Abstract:

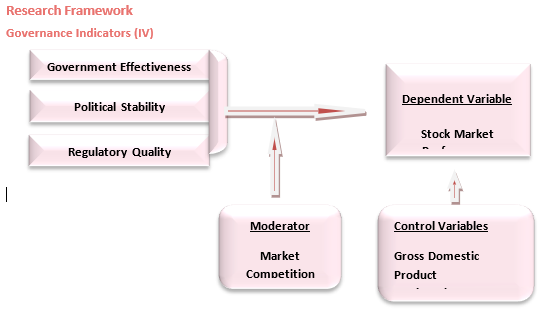

This paper's objective is to investigate how market competition moderates the association between governance indicators and stock market performance. Data from 110 countries have been taken as a sample for the period spanning from 2007 to 2016. For this purpose data is divided into three subpanels high earnings group, middle earnings group and low earnings group. Ordinary Least Square (OLS), Random Effect Model, Fixed Effect Model and Prais-Winsten regression estimation are used to analyze the data. Moreover, we find a positive effect of market competition along with government effectiveness and regulatory quality on Stock Market Performance. Nevertheless, the conjunction of market competition and political stability exerts a detrimental influence on stock market performance. This study provides some guidelines to policymakers, investors and researchers.

Key Words:

Stock Market Performance, Market Competition, Governance Indicators, GDP, Market size

Introduction

The performance of the stock market is an essential element to analyze the financial condition of the country. A wide range of literature is available that demonstrates that the stock market performance (SMP) of a country improves overall economic growth and human well-being (Olweny & Kimani, 2011; Sraer & Thesmar, 2007; Pfeffer, 2010; Castriota, 2007). Both primary and secondary investors get benefits when the stock market rises by even a few points. Stock markets provide an easy mechanism for central entry by investors and stakeholders, thus, constant liquidity is mandatory. Liquidity can be maintained with adequate size and volume of transactions in the capital market. An efficient stock market may expand resources, increase domestic resource mobilization and attract foreign portfolios, especially for developing countries. Although it is factual that SMP plays a very important function in enhancing growth. Literature is still confused about the phenomenon of what determines SMP. Today, especially in the context of cross-country analysis, researchers have tried to search for the influence of macro-economic variables and governmental influences on SMP (Kyereboah-Coleman & Agyire-Tettey, 2008; Gay, 2016; Humpe & Macmillan, 2009; Hondroyiannis & Papapetrou, 2001); however, the literature is scarcely related to the result of market competition on the performance of the capital market.

Cross-country studies (Durnev & Kim, 2005; Bruno & Claessens, 2010; Fraj & Maktouf, 2018) reveal that successful investment operations bolster economic growth, contingent on a governance framework. Governance indicators intersect with market competition, impacting organizations' performance. For instance, the US House's decision against a bailout bill on October 29, 2008, triggered a 17% global stock market surge in hours. Prior research by Darley (2012) and Hooper (2009) links financial and capital markets' functioning to governance quality. Market competition thrives on supply-demand disparities, positively influencing stock performance. More competitive firms yield higher returns (Gaspar & Massa, 2005; Irvine & Pontiff, 2005), attracting investment due to profitability and reduced volatility. Hoberg and Phillips (2009) suggest that heightened industry competition diminishes stock returns, aligning with firms' multifaceted activities in the market.

Stock markets reflect economic health; booms (e.g., 2009, 2018) bolster growth, while crashes (2000, 2007, 2009, 2015) impede it. SMP affects consumers, impacting individuals and firms alike. In summary, the intricate linkages between governance, market competition, and stock performance contribute to economic fluctuations and resonate across sectors. However, before making an investment, investors consider several macroeconomic, social and political factors. Although there is some literature related to the result of macro-economic variables and government element on SMP, there is little known phenomenon that how market competition influence stock market development. Previous studies reveal that laws and the quality of their enforcement are essential for governance and SMP (Giannetti & Koskinen, 2012). The observed cross-countries differences in governance indicators and SMP may be explained by a single factor which is a difference in law and its enforcement (La Porta 1997, 1998). According to researchers countries having sound governance indicators may attract foreign investors more as compared to those countries having poor governance quality. Many economists suggested that market competition and governance indicators are two main factors that are affecting the SMP because in the absence of market competition the performance of the firms are low as compared to the performance of those firm where exist the concept of competition (Allen & Gale, 2000).

