Abstract:

The study will examine the performance of Islamic and conventional banks in Pakistan, as well as the impact of concentration on bank efficiency. The structure conduct and performance method is a structural method and the theory of this model holds that the level of profits acquired by the bank is influenced by market structure and the degree of competition. The data for Islamic and conventional have been taken from financial reports of 4 Islamic and 4 conventional banks for the period of 2006 to 2020. PLS regression method has been applied which is then verified with the help of the Breusch-Pagan test and analysis further tested fixed and random effect models which were verified with the help of the Hausman test. The finding of the study confirmed the significant relationship between HHI and CR with Performance indicators (ROA, ROE, NIM, and NPM) of both banking systems. However, the ROE of conventional banks was observed non-significant with Concentration variables

Key Words:

Concentration, Banking Sector, Islamic, Conventional

Introduction

The banking system's survival depends on the performance of the banking firm. The Islamic banking business is thought to be a novel form of financial intermediation, in comparison to the traditional system. According to the SCP paradigm, which demonstrates a causal association among market structure (concentration) and industry performance (profitability), a firm's performance is linked to its market structure as well as its conduct or behavioural context of collusion. Furthermore, according to the Structure-conduct-performance (SCP) hypothesis, highly concentrated organisations are more competitive, and lucrative, and have more market power (Hamza & Kachtouli, 2014).

It also examines market circumstances using concentration ratios of big enterprises and the Herfindahl-Hirschman index (HHI), both of which characterise the market structure. Banks' market strength may allow managers to pursue aims other than company profitability or managerial pleasure. The structure–conduct–performance (SCP) paradigm is at least partially correct companies in highly concentrated markets have more market power and so provide a pricing cushion (Berger Allen N. et al, 1998). Islamic banking is believed to be superior to traditional banking since it ensures a financial sector that is more stable. A comparison analysis is required to evaluate the performance of their operations and products/services. (Ashfaq Ahmad et al, 2010).

The Islamic banking system has grown fast in recent years, demonstrating its ability to function as a complementary and parallel system for providing financial services. Islamic banks and conventional banks are increasingly competing for new customers as well as retaining existing ones. The connection between market competition and the financial system Economic theory and empirical research predict financial stability in conflicting ways. Banking relationship competitiveness and financial stability have been important topics of study in the economic literature. The competition-fragility hypothesis is supported by the majority of researchers.

According to this concept, bank rivalry will reduce interest revenue for banks, causing profits to erode, and increasing the likelihood of default or insolvency, as a result, the general financial system disruption, concentration-stability proponents say that concentrated banks will generate better profits as a result of lesser competition, which will limit excessive risk. (González L.O et al, 2017).

The majority of past research has been undertaken in industrialised countries, where competition is highly similar and usually high. However, depending on the nature of the market, we feel that both hypotheses may be compatible. Increased competitiveness may encourage risk-shifting and boost financial stability in less competitive markets. Concentration-stability advocates say that concentrated banks will generate better profits as a result of less competition, which will restrict excessive risk, Banks in competitive markets, according to Allen and Gale (2004), are more vulnerable to risk than banks in concentrated markets because a negative shock might set off a chain reaction (González L.O et al, 2017).

Large banks can distinguish goods and earn more returns without requiring concentration to raise pricing. However, another body of research considers the link in terms of bank performance and concentration increased effectiveness. Hicks (1935) introduced the quiet life hypothesis (QLH), which claims that there is a negative link between efficiency and market structure characteristics, and thus markets with less concentration and enterprises with smaller MS will be more efficient (González L.O et al, 2019).

Several kinds of research on bank performance, market structure, and efficiency have focused on developed economies like the US and Europe. The structure of the US banking industry, according to Berger and Humphrey (1997), differs significantly from that of other countries. There is more evidence for the SCP idea in European studies, for example (Molyneux & Forbes, 1995). The links between concentration, efficiency, and performance are frequently investigated in established and similar markets where organisations exploit their market power in order to participate in collusive behaviour or to operate in highly efficient competitive markets where more market concentration explains higher performance. Several studies for emerging markets and MENA countries have supported the SCP hypothesis. The global banking industry has experienced significant structural changes over the past two decades. Over the past few years, the behaviour of banks has changed significantly, focusing not only on profitability but also on stability and rigorous asset management (Mirzaei. A et al, 2013).

Bourke (1989) In Europe, North America, and Australia, there is a positive relationship between market concentration and bank productivity. From 1988 to 1991, Rai and Goldberg (1996) a sample of large banks from 11 European countries failed to find a positive relationship between concentration and profitability. The impact of market structure on the profitability and stability of the banking sector is investigated in this article. This study will use data from four full-service Islamic and four conventional banks in Pakistan from 2006 to 2020.

Many banking research has found a favourable statistical association between market structure metrics like concentration versus market share versus profitability (e.g. Molyneux and Thorn-ton, 1992; Berger, 1995) (Mirzaei. A et al, 2013).

The former thinks that a more concentrated banking system reduces risk by raising franchise value, whereas the latter believe that concentration increases risk by allowing higher interest rates to be created. While there is a huge body of evidence that suggests banks choose riskier portfolios when competition is higher (lower concentration), new research discovers risk incentive mechanisms that motivate banks to take on more risk when concentration increases. Policymakers and other stakeholders must understand bank performance. In this regard, several theories characterise the relationship between performance, market structure, and efficiency, and they are useful in establishing whether financial sector performance is achieved under competitive and efficient conditions (Mirzaei. A et al, 2019).

This publication adds to the corpus of knowledge in a number of ways. The study is the first to examine the concentration, efficiency, and performance of Pakistan's banking markets all at once. This research is really valuable because it investigates a hitherto unexplored area.

Market Concentration Hypothesis

Market concentration refers to the bank's proportion in the industry market. Concentration occurs as a result of the strength of certain significant banks Kristanti. F et, al (2019). According to Naylah (2010), increased market concentration reduces the cost of collaboration, allowing industry companies to generate above-average profits. The HHI and CR are used as alternatives for market concentration in this study. The market concentration ratio is used to calculate the distribution of market share in a specific industry Alfi Maghfuriyah et al (2015). Among several works of research, the concentration ratio appears to be the most preferred choice for measuring market structure M. Nasser Katib (2004). Reduced competition and increased concentration in a sector would result in higher profitability for that industry Yudaruddin Rizky (2012). Maniatis (2006) discovered that the relationship between market concentration and performance had no impact on bank profitability in Greek banking.

