one-sided contract. A contract signed by depositor/client with the agents of artificial person which have no real existence or shape in this word. A person who is neither freeNor rational and, even not bestowed with brain or wisdom. How a deal can be made with a person having these attributes? The nonexistence of the artificial person at the time of contract is another problem with the bank which violates the first condition of the contract. Is it possible to make him present at the time of contract? Because it does not exist in any shape in the universe (whether real or imaginary like a ghost or specter), his attributes can be easily quantified with five senses gifted by Almighty Allah. Therefore, his attributes and absence as a party at the time of the contract lead to disqualification of the Mudarabah contract.

e. If we accept the proposition that the company is a "Partnership”, then according to Shari’ah, the directors of bank must be limited to profit only. Apart from the agreed proportion of profit, Mudarib cannot claim any periodical salary or a fee or remuneration for the work done by him in Mudarabah, because one partner can’t become remunerator for the other partner in a partnership (Usmani, 2004). In partnership, if a partner is physically contributing with its capital in the business, like Musharakah, then he can only be compensated through a higher ratio in profit. He is not entitled to any claim other than profit. On the contrary, the directors of the bank not only earn a profit on their investments as shareholders, but they are also compensated in the form of salaries allowances, bonuses, and perquisites on behalf of their practical involvement in the business, which is totally against the basic principles of Shariah.

It seems to be rational if one deny this argument on the basis of discussion made above because the purpose of all these efforts was to make such an artificial person where they can perform all their illegal economic activities. With different Islamic names (like Murabaha & Lease Financing) under the shadow of an artificial person having limited liability. If it makes money (no matter whether profit or interest), then his organs (the directors and shareholders) gulp it down with both hands, and if he is not able to generate money, then he is declared insolvent through law and dissolved while making him free from any sort of liabilities if exceeds in worth from the property dissolved.

Argument No. 2

While providing an Islamic base for limited liability, Taqi Usami has mentioned an

Islamic terminology of “Abd M’a Zoon” as evidence from Islamic Fiqh. The capital invested by the slave totally belongs to his master. Whatever he earns will go to the master as his exclusive property. If loans occurred in the course of business, the same would be set off by the cash and the stock present in the hands of the slave. But if the amount of cash and the stock would not be sufficient to set off the debts, the creditors had a right to sell the slave and settle their claims out of his price. However, if their claims would not be satisfied even after selling the slave, and the slave would die in that state of indebtedness, the creditors would not approach his master for the rest of their claims (Usmani, 2004).

Analysis of the Argument

a. In this argument the liability of both the parties (master & salve) is declared limited, which is a matter of special concern. Its position will remain controversial, if special efforts were not made while investigating its validity in the Islamic Jurisprudence. As discussed earlier, the liability of the debtor can only be exempted through repayment or its exemption from heirs. Death can terminate the liability of the debtor in this world only, no matter whether he is slave or master, however, he will be held responsible for his debt in the world hereafter by Almighty Allah. An Islamic procedure has been mentioned in Rad Al-Mukhtar about the settlement of the debts taken by Abd Ma’a Zoon. With this procedure, if the claims of debtors are recoverable through the sale of the slave, then this slave will be sold in the market, and the money will be distributed among the debtors. But if their claims are not recoverable through his sale, then they have a legal right not to let him sold and put him on work for a sufficient time period required for the repayment of their debts. Moreover, if this slave is released, then the debtors have the right to follow him till the repayment of debt. The extension in right of demand even after the release of the slave clearly indicates that the liability of Abd Ma'a Zoon, i.e. slave/mudarib, can’t be limited in any circumstance. In this case, if slave is alive and not been put into artificial death, then the creditors can’t approach his master for the remaining debts, if any.

b. Another aspect of the argument is the comparison of an actual slave with an artificial one, where the artificial slave is deliberately put into artificial death, so that it can be made identical to the actual slave in its attributes, and that an artificial route to qias of bank over Abd Ma’a Zoon may be designed.

c. If we accept this argument as an evidence from Islamic Shari’ah, and also accept that the liability of both the capital owner (master, i.e. depositors) and Mudarib (slave, i.e. the bank) is limited, then it will be unfair if we don’t declare “Zero” ratio of profit for bank (i.e. the slave). Because it is clear from the aforesaid argument that “whatever he earns will go to the master as his exclusively property”, i.e. unlimited liability with zero ratio in the overall profit of the business. The extension of this argument clearly demands that, “the bank must have unlimited liability and that there should be no room for his share in profit, neither as a shareholder and nor as an administrator”, which is obviously not acceptable to none of the supporters of Islamic banking.

Furthermore, if we agree with the concept of artificial person on the basis of their attributes, and declare him an actual person who can sue, can use its name, can make a deal, and can enter into a contract; and if we also accept their proposition that he has organs which are responsible for doing everything related to company affairs, then what about its role in the life hereafter? First you provided a track for its origination, and then you wasted your energies for its legality, and at last you made him free from every liability in this world by its dissolution through law. You are the originator and shooter of this artificial person, so please take one more responsibility on your shoulder, that you should design a route for its rebirth in the life hereafter, so that he may be held responsible for the settlement of the remaining liabilities, if any. You legitimated him with distinct characteristics of “Zero Share” in skills and risk, and gave him endless freedom in the defrayal of profit. If he was to be originated by Almighty Allah, then he will be totally different in the assigned attributes.