Hermalin (1992) suggested four mechanisms of market competition that influence management performance. These are the impact of enhanced data when faced with competing companies, a shift in returns on management effort, an impact of risk adaptation if the risks of profit differ according to competition level and the impact of decreased revenues in a more competitive environment. According to Hermalin if income affects positively then due to the other three effects agency cost becomes low with the impact of market competition. Peress (2010) suggested that organizations having market power will attract investors more as compared to the more competitive industries and in this way, more of this information is associated with the prices of the stock market for firms with a better degree of market power. So, in this way, the investment efficiency of the firms increased and that as a result increased the firm profit. Hoberg and Phillips's (2010b) study reveals that analysts are more partial in competitive organizations which as a result decreases investment efficiency and stock prices.

Vives (2008) considered various models for the reduction of cost. He finds authentic backing for competition dynamic invention events. Positive stock return relation to competition has been found by Hou & Robinson (2006). In the light of aforementioned academic literature, it is believed that market competition (MC) influence the association between governance indicators and SMP. The parsimonious model presented in this study can help market players improve the industrial performance of a nation. SMP is essential for the overall economic growth and prosperity of a country. Prior studies have tested many factors influencing SMP. However, still, some of the factors identified through literature are under-explored. To the best of the author's knowledge, no prior research has investigated the moderating impact of market competition on the correlation between governance indicators and stock market performance. Accordingly, this study will provide a parsimonious model to enhance SMP. Furthermore, the analysis subpanel (on the basis of income level) can provide more robust estimations to the concerned readers.

The study titled "Examining the impact of Market Competition on the Relationship between the Governance Indicators i.e. Political stability (PS), Regulatory quality (RQ), and Stock market performance (SMP)" offers valuable practical and theoretical contributions to the fields of finance, economics, and governance.

From a practical standpoint, the results of the study encompass direct implications in favour of policymakers, investors, as well as market participants. By highlighting the moderating influence of MC on the association between governance indicators i.e. PS, RQ, and SMP, the study provides actionable insights for regulatory bodies and governments seeking to enhance market efficiency and stability. It suggests that in highly competitive markets, the impact of governance practices and RQ on SMP might be more pronounced, underlining the need for robust governance frameworks and stable regulatory environments to bolster investor confidence and attract capital inflows. Investors can also benefit from understanding how market competition influences the efficacy of governance-related factors in predicting stock market outcomes, aiding in more informed investment decisions.

Theoretically, the study enriches the understanding of the intricate dynamics between governance, market competition, and financial performance. It contributes to the existing literature by incorporating the role of market competition as a moderating factor, offering a more nuanced perspective on the complex relationships involved. This theoretical advancement can serve as a foundation for future research endeavours that delve deeper into the mechanisms through which market competition interacts with governance and regulatory quality to shape stock market behaviour. The study's findings challenge traditional assumptions about the unidirectional influence of governance on SMP, emphasizing the importance of contextual factors like market competition. This encourages scholars to adopt a new holistic view when investigating the multifaceted nature of financial markets and their responses to various external influences.

Literature Review and Hypotheses Development Theoretical Framework

Different researchers have employed different theories in support of their argument regarding the Stock Market Performance (SMP). This study used endogenous growth theory, efficient market and behavioural finance theory, Good Governance theory and Pure-contestability (competition theory) to find the relation between the independent and dependent variables.

Theory of Endogenous Growth

In accordance with the Endogenous Growth Theory, economic growth is attained through internal mechanisms rather than external factors (Agarwal, 2001). Investment in human capital, invention and information are the main contributors to economic growth. This theory suggests that policy measures play a very important role in the long-run growth of the economy and this long-run growth can be found by yield per person growth rate, depending on the development rate of total factor output.

Efficient Market and Behavioral Biases

Eugene Fama developed this theory which reveals that stock is always traded on fair value. According to this theory, asset prices completely reflect all available information. This theory basically contains three hypotheses strong, semi-strong and weak. The weak form presents all available past publically information about stock prices. Semi-strong form reveals both publically available information and new public information. The strong form also reflects the hidden information. Kenneth and French (2012) supported this view as they suggested that abnormal returns distribution of US mutual funds is very similar to what is expected.