Origin of Islamic Banking or Riba free System

The Islamic economic and monetary structure is based on the principle of community benefit, which is inspired by both world's ethics and justice. The Islamic banking system dates back approximately 1400 years, and includes a comprehensive structure of ideas, institutions, and explicitly stated injunctions, as a trader by profession, Holy Prophet Muhammad (PBUH) understood the significance of commerce and business, as well as other economic difficulties. Mudarabah, an Islamic style of partnership finance, was a driving force in ancient business and trade. With the passage of time, Muslim people became exposed to industrialisation and institutionalised commercial banking, where Muslims could not reject the interest-based banking system at the time because no practical and effective substitute was offered. It wasn't until the nineteenth century that Muslims realised the dominant banking and economic system was based on Riba, which is forbidden in Islam in all forms, commercial or non-commercial. As a result, an alternative system based on Shariah principles is required. The "Mit Ghamr" project in Egypt lay the groundwork for a bright future for Islamic banking in 1963. Meanwhile, in Malaysia, a project called "Lembaga Tabung Hajj" (Pilgrim Fund Board) was founded to take deposits and provide services to pilgrims. The Lembaga Tabung Hajj claims to be Malaysia's largest investment fund, Malaysians will be empowered by investments in Islamic banking, real estate development, construction, information technology, oil and gas, and hospitality. The number and scale of Islamic financial institutions have increased over time. The Islamic Development Bank (IDB) was established in 1975 as the world's first Islamic financial institution. This was a watershed moment in the history of Islamic banking. During the 1980s, various countries, most notably Pakistan, Iran, Sudan, and Bahrain, launched large-scale projects to implement Islamic banking in their own countries, with the goal of fostering societal well-being, Because of the system's recent expansion and complexity, researchers have been prompted to examine its empirical distinctions from its traditional equivalent. The Islamic banking paradigm was first created on the premise of rewards and risk sharing known as equity-based (Muhammad Aqib Ali, 2015, World Bank and Islamic Development Bank Group, 2017 and Kabir Hassan & Sirajo Aliyu, 2018).

Origin of Interest-free Banking in Pakistan

Riba-free banking evolved in Pakistan in response to both religious and economic needs. Riba-abolition economic initiatives began in the 1970s, with the majority of significant and practical actions achieved in the 1980s. The effort in the mid-1980s was a momentous way forward in the construction of the country's Interest-free banking (Islamic) system; in terms of technology, it was the most sophisticated model in operation anywhere in the world at the time. That approach, however, failed because it was unable to adequately handle difficulties such as building an effective Shariah compliance process. The government of Pakistan began attempts to re-establish Islamic banking in 2001, with the intention of gradually restoring Islamic banking as a parallel and comparable system (State Bank of Pakistan, Islamic Banking Sector Review Report 2003–2007).

Progress of Riba free (Islamic) Banking System Globally and in Pakistan

Islamic banking is quickly spreading not just in Muslim countries but also in non-Muslim countries (Salman A, Huma 2018). According to Khan (1991), Islamic financial institutions have the potential to provide solutions to socioeconomic difficulties that mainstream neoclassical economic frameworks have failed to address. Islamic Banking has proved itself on a remarkable level and contributes equally to the economy of the country.

According to the Global Islamic Finance Market report (2019). The Islamic banking industry contributes 71% of USD 1.72 trillion to the world economy. While seeing growth and sustainability in Pakistan according to the SBP (2020), the assets of the Islamic banking industry increased by 8.1% to $3,633 billion, while deposits increased by 9.5% to $2,946 billion. In terms of assets and deposits, the whole banking industry's market share is now 15.3% and 16.9%, respectively. The current state of the institution indicates its progression.

Research Hypothesis

H1: There is a favourable association between competition and bank concentration.

H2: In highly concentrated marketplaces, banks achieve more profitability.

H3: Banks that have a significant market share are more profitable.

H4: The efficiency of a bank has a favourable impact on its profitability.

H5: As banks grow more efficient, the level of market concentration rises.

H6: Efficiency suffers as a result of market share and concentration.

Objectives

? To investigate the influence of market concentration on the performance of Pakistan's conventional banks.

? To investigate the impact of market concentration on the performance of Pakistani Islamic banks.

? To assess the impact of market concentration on the performance of Pakistan's Islamic and conventional banks.

Problem Statement

Based on the review of the literature it is observed that there have been a number of notable comparative studies on the performance of conventional and Islamic banks. But a few studies have worked on the aspect of concentration of Islamic banks such as (Hichem Hamza et, al, 2014) and (Kassim, 2020). Hence this study will fill the gap by analysing the market power (concentration) and performance relationship of the Islamic banking sector and will compare similar analyses with conventional banks to explore the distinct performance behaviour having highly concentrated banking systems.

Literature Background

It is critical for bank productivity to ensure the survival of the banking sector. Market concentration, according to the structure-conduct-performance (SCP) theory, determines the amount of competitiveness among companies. Because a more concentrated economic system is thought to foster more successful collaboration. As a result, SCP shows a positive relationship between concentration and performance, as well as banks' propensity to charge higher loan rates in exchange for lower deposit rates. The relationship between bank competitiveness and financial stability has long been a source of contention in economics (Gonzalez. L.O et al 2017). The Relative Market Power (RMP) hypothesis, like the SCP hypothesis, predicts a positive relationship between a company's market share (MS) and its performance (Gonzalez. L.O et al 2019). (Rhoades, 1983) proposed a Relative Market Power (RMP) that emphasises the relevance of Market Share (MS) in profits and pricing. Concentration is not required to raise pricing; major banks can differentiate their offerings and make more profits as a result. Markets with low concentration and enterprises with a smaller market share would be more efficient. According to RMP, increased market share boosts the profitability of large institutions. In the banking sector, both SCP and RMP imply one-way causality from market structure to performance or rivalry. (Mason 1939) developed the SCP paradigm, which was expanded upon by Bain (1951). (Mason, 1939) believes that when there is a high level of concentration in the market (few providers), an environment arises that fosters business collusion. Bain (1951) was the first to construct this concept by demonstrating a statistically significant relationship between manufacturing industry profitability and concentration in the United States. Bhatti and Hussain (2010) used yearly and pooled commercial bank data to investigate the relationship between market structure and performance in Pakistan's banking sector from 1996 to 2004. Profitability and concentration have a positive relationship, according to the findings, in favour of the hypothesis. A reduction in competition and a rise in concentration in an industry would result in higher profits for that industry (Yudaruddin 2012).