The intentions of all these arguments, in unanimous, seems

i. To built an institution in the name of Islam (i.e. Sharikah); an institution where, they (directors & shareholders) can wear the shield of limited liability and have access to gulp down the profit it generates with both hands, and where they have the right to put him into artificial death if it is not able to generate money.

ii. To provide unlimited & un-Islamic reliefs to the directors (the real shareholders) of the Islamic banks under the shadow of an artificial person in the name of Mudarabah, i.e., unlimited benefits in the form of profit, salaries, allowances, bonuses, and perquisites.

iii. To limit the liability of bank as an artificial Mudarib in every aspect, except profit, while holding the prospectus as a statute in their hands.

iv. To save the artificial person (debtor) on the cost of the actual person (creditor). Because it doesn’t mean to them if the debts of an actual person is drowned by an artificial person (bank), but it means a lot to them that bank (artificial person) must not be held liable by the creditors (actual person) for their remaining debts.

v. To deceive the Islamic jurists and general public of the Muslim community and provide a base for its legality in Islamic Jurisprudence, so that they can build the so-called "Islamic business empire", and can forward the so-called "Halal Return" to its clients as a reward of their buffoonery, which has no roots and evidence in the history of Islamic Jurisprudence.

If the intention was to facilitate the Islamic investors, while giving them maximum benefits in the form of high return (would have incurred through lower administrative costs), then they would have utilized their services for the establishment of Islamic investment unit, based purely on the principles of Mudarabah or Musharakah only. What were the reasons of pasting the attributes of conventional bank over the so called “Islamic Bank”? If someone tries to present his logic in the form of “Iztir’ar”, by resembling its negligence/detraction from today’s economy to an “economic suicide”, then he must also built a logic for the provision of “Halal Sex Shop” or “Islamic Club” on the basis of its needs to the youth of the era. Advice of Marriage can’t be resembled in attributes to these two un-Islamic concepts.

Conclusion

Islamic bank is a registered company which plays its role as an artificial person having limited liability, a case where boundaries between conventional banking and Islamic banking appears to have been mixed. The analysis made in the preceding pages clearly indicates that the provision of arguments in favor of its origination and legitimacy, through their judgment of its resemblance in attributes with the traditional Islamic concepts like Waqf, Bait-ul-Maal, Inheritance under Debt, Zakat on Joint Venture, Abd Ma’a Zoon, and role of un-active partner, were found inconsistent with the Shari’ah. Its role as an artificial person with limited liability also appears to be contradictory with the basic concepts of "Al-Khiraj Bizzaman" and "Al-Gharamo Bil Ghana”. These arguments may be acceptable to the supporters of Islamic banking for its legitimacy, but they are not even acceptable to a pathetic student and follower of Shari’ah. On the other hand, the transactions held by the Islamic banks with their clients were found to be contradictorily with the basic conditions of a valid contract. The acceptance of their arguments as evidence from Islamic Jurisprudence also put serious questions on its legitimacy, if implemented fully. These scholars should have utilized their skills on the establishment of an “Islamic Investment Unit”, rather than Islamic Bank, and should have focused on its legitimacy by making it a true Shari’ah based investment unit rather than Shari’ah based Islamic banking.

References

- Ahmad M. M., Farooq M., Muhammad N., & Shakir. (2012).

- Dubai Islamic Bank. (2014). Schedule of bank charges

- Khalifa, A. (1997). Transaction in Islamic Law. Kuala Lumpur: A. S. Nordeen

- Mark, G. A. (1987). The personification of the business corporation in American law. U. Chi. L. Rev., 54, 1441.

- Rufaqa-i-Darul Iftha. (2008). Murawwija Islami Bankari, Jamia Uloom Al-Islamia, Banoori Town Karachi

- Ahmed, S. S. (2013).

- State Bank of Pakistan. (2011). DMMD Circular NO. 3

- State Bank of Pakistan. (2014). Islamic Banking Bulletin

- Suryawnshi, K. (2013). Corporate Personality: An Analysis under Companies Act, 1956. Research Journal of Humanities and Social Sciences, 4(2), 140-144.

- Usmani, M. T. (2004). Introduction to Islamic Finance. Karachi: Idarah Ma'ariful Qura'an, Karachi.

- Usmani, M. T. (2003).

- Usmani, M. T. (2007).

- Wolgast, E. H. (1992). Ethics of an artificial person: Lost responsibility in professions and organizations. Stanford University Press.

- Zubair H. M., & Chaudhary, N. G. (2014)

Cite this article

-

APA : Minhajuddin., Khan, M. S. A., & Gul, B. (2019). Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability. Global Economics Review, IV(II), 141 - 153. https://doi.org/10.31703/ger.2019(IV-II).11

-

CHICAGO : Minhajuddin, , Muhammad Sohail Alam Khan, and Brekhana Gul. 2019. "Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability." Global Economics Review, IV (II): 141 - 153 doi: 10.31703/ger.2019(IV-II).11

-

HARVARD : MINHAJUDDIN., KHAN, M. S. A. & GUL, B. 2019. Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability. Global Economics Review, IV, 141 - 153.

-

MHRA : Minhajuddin, , Muhammad Sohail Alam Khan, and Brekhana Gul. 2019. "Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability." Global Economics Review, IV: 141 - 153

-

MLA : Minhajuddin, , Muhammad Sohail Alam Khan, and Brekhana Gul. "Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability." Global Economics Review, IV.II (2019): 141 - 153 Print.

-

OXFORD : Minhajuddin, , Khan, Muhammad Sohail Alam, and Gul, Brekhana (2019), "Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability", Global Economics Review, IV (II), 141 - 153

-

TURABIAN : Minhajuddin, , Muhammad Sohail Alam Khan, and Brekhana Gul. "Shari'ah Legitimacy of the Existing Islamic Banks: As Artificial Person having Limited Liability." Global Economics Review IV, no. II (2019): 141 - 153. https://doi.org/10.31703/ger.2019(IV-II).11