However, the influence of emotions is ignored in investment decision-making (Aronson, Cohen, Nystrom, Rilling & Sanfey, 2003). Behaviours of investors are different because of different situations, incorrect decisions and falsification in observation whereas other traditional models consider humans as perfect balanced negotiators (Adetiloy & Babajide, 2012). Behavior finance creates serious doubt on the legitimacy of traditional finance theory like efficient market theory. Modigliani and Miller (MM) work in finance, they assumed normal man as maximizing utility is not appropriate due to the absence of experimental evidence (De Bondt et al., 2013).

Good Governance Theory

Basic principles are set by good governance theory to run every form of government. IMF (2012) declares that good governance includes the rule of law, effectiveness and responsibility of the civic sector, and corruption. Moreover, UNDP (2007) defines these eight principles as governmental impact, rule of law, transparency, openness, unanimity, justice and completeness, efficiency and effectiveness, and accountability.

Pure-contestability (competition theory)

Perfect competition is a well-established theory in which price-taking procedures of product is based on average price when information on prices is perfect (Varian, 1984). This theory has main three aspects known as

1. No entry or exit barriers

2. No sunk costs

3. Access to the same level of technology

Some economist suggests that price can not only be determined by market structure but competition is also an important factor to determine the price and output Brock (1983). Firms that are equipped with the latest technology and have more information about the production of goods can achieve high economies of scale because of lesser average cost as compared to those firms that have less information and technology. Such kinds of firms will not be able to compete and thus they will exit from the market. So, it is necessary that government should provide equal access to technology and information (Sloman & Garratt, 2009).

Stock Market Performance

The stock market is an essential part of the economy as stock markets provide long-term and short-term investment opportunities to primary and secondary investors. So, when there is an improvement in the stock market then a visible improvement can be seen in the financial progress of a country (Barasa, 2014). The basic role of the stock market is to serve as a place for exchanging capital because only the stock market can perform this task well. Only stock markets enable the investors to make the right investment in the right place and at the right time because the stock market is a place that can provide the full and right information about the shares and securities to the investors (Fama, 1965a, b; Malkiel and Fama, 1970) and Behavioral Finance (Barberis & Thaler, 2003; Ritter, 2003; Shiller, 2003).

The stock market is an important place for the trade of shares and commodities. According to Arnold (2004), the stock market is an important place where investors can sell and buy shares and governments and organizations can raise their long-term capital. The economic growth of a nation is directly related to the stock market.

Governance Indicators and stock market Performance

The interplay between governance indicators and stock market performance (SMP) holds significant implications, as evidenced by academic and experimental literature. Effective governance profoundly impacts an economy's stock market performance. Notably, this connection extends to direct influence on stock price fluctuations. Research, such as Beaulieu and Caron's (2005), establishes a positive correlation between stock returns and governance quality. Conversely, nations with inadequate governance structures incur higher agency and transaction costs compared to well-governed counterparts (Fan, 2008; Fui, 2008; Zhao, 2008). Brooks (2016) underscores the favourable impact of governance quality on stock market growth. Hooper et al.'s (2009) examination reveals that well-governed economies experience lower risk and higher equity returns in their stock markets. The pivotal role of governance in stock market development becomes evident in its facilitation of external financing (Chiou et al., 2010). Moreover, attractively governed nations, per Li and Filer (2007), draw in more equity investors. The instant responsiveness of stock markets to governance indicators is highlighted by Milyo's (2012) findings. Conversely, Low et al. (2011) establish a negative correlation between governance quality and SMP.

Within developing European economies, Munteanu and Brezeanu's (2014) study emphasizes the positive impact of governance quality on stock markets. Notably, Lombardo and Pagano's (2000) research reinforces the link between governance quality and SMP using stock market indices from developed and emerging markets. Political stability (PS), as indicated by Manzoor (2013), fosters an environment conducive to business activities, reassuring investors and lowering financial

market risks. Bechtel's (2009) research highlights how PS bolsters investor confidence, catalyzing growth, capital investments, and overall economic performance. Conversely, Chiu et al. (2005) show that political instability can alter foreign investor behaviour in financial markets. Government actions strongly influence stock returns and market resilience (Beaulieu et al., 2006; Aktas & Oncu, 2006; Bailey et al., 2005; Frey & Waldenstrom, 2004).