The SP hypothesis' main message is that a higher concentration ratio contributes to higher profitability (Samad 2008). According to the SCP hypothesis, there is a positive link between the degree of market share concentration and firm output (Yudaruddin 2012). For such a theory, Hamza, H., and Kachtouli, S (2014) describe a positive association between market concentration and profits as measured by profits. Profits are more important to companies among the most concentrated industries than profits are to companies operating in less concentrated industries, without taking efficiency into account. Concentration ratio (CR), Herfindahl-Hirschman Index (HHI), and market share (MS) can all be used to determine the extent of market structure (Maghfuriyah. A et al 2015).

When only a few firms had considerable market share, this encouraged industry collusion (Al-Arif, 2017). According to the Relative Market Power (RMP) hypothesis, only enterprises with large market shares and the ability to adequately diversify their products may use market power to fix goods prices and earn large profits (Berger, 1995).

Here is a positive relationship between concentration ratio and profitability, according to Bello and Isola (2012), Ahamed (2012), and Bhatti and Hussain (2010). According to Ahamed (2012), the profitability of the Bangladesh banking market is driven by concentration rather than market share. Due to imperfectly competitive marketplaces, corporations in highly concentrated markets may establish prices that are less acceptable to customers, according to the structure-conduct-performance (SCP) theory. Higher spreads are possible for a bank to set in a concentrated banking system by introducing lower deposit rates and higher lending rates (Mirzaei A, 2013). To begin, banking firms in Malaysia's dual banking system must have some level of market concentration while yet operating in a competitive atmosphere in order to achieve higher profits and operate efficiently (Nafisah Mohammeda et al 2015). The structure–conduct–performance (SCP) theory holds that organizations in markets with higher concentration have greater bargaining leverage in deciding to price and thereby create a price buffer. High levels of market concentration enable firms to charge prices over reasonable levels, which is at least partially accurate, the benefits of higher prices may then be reaped by management in the form of a "quiet life," in which they do not have to work too hard to keep costs under control (Berger. Aand Hannan 1995). As the literature shows in many countries highly concentrated markets enjoys more profits and dominate the market by setting rates and prices of the products they offer more rates on advances and low charges on deposits but at the same time both hypothesis can be different it depends upon the policies and procedures of different region to region and these hypothesis can be unfavourable in some region as we have seen in literature above according to Mirzaei, A, Moore T, Guy Liu, (2013).

In the context of collusion, highly concentrated firms are more competitive, profitable, and have a greater market impact, according to the SCP theory. According to the efficiency principle, a bank's high efficiency helps it gain market share and profits. According to the SCP hypothesis, higher concentration results in less competitive bank action, which results in increased market power and profitability for the bank Hamza and Kachtouli.S (2014). In general, extant research fully explores the implications of market power, financial structure, and bank activities on bank risks and returns. Several questions about emerging market financial systems, however, remain unaddressed. The impact of bank concentration on financial stability has also yielded mixed results in empirical studies, indicating that more research is needed.

Large banks can differentiate their products and increase profits without the need for concentration to raise prices; yet, another body of research investigates the relationship between bank performance and concentration in terms of improved efficiency (Mirzaei. A et al, 2019). Demsetz (1973) hypothesised that firms with higher levels of efficiency can gain Market Share (MS), and that company productivity will drive market concentration. Theoretical research can help with the evaluation of bank performance as well as policy planning. The SCP paradigm's formal theoretical and empirical research examines the impact of bank market structure and performance on interest rates on loans and deposits Anthony Musonda (2008).

Structure-conduct-performance Hypothesis

Mason (1937) and Bain (1956) developed the Structure-Conduct-Performance (SCP) model as a framework for empirical investigation of the impact of market structure on industrial performance (Lelissa.T, 2018). In the 1940s and 1950s, business structure economic principles were used to build the (SCP) model (Nurwati, et al; 2014).

This paradigm was first created by Bain by demonstrating a statistically significant association between manufacturing sector profitability and concentration in the United States (1950). Bain's SCP model is a one-of-a-kind operational philosophy offered solely in the automotive industry in the United States. The SCP hypothesis was then used in the banking industry to investigate the relationship between market structures and bank results or performance Alfi Maghfuriyah et al (2015). On a theoretical level, it has frequently been used to defend industry policies P. R. Ferguson, (1988). To further demonstrate the relationship between market structure and efficiency Demesetz (1973). While the SCP model has been implemented in a range of enterprises and sectors, including traditional banking in many countries, its application in the Islamic banking sector is restricted, In contrast to traditional business operations, Islamic finance has the potential to expand the scope of interconnected intermediary activities in a country by providing a variety of unbiased alternatives (Abidin and Haeeb, 2018).

The market strength of the bank determines its activities (conduct), which influences its efficiency, As a consequence, there is a model for examining the significant influence of the market structure, conduct, and performance (SCP) research (Alfi Maghfuriyah et al 2019). The structure-conduct-performance model will be used to study how market structure and behaviour affect outcomes. According to Dina (2013), there are 3 noteworthy aims why the implications of market structure on the success of the Islamic banking business are worth discussing.

To begin with, the findings will be beneficial in developing policies to prevent unfair corporate competition.

Second, identify the variables that can improve the performance of the Islamic banking industry.

Finally, this will increase the knowledge and use of the concept of SCPs in the Islamic banking industry.

Research Methodology Introduction Research Methodology

The procedures/techniques used to conduct the research can all be classed as research methods. We can divide research methods into three major groups as follows.

The first group contains data collection processes; these ways will be used when the data the information previously supplied is inadequate to provide the needed answer.

The second category comprises statistical approaches used to connect variables.

The third category includes ways for assessing the accuracy of the results obtained.

An approach for tackling a research topic methodically is known as the research methodology. The research methodology includes research methodologies as well as research method selection criteria that are employed in the context of a research investigation. Includes an explanation of why a certain approach or technique was employed and why other techniques were not used, so that research results can be assessed either by the researcher or by others (Vincze, Szilvia, 2013).

Methodology aids in understanding not only the findings of scientific research but also the technique itself. The methodology is the systematic, theoretical evaluation of the techniques employed in a specific field of study (Mimansha Patel and Nitin Patel, 2019).

Research approaches

Quantitative Approach

Researchers who sought to quantify data initiated a quantitative study around 1250 A.D. Since that time, quantitative research has dominated Western culture as a means of uncovering new meanings and knowledge. A quantitative research method is one that designs research using numerical or statistical methods (Carrie Williams, 2007).

Quantitative research is an investigation that employs natural science approaches. This produces both numerical data and hard facts. To establish a cause-and-effect relationship between the two variables, it employs mathematical, computational, and statistical approaches. Because it can be properly quantified, it is also known as empirical research. A quantitative study enables the researcher to quickly analyse the results (Ahmad Sharique et al, 2019). As a result, data is used to objectively measure reality. By establishing objectivity in the gathered data, quantitative research generates relevance Quantitative research may be used to answer relationship questions about study variables. “Numerical scientists are looking for solutions and projections that will lead to other people and locations." The purpose is to find, confirm, or validate links while also constructing generalisations that contribute to theory." Quantitative research, according to Creswell (2003), "employs inquiry procedures such as experiments and surveys, and gathers data on specified instruments that yield statistical data" (page No. 18). The results of quantitative research can be expected, informative, or confirming.

Qualitative Research Approach

Qualitative research is a broad technique that incorporates outcomes. Some characterise qualitative research as an unfolding model that takes place in a natural setting and allows the researcher to gain depth through active engagement in actual occurrences (Creswell. J, 1994). Qualitative research provides insight and understanding into the background of the situation. It is an unstructured, exploratory research strategy used to examine extremely complex phenomena that quantitative studies cannot explain (Ahmad Sharique et al, 2019).

Several study designs frame the research plan using qualitative research methodologies. Because qualitative research generates and tests new theories, its depiction is less organised, according to Leedy and Ormrod (2001). It is a sort of research in which the researcher gives more weight to the opinions of the participants. Case studies, grounded theory, ethnography, history, content analysis, and phenomenology are examples of qualitative research approaches (Williams, 2007). Qualitative research may also be defined as an efficient model that takes place in a natural setting and allows the researcher to acquire a large amount of detail by heavily interacting in real-life situations (Creswell. J, 2003).

Collection of Data

This study relies on the quantitative form. While the data used in this study was obtained from secondary sources, our data is derived from bank annual reports and spans the years 2006 to 2020, covering 8 banks in Pakistan, four of which are Islamic and four of which are conventional.

Sample

The data is gathered from a significant sample of 8 Banks 4 Islamic and 4 Conventional. Sample size has been taken based on larger asset size to meet objectives this study examines the data in E-views and we take HHI and CR as independent variables so it is required for the study to have larger asset size banks whose ROA and ROE are stronger enough in the market to hold the maximum share of the market.

Results and Discussion Introduction

This study looks into the competitive climate and market strength in the banking sector. To explore the differences, the sample comprises both Islamic and conventional commercial banks operating in the same region. All data were acquired directly from financial reports and checked in the Bank scope database between 2006 and 2020 for greater precision in our selection approach. The time period chosen for the analysis is ideal since it combines high-risk scenarios with data from countries with widely different economic and financial situations. Data on conventional and Islamic items are mixed in the same bank accounts, making it difficult to select Islamic windows. Following this preliminary screening, we chose four Islamic banks and four commercial banks. This selection looks to be sufficiently representative because it includes significant hubs from both the Islamic and Conventional sectors. The rationale for selecting these two sectors is that I wanted to evaluate their concentration performance, and in order to do so, I needed to select two separate sectors to analyse their market share, performance, and strength. I obtained the information from a secondary source. I acquired data from a variety of sources, the most reliable of which are annual reports from banks' official websites that have been confirmed by the SBP and the (IFSB).

Results

After employing correct mathematical procedures, the research reports empirical findings. Data Panel Regression is a cross-section data and time series combo that collects the same unit cross-section many times. Panel data is a sort of dataset that tracks the behaviour of objects through time (also known as longitudinal or cross-sectional time-series data). These entities include states, corporations, individuals, and countries. If the cumulative unit time for each participant is the same, the data is considered to be a balanced panel. If the amount of time units differ for each member, the panel is deemed uneven. There are two more categories of data: time series data and cross-section data. One or more variables will be observed on a single observation unit within a defined time frame. While data cross-section is the simultaneous observation of several units of observation. Periods Include: The number of time periods or sequences that are included in the study. In this panel data regression example, the time span is from 2006 to 2020. As a result, the study's time span can extend up to 15 years.

Explanation of Variables

Independent variables

? HHI= Herfindahl–Hirschman index

? CR= Concentration Ratio

Dependent variables

? ROA= Return on Assets

? ROE= Return on Equity

? NIM= Net Interest Margin

? NPM= Net profit Margin

Basic Equation:

Yit = ?0 + ? 1 X1,it + ?2 X2,it + Vit

Equations derived from basic equations conventional banks

ROA = ?0 + ? 1 (CR) + ?2 (HHI) ………. (1)

NIM= ?0 + ? 1 (CR) + ?2 (HHI) ………… (2)

ROE = ?0 + ? 1 (CR) + ?2 (HHI) ………… (3)

Equations derived from basic equations Islamic banks

ROA = ?0 + ? 1 (CR) + ?2 (HHI)…….. (1)

ROE = ?0 + ? 1 (CR) + ?2 (HHI)……. (2)

NPM= ?0 + ? 1 (CR) + ?2 (HHI) ……. (3)

Table 1

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob |

||

|

C |

1.081897 |

0.812768 |

1.331126 |

0.1884 |

||

|

HHI |

0.001111 |

0.000391 |

2.841414 |

0.0062 |

||

|

CR |

-0.147895 |

0.029951 |

-4.937908 |

0.0000 |

||

|

R-squared |

0.328825 |

|

|

|

||

|

F-statistic |

13.96283 |

|||||

|

Prob (F-statistic) |

0.000012 |

|||||

Table 1: The dependent variable Return on Assets (ROA) for conventional banks is displayed, and the above estimations explain the model equation 1 results. The prob value for HHI is (0.0062) and for CR (0.0000) the coefficient for HHI is (0.001111) and the coefficient for CR is (-0.147895) Hence, the results show there is a positive significant relationship between HHI with ROA and negatively significant relationship between CR and ROA. Therefore, the alternative hypothesis of a significant relationship between CR and HHI with ROA is accepted.