Lehkonen and Heimonen (2015) corroborate the strong positive correlation between governance quality and SMP, particularly during deviations in democracy and political risk. Bekaert and Harvey's (2000) empirical work indicates that uncertainty, political instability, and poor governance escalate stock market volatility. Examples abound to illustrate the impact of uncertainty, political instability, and poor governance on stock markets. Nations embroiled in conflict experience notably lower stock market performance and economic growth (Bailey et al., 2005). Ahmed and Javed's (1999) study on the effects of nuclear tests in Pakistan and India further underscores this connection. Notably, politically stable countries demonstrate sustained economic growth (Bittlingmayer, 1998; Henry 2000, Bekaert & Harvey, 2000; Bailey & Chung, 1995; Bechtel, 2009).

Government capabilities are quantified through the regulatory quality (RQ) index, essential for formulating and executing effective policies. Low et al. (2011) establish a positive link between governance indicators, particularly RQ, and stock market returns. Regulatory systems must balance accountability, transparency, and consistency, as advocated by Parker (1999). Such equilibrium fosters public and investor confidence, subsequently driving economic growth. Inconsistent regulations, however, breed uncertainty, raise capital costs, and deter investment willingness. Developing countries must craft regulations that support sustainable economic development and poverty reduction (Guasch and Hahn, 1999).

Market Competition

Competition in markets offers distinct advantages over non-competitive scenarios. Competitive firms strive to boost sales and market share by minimizing costs, lowering prices, and upholding product quality. However, certain researchers suggest an inverse relationship between market competition and stock markets, potentially leading to firm bankruptcy and job losses, posing challenges for the economy. Economists attribute poor firm performance to insufficient market competition (Allen & Gale, 2000). Sharma (2010) correlates competitive market structures with lower stock returns, favouring companies with higher production success. Exchange, a fundamental human need, relies on the market. Hou and Robinson (2006) find competitive product pricing influences stock returns.

Hoberg and Phillips (2009) link competitive industries to low stock returns and stock market valuation. Balakrishnan & Cohen (2013) and Alimov (2013) suggest competition enhances stock liquidity by disciplining managers. Two competition forms, local and foreign market intensity, substantially impact the stock market. Firms' survival instincts drive market changes (Greer, 1992), necessitating competition measurement for strategic guidance. Porter (1980) outlines five market forces that gauge competition intensity: substitute product risk, traditional rival risk, new entrant risk, supplier bargaining power, and customer bargaining power.

Moderating Effect of market Competition

Market competition is a crucial resource that leads towards a high market share or exit from the market for an organization (Waweru et al., 2004). Companies that are facing the intensity of market competition use a large number of product and service lines (Mia & Clarke 1999; Al-Omiri & Drury, 2007). Chong and Rundus (2004), suggested that the firms which are facing high competition are providing high-quality products to their customers in order to satisfy them. Thus, in this way performance of such firms is improving and this situation affects the SMP positively.

According to Patiar and Mia (2009), customer satisfaction and quality are important factors to achieve a competitive advantage. There is a positive influence of MC on company performance (Chong & Rundus, 2004). Since governance indicators are necessary for enhancing the performance of the stock market which in turn is affected by MC, the need to explore the moderating role of market competition is apparent. Large corporations play a very important role in the economic development of the country due to their greater advantage in terms of resources and capabilities (Murad et al., 2015).

On the other hand, poorly designed rules affect trade and humanity altogether because these can lower investment, discourage competition, and make trade difficult with the other markets (Growth Analysis, 2010). Competition is measured as a key element intended for increasing financial augmentation and consumer welfare (Gomaa, 2014; Buccirossi et al, 2011).

According to endogenous growth theory competition constrains innovation because it provides the incentive to the firms to develop new products and services by allowing them abnormal profits which are gained by market power (Gaffard, 2006). Aghion et al. (2000) suggested that the maximum growth rate is achieved by the greatest amount of competition for all time. Giroud and Mueller (2011) argued that managers should be provided incentives through good governance so that in case of less competition firms may perform well. Nickell et al. (1997) suggested that market competition and governance indicators are the determinants of productivity growth in manufacturing firms.

Government effectiveness (GE) is directly linked with the intensity of market competition because policies about competition are formed by the government. If the government is less effective than its means policies will not be implemented properly. As a result, this situation will stop the economic growth of the countries (Broadman, 2007).

Competition is a key factor for the operation of the market because it increases productivity and growth which in turn increases wealth and minimizes poverty (Cook et al., 2007). They also suggest that wealth creation is a big relief for the people because it increases the purchasing power of the people. Broadman (2007) proved that market competition bound the governments to make regulatory reforms. Furthermore, according to critics of the United States, government reforms sometimes can cause serious chaos such as high cost, unfairness, complexity and delay. This situation leads towards business failure, increases poverty, decreases domestic economic growth and decreases the employment level.

This situation on one side suits the end user because goods and services are available at a cheaper rate and on the other side it increases the company's market shares. Dollar and Kraay (2001) suggested that MC has a positive strong influence on government policies because market competition increases the opportunity for innovation and growth, decreases the chances of corruption and minimizes the difficulties of end users. They also suggested that MC increase the usefulness of costs provided on services like infrastructure as well as education. Thus, government policies are not automatic, market competition forces the government to make such kinds of policies that are helpful for the investment environment which as a result increases the confidence of investors to make the investment. Entry and exit barriers become low in case of market competition because goods and services are available at fair prices to the consumers and firms are able to sell their products on fair terms. The report of the Commission for Africa (2005) concluded that:

“Strong institutions tasked with enforcing robust competition laws and policies are essential for enhancing productivity and fostering innovation and more favourable pricing”.

Based on the above literature we developed the following hypotheses:

H1: Government Effectiveness has a strong positive influence on Stock Market Performance.

H2: Political Stability has a strong positive influence on Stock Market Performance.

H3: Regulatory Quality has a strong positive influence on Stock Market Performance.

H4: Market Competition positively moderates in association between Governance Effectiveness and Stock Market Performance.

H5: Market Competition positively moderates in association between Political Stability and Stock Market Performance.

H6: Market Competition positively moderates the association between Regulatory Quality and Stock Market Performance.

Research Methodology

The study examines how market competition moderates the relationship between global governance indicators and stock market performance (SMP). Dynamic econometric modelling addresses endogeneity. This model's strengths include its applicability to both 1(0) and 1(1) regressors, irrespective of stationarity, the ability to analyze data from general to specific using numerous lags, and the provision of reliable long-run coefficient estimates (Laurenceson & Chai, 2003; Gerrard & Godfrey, 1998; Laurenceson & Chai, 1998).

Sampling and data Collection

Information for this research has been gathered from a worldwide sample, which was segmented into subpanels consisting of countries with low, middle, and high levels of income. The data covers the time frame from 2007 to 2016 and was sourced from institutions such as the World Bank, the World Economic Forum, and the Global Competitive Index.

Operational Definition and Variables Measurement Dependent Variable Stock Market Performance

The stock market serves as a platform for trading shares of publicly listed firms to raise capital. It enables stockbrokers to conduct transactions involving company stocks and securities. Listing on an exchange is essential. Stock market performance is measured through financial market development, which enhances economic growth and diminishes poverty by cutting financial investment costs. (Data source, World Bank).

Independent Variable

Governance Indicators

Since 1996, six core governance dimensions have been identified, including Voice and Accountability, Political Stability, State Effectiveness, Regulatory Equality, Law, and Corporate Control. Kaufmann et al. (2010) created variables like Governance Effectiveness, Political Stability, and Regulatory Quality to gauge governance quality. (Data source World Bank).

Moderator Variable

Market Competition

Competition represents the rivalry among firms offering similar goods and services, aiming for income, revenue, and market share growth. Market competition drives companies to augment sales through the marketing mix: Product, Price, Place, and Promotion. To assess how market competition moderates the connection between governance indicators and SMP, local market intensity will be used. Product market competition will be gauged via industry concentration analysis (Hou & Robinson, 2006).