Table 2

|

Test Hypothesis |

|||

|

|

Cross-section |

Time |

Both |

|

Breusch-Pagan |

2.122839 |

14.42232 |

16.54516 |

|

|

(0.1451) |

(0.0001) |

(0.0000) |

Table 2: The results of the Breusch Pagan test for all Return on Assets equations are shown. Return on Assets has a non-significant cross-sectional P-Value (0.1451), however, the time has a significant value (0.0001). As a result, the null hypothesis is rejected with a probability of less than 0.05, according to the Breusch-Pagan Hypothesis. As a result, test Pooled OLS is not appropriate, and because entities differ, so does the intercept, the study continues to estimate Random Effect Models / Fixed Effect Models.

Table 3

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob |

|

HHI |

0.001112 |

0.000590 |

1.886713 |

0.0064 |

|

CR |

-0.148249 |

-0.148249 |

-6.484356 |

0.0000 |

|

C |

1.083986 |

1.222068 |

0.887010 |

0.3788 |

|

R-squared |

0.431529 |

|

|

|

|

F-statistic |

21.63446 |

|||

|

Prob(F-statistic |

0.000000 |

Table 3: Offers the Random Effect Model findings; however, before analysing the data, perform the Husman test to see whether the Random Effect Model is appropriate before proceeding to the Fixed Effect Model.

Table 4

|

Test summary |

Chi-Square |

Chi-Square D.F |

Prob |

|

Period

random |

1.381321 |

1 |

0.2399 |

If the P-value is greater than (0.05), the null hypothesis must be rejected and the Random Effect Model must be utilised. As a result of the data in the preceding table, the null hypothesis is accepted with a P value larger than 0.05. As a consequence, the result displays Prob Value (0.2399), indicating that the Random Effect Model is adequate for the model equation.

Table 5

|

Variable |

Coefficient |

Std.

Error |

T-Statistic |

Prob |

|

HHI |

0.002101 |

0.000618 |

3.398775 |

0.0012 |

|

CR |

-0.201453 |

0.047323 |

-4.256969 |

0.0001 |

|

C |

1.967772 |

1.284197 |

1.532297 |

0.1310 |

|

R-squared |

0.303515 |

|

|

|

|

F-statistic |

12.41974 |

|

|

|

|

Prob(F-statistic) |

0.000033 |

|

|

|

Table 5: shows the dependent variable Net interest margin (NIM) in the model equation 1 which explain the results for conventional banks. The prob value for CR is (0.0001) and HHI (0.0012) and the coefficient for CR and HHI shows (-0.201453) and (0.002101) accordingly. Hence, the results show there is a positively significant relationship between HHI with NIM, but negatively with CR. Therefore, the alternative hypothesis is accepted.

Table 6

|

Test

Hypothesis |

|||

|

|

Cross-section |

Time |

Both |

|

Breusch-Pagan |

0.152510 |

9.640710 |

9.793220 |

|

|

(0.6961) |

(0.0019) |

(0.0018) |

Table 6: The Breusch Pagan Test findings for all NIM equations are shown, with the cross-sectional P-Value of (0.6961) being non-significant and the Time P-Value of (0.0019) being less than 0.05, suggesting that the study rejects the null hypothesis. As a result, the Pooled OLS experiment is inapplicable, and the Random Effect Model / Fixed Effect Model must be approximated.

Table 7

|

Variable

|

Coefficient |

Std. Error |

t-Statistic |

Prob |

|

HHI |

0.002101 |

0.000934 |

2.249174 |

0.0284 |

|

CR |

-0.201475 |

0.038260 |

-5.265984 |

0.0000 |

|

C |

1.967899 |

1.936066 |

1.016442 |

0.3137 |

|

R-squared |

0.353231 |

|

|

|

|

F-statistic |

15.56522 |

|||

|

Prob(F-statistic) |

0.000004 |

Table 7 Displays the Random Effect Model findings; however, before analysing the data, perform the Husman test to determine whether the Random Effect Model is acceptable before moving on to the Fixed Effect Model.

Table 8

|

Test summary |

Chi-Square |

Chi-Square D.F |

Prob |

|

Period random |

0.002224 |

1 |

0.9624 |

Table 8: The Hausman test is a statistical test used to determine whether the optimal Fixed Effect or Random Effect model should be selected. If the P-value is greater than (0.05), the Husman Test states that the investigation must accept the null hypothesis and employ the Random Effect Model. As a consequence, the p-value is 0.9624, indicating that the study accepts the null hypothesis and does not need to compute further.

Table 9

|

Variable

|

Coefficient |

Std. Error |

t-Statistic |

Prob |

||

|

HHI |

-0.010909 |

0.005216 |

-2.091371 |

0.0410 |

||

|

CR |

-0.333283 |

0.399402 |

-0.834454 |

0.4075 |

||

|

C |

38.22916 |

10.83847 |

3.527173 |

0.0008 |

||

|

R-squared |

3.010799 |

|

|

|

||

|

F-statistic |

0.095548 |

|||||

|

Prob(F-statistic) |

0.057146 |

|||||

Table 9: shows the dependent variable ROE the above estimates explain the results of the model's results for equation 1 the prob value for HHI is (0.0410) and CR (0.4075) and the coefficient for HHI and CR shows (-0.010909) (-0.333283) accordingly. Hence the results show there is a positively non-significant relationship between CR and HHI with ROE. Therefore, the alternative hypothesis of being a positively non-significant relationship between CR and HHI with ROE is rejected.

Findings of Objective 1

In objective 1, ROA, ROE, and NIM has taken as dependent variables, and independent variables such as CR ratio and HHI. It is observed from analysis that the increased size of the banking sector in terms of assets banking sector indicated that more concentrated banks earn more profit. The study further indicated that the CR ratio has a negative impact on performance that shows as the number of competitors increased in the market the performance of the banking sector declined.

Islamic Banks Objective 2 Table 10

|

Variable

|

Coefficient |

Std. Error |

t-Statistic |

Prob |

||

|

CR |

0.372500 |

0.115569 |

3.223186 |

0.0021 |

||

|

HHI |

0.012630 |

0.006283 |

2.010086 |

0.0492 |

||

|

C |

-0.822160 |

0.251634 |

-3.267289 |

0.0018 |

||

|

R-squared |

0.292562 |

|

|

|

||

|

F-statistic |

11.78623 |

|||||

|

Prob(F-statistic) |

0.000052 |

|||||

Table 10

Table 10: Shows dependent variable Return on Assets (ROA) the above estimates explain the results of model's equation 1 for Islamic banks. The prob value for CR is (0.0021) and HHI (0.0492) and the coefficient for CR and HHI shows (0.372500) and (0.012630) accordingly. As a result, the data reveal that there is a positive association between CR and HHI and ROA. Therefore, the alternative hypothesis of a positively significant relationship between CR and HHI with ROA is accepted.