Intensity of Local Market

Intensity measurement using concentration is valuable (Ye et al. 2009), in assessing market share distribution among incumbents (Bajo & Salas, 2002). Concentration gauged relatively and absolutely, indicates a market's shift from a defined competitive state (Fedderke & Szalontai, 2009).

(Data source World Economic Forum, Global Competitive Index).

Control Variables

Gross Domestic Product Per Capita

Gross Domestic Product (GDP) reflects the total value of a country's products, regardless of their origin. To avoid double-counting, GDP includes only the final product value, not its components. GDP is computed from a country’s total final goods and services value. (Data source World Bank)

Market Size

Market size refers to the potential customer base or sales for the current year. For existing businesses, this is deduced from current sales figures. For new products like shampoo or cars, market size aligns with current sector sales. The Market potential is a synonymous concept. Sales data can be found online or in industry journals. Size is computed by multiplying target customers with the penetration rate. (Data source World Economic Forum Global Competitive Index)

Statistical Test

This study will use static models such as OLS, Fixed effect estimation, random effect estimation and Prais-Winsten regression estimation to evaluate and analyze the data.

Operational Model

SMP = ?0 + ?1 GE +?2 PS + ?3 RQ + ?4 MC + ?5 GEMC + ?6 PSMC + ?7 RQMC + ?8 GDP+ ?9 MS + ?

Table 1

|

Whereas |

||

|

SMP |

= |

Stock Market

Performance |

|

PS |

= |

Political Stability |

|

RQ |

= |

Regulatory Quality |

|

GE |

= |

Government Effectiveness |

|

MC |

= |

Market Competition |

|

PSMC |

= |

Interaction of PS with

MC |

|

RQMC |

= |

Interaction of RQ with

MC |

|

GEMC |

= |

Interaction of GE with MC |

|

GDP |

= |

Gross Domestic Product |

|

MSIZE |

= |

Market Size |

Data Analysis Descriptive Test

Descriptive statistics has been explained in table 2 which includes Mean, Standard Deviation, Minima and Maxima values of dependent, independent, moderator and control variables. Data is spanning over the period of 10 years from 2007 to 2016. Data from 110 countries have been taken. Total number of observations is 1110. Data is divided into subpanels i.e. High earnings group, the Middle earnings group and the Low earnings group. Out of 110 countries, 47 countries are high earnings level countries, 54 are middle earnings countries and 9 countries have low earnings level.

Table 2

|

Variable |

Mean |

Std. Dev. |

Min |

Max |

|

SMP |

4.247157 |

0.749799 |

2.21366 |

6.231555 |

|

GE |

59.82374 |

25.7003 |

2.427185 |

100 |

|

PS |

49.96678 |

27.88972 |

0.473934 |

100 |

|

RQ |

61.49698 |

24.39255 |

8.173077 |

100 |

|

MC |

4.987546 |

0.6351 |

3.035214 |

6.381267 |

|

GDP |

18369.51 |

21905.29 |

170.8151 |

118823.6 |

|

MSIZE |

3.77311 |

1.181313 |

1 |

7 |

This table shows that the mean value of SMP is 4.25 with a Min of 2.21 which is (Mauritania) and max value of 6.23 (Hong Kong SAR, China) and the value of standard deviation are 0.745. The mean of GE is 59.82 with Min of 2.43 (Chad) and Max 100 (Finland and Singapore) and the value of standard deviation is 25.7. The mean value of PS is 49.97 with a value of Min of .47 from (Pakistan) and a Value of Max is 100 from (Finland and Luxembourg). For as the mean values of RQ, MC, GDP and Msize are 61.5, 4.99, 18369.5 and 3.77 respectively. The values of Min of these variables are 8.17 (Algeria), 3.04 from (Chad), 170.82 from (Burundi) and 1 from (Gambia and Montenegro) respectively. The values of Max of these variables are 100 from (Denmark, Hong Kong SAR, China, New Zealand and Singapore), 6.38 from (Germany), 118823.60 from (Luxembourg) and 7 from (China) respectively. The value of the standard deviation of PS, RQ, MC, GDP and MSIZE is 27.89, 24.39, 0.64, 21905.29 and 1.18 respectively.

Regression Analysis (Pooled Ordinary Least Square (OLS) Table 3

|

Global |

High Income |

Middle Income |

Low Income |

|||||

|

SMP |

Coef |

P.V |

Coef |

P.V |

Coef |

P.V |

Coef |

P.V |

|

GE |

0.00 |

0.05 |

0.00 |

0.68 |

0.00 |

0.01 |

0.01 |

0.06 |

|

PS |

0.00 |

0.08 |

0.00 |

0.09 |

0.00 |

0.43 |

0.01 |

0.08 |

|

RQ |

0.01 |

0.00 |

0.03 |

0.00 |

0.01 |

0.00 |

0.01 |

0.17 |

|

MC |

0.39 |

0.00 |

0.39 |

0.00 |

-1.01 |

0.12 |

0.06 |

0.58 |

|

GEMC |

0.04 |

0.27 |

0.02 |

0.76 |

0.06 |

0.03 |

-0.03 |

0.66 |

|

PSMC |

-0.04 |

0.10 |

0.04 |

0.15 |

-0.05 |

0.03 |

-0.22 |

0.01 |

|

RQMC |

-0.04 |

0.33 |

0.03 |

0.63 |

-0.05 |

0.07 |

0.00 |

0.99 |

|

GDP |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.17 |

0.00 |

0.15 |

|

MSIZE |

-0.01 |

0.41 |

-0.11 |

0.00 |

0.01 |

0.60 |

0.03 |

0.67 |

|

_cons |

1.52 |

0.00 |

0.56 |

0.07 |

8.06 |

0.01 |

2.35 |

0.00 |

Table 3 provides the effect of the polled OLS regression model. The value of R-Square is 60% at the global level. Whereas this value is 49%, 51% and 67 in all respective subpanels. Independent variable GE positively affects the SMP at the global level, as well as in all subpanels because the coefficient value is positive and it has a positive but insignificant effect in the case of high income because the p-value is greater than 0.1.

PS has a negative and significant effect on SMP at the global level as well as at the high-income level because of the negative coefficient value and greater P<0.1. In the case of low income level PS has a positive and significant effect on SMP. RQ has a positive and significant effect on SMP at the global level, high-income level and middle-income level as p<0.1.

Moderating variable market competition along with GE has a significant impact on SMP as P<0.1 in the case of the middle-income level. It has positive but insignificant effects at the global and high-income levels. Whereas, it has a negative and insignificant effect as P>0.1 in the case of low income level. Market competition along with PS has a positive effect on SMP as P<0.1 except in the case of high-income level. 4.3. Random Effect Model

Table 4

|

|

Global |

|

High Income |

Middle Income |

Low Income |

|||

|

SMP |

Coef |

P.V |

Coef |

P.V |

Coef |

P.V |

Coef |

P.V |

|

GE |

0.00 |

0.84 |

-0.01 |

0.09 |

0.00 |

0.08 |

0.01 |

0.05 |

|

PS |

0.00 |

0.09 |

0.01 |

0.03 |

0.00 |

0.28 |

0.01 |

0.08 |

|

RQ |

0.01 |

0.00 |

0.04 |

0.00 |

0.00 |

0.61 |

0.01 |

0.17 |

|

MC |

0.20 |

0.00 |

0.23 |

0.00 |

-1.64 |

0.00 |

0.06 |

0.58 |

|

GEMC |

0.05 |

0.25 |

0.08 |

0.15 |

0.07 |

0.01 |

-0.03 |

0.66 |

|

PSMC |

-0.07 |

0.00 |

-0.02 |

0.48 |

-0.07 |

0.00 |

-0.22 |

0.01 |

|

RQMC |

0.06 |

0.13 |

-0.01 |

0.92 |

-0.01 |

0.63 |

0.00 |

0.99 |

|

GDP |

0.00 |

0.00 |

0.00 |

0.03 |

0.00 |

0.12 |

0.00 |

0.15 |

|

MSIZE |

-0.04 |

0.23 |

-0.08 |

0.15 |

-0.14 |

0.00 |

0.03 |

0.67 |

|

_cons |

2.34 |

0.00 |

0.57 |

0.20 |

11.90 |

0.00 |

2.35 |

0.00 |

Table 4 provides the result of the Random Effect Model in which the value of R-Square is 54% in the case of global level, 45% in case of high-income level, 25% in case of middle income level and 67% in case low income level.