Table 11

|

Test Hypothesis |

|||

|

|

Cross-section |

Time |

Both |

|

Breusch-Pagan |

1.594537 |

0.052213 |

1.646750 |

|

(0.2067) |

(0.8193) |

(0.1994) |

|

Table 11

The Breusch Pagan Test findings for the Return on Asset equation were provided. The statistics for Return on Assets show that the cross-sectional P-Value (0.2067) is non-significant, as is time according to the Bresuch Pagan Test hypothesis (0.8193). The Brush Pagan Hypothesis is accepted because both cross-sectional and time are more than the P-value 0.05. Breusch Pagan's test suggests Panel Least is appropriate and there is no need to compute further because we accept the null hypothesis, which has been concluded.

Table 12

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob |

||

|

CR |

5.495884 |

0.507113 |

10.83760 |

0.0000 |

||

|

HHI |

0.062415 |

0.027570 |

2.263869 |

0.0274 |

||

|

C |

-3.494312 |

1.104161 |

-3.164675 |

0.0025 |

||

|

R-squared |

0.749564 |

|

|

|

||

|

F-statistic |

10.75902 |

|||||

|

Prob(F-statistic) |

0.000000 |

|||||

Table 12 shows the dependent variable ROE the above estimates explain the results of the model's results for equation 1 the prob value for CR is (0.0000) and HHI (0.0274) and the coefficient for CR and HHI shows (5.495884) (0.062415) accordingly. Hence the results show there is a positive significant relationship between CR and HHI with ROE. Therefore, the alternative hypothesis of a positively significant relationship between CR and HHI with ROE is accepted.

Table 13

|

Test Hypothesis |

|||

|

|

Cross-section |

Time |

Both |

|

Breusch-Pagan |

4.125477 |

0.042765 |

4.168242 |

|

(0.0422) |

(0.8362) |

(0.0412) |

|

The results of the Breusch-Pagan test for ROE are shown, with the cross-sectional P-value (0.0422) being significant and time revealing a non-significant value (0.8362). With a cross-sectional prob value of less than 0.05, the null hypothesis is rejected because the cross-section probability value implies that ROE is significant at the P-value (0.0422) but time is insignificant at the P-value (0.08362). As a result, test pooled OLS is unsuccessful and should only be used to estimate a random effect model or a fixed effect model.

Table 14

|

Variable

|

Coefficient |

Std. Error |

t-Statistic |

Prob |

|

CR |

6.029184 |

0.787952 |

7.651713 |

0.0000 |

|

HHI |

0.050647 |

0.029205 |

1.734183 |

0.0883 |

|

C |

-3.816255 |

1.581304 |

-2.413360 |

0.0190 |

|

R-squared F-statistic

Prob(F-statistic) |

0.678164 60.05443 0.000000 |

|

|

|

Table 14

The findings of the Random Effect Model are reported; however, before interpreting the results, use the Hausman Test to determine whether the Random Effect Model is appropriate before proceeding to the Fixed Effect Model.

Table 15

|

|

Chi-Square |

Chi-Square D.F |

Prob |

|

Cross Section |

0.000000 |

2 |

1.0000 |

As a result of the above table's results, the null hypothesis is accepted because the Probability value (1.0000) is greater than (0.05); thus, the Random Effect Model is appropriate for the model equation.

Table 16

|

Variable

|

Coefficient |

Std. Error |

t-Statistic |

Prob |

|

HHI |

96749.44 |

22455.33 |

4.308528 |

0.0001 |

|

CR |

5915822 |

413032.7 |

14.32289 |

0.0000 |

|

C |

-5110942 |

899316.2 |

-5.683143 |

0.0000 |

|

R-squared F-statistic Prob(F-statistic) |

0.851876 163.9061 0.000000 |

|

|

|

Table 16: shows the dependent variable Net profit margin (NPM) the above estimates explain the results of the model's equation 1 for Islamic banks. The prob value for HHI is (0.0001) and CR (0.0000) and the coefficient for HHI is and CR shows (96749.44) and (5915822) accordingly. Hence, the results show there is a positive significant relationship between CR and HHI with NPM. Therefore, the alternative hypothesis of a positively significant relationship between CR and HHI with ROA is accepted.

Table 17

|

Test Hypothesis |

|||

|

|

Cross-section |

Time |

Both |

|

Breusch-Pagan |

0.000505 |

0.035387 |

0.035892 |

|

(0.9821) |

(0.8508) |

(0.8497) |

|

As the cross-section probability value for NPM is non-significant at P-value (0.9821) and time is non-significant at P-value (0.8508). As a result, because both cross-sectional and time are greater than the P-value 0.05, the Brush Pagan Hypothesis is supported. There is no need to compute further because we accept the null hypothesis, which has been concluded.

Findings of Objective 2

In objective 2, for the Islamic banking sector ROA, ROE, and NPM has taken as dependent variables, whereas, independent variables are CR ratio and HHI. It is observed from the analysis of Islamic banks, similar to conventional banks, with an increased size of the banking sector in terms of assets banking sector indicated that more concentrated banks earn more profit. In Islamic banking, it is observed from analysis that with an increased CR ratio performance also increased. Hence, with an increased number of competitors in the market the performance of the banking sector also increases.

The above graph results show that the conventional banking sector has a higher concentration as HHI is constantly greater than the Islamic Banking sector according to the graph presented.

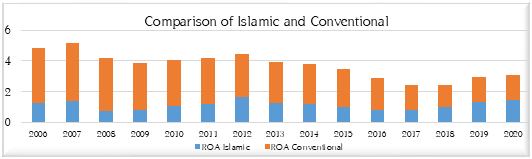

The graph results show a higher ROA for the conventional banking sector than the Islamic banking sector from the given period of time. Notably, in 2019 and 2020 it seems both firms perform equally rather Islamic banks increased in return on assets. It could be the reason for covid-19 impact on conventional banks.

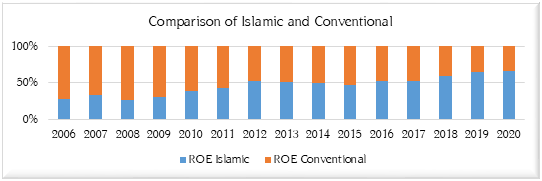

As the graph shows ROE for the Islamic banking sector is continuously increasing to the Conventional banking system. Hence, it confirms the results of HHI's non-significant impact on ROE for conventional banks.

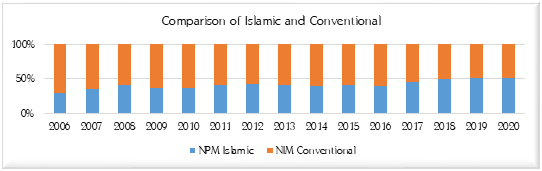

The graph indicated the NPM for the Islamic banking sector shows less than the Conventional banking sector till 2016 and 17 but an unanticipated increase observe from 2018 to 2020.

Findings of Objective 3

It is observed from the comparative analysis that the asset size of the conventional banking system is greater than the Islamic banking system. Hence, the performance indicator ROA of conventional banks indicated a higher ratio than the Islamic banking system. But it also highlighted that in the period of 2019 and 2020, the performance tends to decline. It may be due to the covid-19 crisis because in this period Islamic banks remain sustained in comparison to conventional banks. Although HHI and CR were influencing significantly the ROE of Islamic banks, it observed no influence in conventional. Additionally, the NPM of Islamic banks is comparatively less than conventional net interest margin till 2017 but it tends to increase in 2017 to 2020, which also indicated it may be due to covid-19 conventional banks reduce the earning performance and Islamic remains stable.

Discussion

The study focused on the concentration -performance of the banking sector and compare Islamic and conventional banking systems, where we analyse dependent variables for Islamic banks such as ROA, ROE and NPM and for conventional ROA, ROE and NIM. And we have taken independent variables HHI and CR for both Islamic and conventional banks. Results of the conventional banking system indicated that HHI has a positively significant impact on two performance indicators such as ROA and NIM. However, ROE shows non-significant in the case of conventional banks. Conversely, CR observed negatively significant with ROA and NIM, but non-significant with ROE. Similarly, results for Islamic banks show ROA, ROE and NPM all observed positively significant with HHI and CR. The concentration performance analysis of our study shows results similar to Hamza H. and Kachtouli (2014), Yudarrudin (2012), and Samad (2008) who analyse market structure, conduct and performance in the Indonesian banking industry. They concluded that a reduction in competition and rise in concentration in an industry would result in higher profits for that industry higher concentration ratio (CR) contributes to higher profitability. It is also observed that conventional banks indicatively showed a higher HHI index, which is used to determine market competitiveness. This index measures the size of companies relative to the size of the industry. Moreover, CR ratios are used to quantify market concentration and are based on a company's market share in a given industry. The concentration ratio is determined by the number of enterprises and their market shares.

Conclusion And Recommendations Conclusion

Limitation

The number of banks was reduced due to the lack of data for some Islamic banks that were introduced in 2015, and this study spans the years 2006 to 2020.

Lack of availability in literature in the context of Pakistan, especially on concentration performance analysis.

Future Research Directions

It is recommended that the same dimension can be compared with other countries.

It is observed from research analysis that the performance of the banking sector reduced in terms of the conventional banking sector during the Covid-19 period and Islamic banks remain stable rather than improved performance taking all the theoretical assumptions. Hence, this study can also be done in terms of covid-19 impact on the performance of the conventional banking system.

Practical Contribution

? This study will be helpful for investors will help to decide whether to invest in Islamic or conventional or both banks.

? This study will also help the Islamic banking sector to be more competitive in comparison to conventional banks in Pakistan.

? This study will be helpful for future researchers to use concentration in other sectors as well.

? This study will help Conventional banks to enhance policies and advancement in products and services within the convenience of customers to have more profits in the era of recession and shocks like the Covid-19 Pandemic.

Theoretical Contribution

? The study added to the existing literature by examining the concentration performance analysis of the banking sector and comparing both the banking systems of Pakistan. This is the first time a study of this type has been conducted on the basis of the concentration performance of Islamic and conventional banks in Pakistan.

? This study contributes to the literature for upcoming researchers who want to research this side of the concentration performance of different sectors other than the banking sector.

? Many researchers in other countries like Malaysia and Indonesia have done this research in the context of concentration performance analysis but in Pakistan, we have only comparative studies of the performance of both sectors this is the contribution of the study for future research.

? Academicians and researchers benefit from the study since it bridges gaps in the field.

References

- Mirzaei, A., Moore, T., & Liu, G. S. (2013). Does market structure matter on banks’ profitability and stability? Emerging vs. advanced economies. Journal of Banking and Finance, 37(8), 2920–2937.

- Berger, A. N., & Humphrey, D. B. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98(2), 175–212.

- González, L. A., Razia, A., Búa, M. V., & Sestayo, R. L. (2019). Market structure, performance, and efficiency: Evidence from the MENA banking sector. International Review of Economics & Finance, 64, 84–101.

- González, L. A., Razia, A., Búa, M. V., & Sestayo, R. L. (2017). Competition, concentration and risk taking in Banking sector of MENA countries. Research in International Business and Finance, 42, 591–604.

- Mason, E. S. (1939). Price and Production Policies of Large-Scale Enterprise. The American Economic Review, 29(1), 61– 74.

- Mohammed, N., Ismail, A. G., & Muhammad, J. (2015). Evidence on Market Concentration in Malaysian Dual Banking System. Procedia - Social and Behavioral Sciences, 172, 169–176.

- Asadullah, M. (2017). Determinants of Profitability of Islamic Banks of Pakistan – A Case Study on Pakistan’s Islamic Banking Sector. International Conference on Advances in Business, Management and Law, 1(1), 61–73.

- Shahid, M. S., Hassan, M., & Rizwan, M. (2015). Determinants of Islamic Banks’ Profitability: Some Evidence from Pakistan. PAKISTAN JOURNAL OF ISLAMIC RESEARCH, 1(16).

- Ahamed, M. M. (2012). Market Structure and Performance of Bangladesh Banking Industry: A Panel Data Analysis. The Bangladesh Development Studies, 35(3), 1–18.

- Ajami, H. (2015). Islamic Philosophy and Meaning. International Journal of Philosophy and Theology, 3(1).

- Moh’d M, A. (2010). The Main Features of the Structure-Conduct-Performance (SCP) Literature in Banking during the Period 1960s - 1980s. International Journal of Economic Perspectives, 4(3), 509–523.

- ALAM, N. (/2019 ). REGULATORY AND SUPERVISORY ISSUES IN SHARĪ`AH- COMPLIANT HEDGING INSTRUMENTS. Islamic Financial Services Board

- Alfi Maghfuriyah *) Sam'ani, S.E., M.M. **) Dr. Sartono, S.E., M.Si. **). (2015). STRUCTURE CONDUCTED PERFORMANCE ANALYSIS TOWARDS ISLAMIC BANKING IN INDONESIA FROM 2011-2015.

- Maghfuriyah, A., Azam, S. M. F., & Shukri, S. M. (2019). Market structure and Islamic banking performance in Indonesia: An error correction model. Management Science Letters, 1407–1418.

- Talpur, A. B., Shah, P., Pathan, P. A., & Halepoto, J. A. (2016). Structure Conduct Performance (Scp) Paradigm In Pakistan Banking Sector: A Conceptual Framework And Performance Of The First Woman Bank Under Scp Model. The Women, Research Journal, 8(8).

- Salman, A., & Nawaz, H. (2018). Islamic financial system and conventional banking: A comparison. Arab Economic and Business Journal, 13(2), 155–167.

- Obeidat, B., El-Rimawi, S. Y., Masa’deh, R., & Maqableh, M. (2013). Evaluating the Profitability of the Islamic Banks in Jordan. European Journal of Economics, Finance and Administrative Sciences, 56.

- Bain, J. S. ((1950). Workable competition in oligopoly: Theoretical Considerations and Some Empirical Evidence. The American Economic Review, 35-47

- Bain, J. S. (1951). Relation of Profit Rate to Industry Concentration: American Manufacturing, 1936-1940. Quarterly Journal of Economics, 65(3), 293.

- Bhatti, G. A., & Hussain, H. (2010). Evidence on Structure Conduct Performance Hypothesis in Pakistani Commercial Banks. International Journal of Business and Management, 5(9).

- Demsetz, H. (1973). Industry Structure, Market Rivalry, and Public Policy. The Journal of Law and Economics, 16(1), 1– 9.

- Nurwati, E., Achsani, N. A., Hafidhuddin, D., & Nuryartono, N. (2014). Market Structure and Bank Performance: Empirical Evidence of Islamic Banking in Indonesia. Asian Social Science, 10(10).

- Fayed, M. E. (2013). Comparative Performance Study of Conventional and Islamic Banking in Egypt. ideas.repec.org.

- Gilbert, A. R. (1984). Bank Market Structure and Competition: A Survey. Journal of Money, Credit, and Banking, 617-44.

- Rammal, H. G., & Parker, L. D. (2012). Islamic banking in Pakistan: A history of emergent accountability and regulation. Accounting History, 18(1), 5–29.

- Saba, I., Kibriya, R., & Kouser, R. (2015). Antecedents of Financial Performance of Banking Sector: Panel Analysis of Islamic,

- Moisseron, J., Moschetto, B., & Teulon, F. (2015). Islamic Finance: A Review Of The Literature. International Business & Economics Research Journal, 14(5), 745.

- Arif, M. N. R. A., & Awwaliyah, T. B. (2019). Market Share, Concentration Ratio and Profitability: Evidence from Indonesian Islamic Banking Industry. Journal of Central Banking Theory and Practice, 8(2), 189–201.

- Khan, M., & Abbas, G. (2019). Empirical evaluation of ‘structure-conduct- performance’ and ‘efficient-structure’ paradigms in banking sector of Pakistan. International Review of Applied Economics, 33(5), 682–696.

- Moin, M. (2008). Performance of Islamic Banking and Conventional banking in Pakistan : a Comparative Study. School of Technology and Societ.

- An Overview of Islamic Finance. (2015). In IMF. International Monetray Fund.

- Bello, M. O., & Isola, W. (2014). Empirical analysis of structure-conduct- performance paradigm on Nigerian banking industry. ResearchGate.

- State Bank of Pakistan. (2020).

- Khaki, A., & Sangmi, M. (2011). Islamic Banking: Concept and Methodology. SSRN Electronic Journal.

- Ansari, S., & Rehman, A. (2009). Financial Performance of Islamic and Conventional Banks in Pakistan: A Comparative Study. In iefpedia.com. 8th International Conference on Islamic Economics and Finance, Pakistan.

- Parashar, S. P., & Venkatesh, J. (2010). How Did Islamic Banks Do During Global Financial Crisis. Banks and Bank Systems, 5(4).

- Shijaku, G. (2017). Bank Stability and Competition: Evidence from Albanian Banking Market. Eurasian Journal of Business and Economics, 10(19), 127– 154.

- Smirlock, M. (1985). Evidence on the (Non) Relationship between Concentration and Profitability in Banking. Journal of Money, Credit and Banking, 17(1), 69.

- Latif1, Y., Abbas, A., Akram, M.N., Manzoor, S., & Ahmad, S. ( 2016). Study Of Performance Comparison Between Islamic And Conventional Banking In Pakistan. European Journal of Educational and Development Psychology,4(1) 17-33.

- Yudaruddin, R. (2017b). MARKET STRUCTURE, CONDUCT AND PERFORMANCE: EVIDENCE FROM INDONESIA BANKING INDUSTRY. Ekuitas.

Cite this article

-

APA : Channa, F., & Talpur, A. B. (2023). Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan. Global Economics Review, VIII(II), 140-161. https://doi.org/10.31703/ger.2023(VIII-II).11

-

CHICAGO : Channa, Faiza, and Arifa Bano Talpur. 2023. "Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan." Global Economics Review, VIII (II): 140-161 doi: 10.31703/ger.2023(VIII-II).11

-

HARVARD : CHANNA, F. & TALPUR, A. B. 2023. Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan. Global Economics Review, VIII, 140-161.

-

MHRA : Channa, Faiza, and Arifa Bano Talpur. 2023. "Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan." Global Economics Review, VIII: 140-161

-

MLA : Channa, Faiza, and Arifa Bano Talpur. "Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan." Global Economics Review, VIII.II (2023): 140-161 Print.

-

OXFORD : Channa, Faiza and Talpur, Arifa Bano (2023), "Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan", Global Economics Review, VIII (II), 140-161

-

TURABIAN : Channa, Faiza, and Arifa Bano Talpur. "Concentration Performance Analysis of Banking Sector: A Comparative Study of Islamic and Conventional Banks of Pakistan." Global Economics Review VIII, no. II (2023): 140-161. https://doi.org/10.31703/ger.2023(VIII-II).11