Table 4 reveals that GE has a positive effect on SMP at the global level. Whereas, it has a negative and significant effect in the case of the high-income group and has a positive and significant effect in the case of middle and low-level income groups because in all cases P>0.1. Moreover, PS has a positive and significant effect on SMP in all cases.

RQ has a positive and significant effect on SMP at the global level as well as in the high earnings group because the value of p is less than 0.1 and it has a positive but insignificant effect on SMP because P>0.1 at middle income as well as in low income level.

Table 4 also reveals that moderating variable market completion along with GE has a positive but not significant influence on SMP at the global level as well as at the high-income level. In the case of the middle-income level, it has a positive and significant effect on SMP as P<0.1. Moreover, it has an inverse and insignificant effect in the case of low-income levels as P>0.1. Market competition along with PS has an inverse but significant effect on SMP as P<0.1 at the global level, middle-income and low-income levels. Moreover, in the case of the high-income groups it has a negative and insignificant effect on SMP as P>0.1.

RQ along with market competition has positive but insignificant on SMP at the global level because P>0.1. Further, in the case of high-level income, middle-level income and low-level income it has a negative and insignificant effect on SMP as P>0.1.

Comparison of OLS and Random Effect Model

Breusch and Pagan Lagrangian multiplier test

Table 5

|

|

Global |

High Income |

Middle Income |

Low Income |

|

chibar2(01) |

1824.64 |

646.32 |

851.75 |

0.00 |

|

Prob > chibar2 |

0.00 |

0.00 |

0.00 |

1.00 |

The comparison of pooled OLS and the Random effect model shows that the random effect model is better as compared to the pooled OLS model.

Fixed Effect Model Table 6

|

Global |

High Income |

Middle Income |

Low Income |

|||||

|

SMP |

Coef |

P. V |

Coef |

P. V |

Coef |

P. V |

Coef |

P. V |

|

GE |

0.00 |

0.73 |

-0.01 |

0.21 |

0.00 |

0.45 |

0.00 |

0.57 |

|

PS |

0.00 |

0.00 |

0.01 |

0.00 |

0.00 |

0.00 |

0.00 |

0.08 |

|

RQ |

0.01 |

0.00 |

0.05 |

0.00 |

-0.01 |

0.08 |

-0.01 |

0.14 |

|

MC |

0.18 |

0.00 |

0.19 |

0.01 |

-1.26 |

0.02 |

-0.18 |

0.02 |

|

GEMC |

0.02 |

0.59 |

0.07 |

0.22 |

0.03 |

0.29 |

0.03 |

0.40 |

|

PSMC |

-0.06 |

0.01 |

-0.02 |

0.37 |

-0.05 |

0.01 |

-0.15 |

0.01 |

|

RQMC |

0.10 |

0.02 |

0.00 |

0.96 |

0.02 |

0.48 |

0.03 |

0.61 |

|

GDP |

0.00 |

0.00 |

0.00 |

0.07 |

0.00 |

0.02 |

0.00 |

0.63 |

|

MSIZE |

-0.32 |

0.00 |

-0.06 |

0.63 |

-0.55 |

0.00 |

-0.03 |

0.78 |

|

_cons |

3.38 |

0.00 |

-0.22 |

0.76 |

11.89 |

0.00 |

4.49 |

0.00 |

Table 6 shows the result of the Fixed Effect Model. The value of R-Square is 30% in the case of global, 43% in the case of high-income level, .9% in the case of middle-income level and 25% in the case of low-income level. These values of R-Square show that there is a moderating relationship between the variables at the high-income level and there is a weak relationship between the variables at the global, high-income level and at low income level. Table 6 also reveals that the independent variable GE has an inverse and insignificant effect on SMP at the global level as well as at the high-income level as the p-value is greater than 0.1. Whereas, GE has a positive but insignificant effect on SMP at a middle-income level as well as at a low-income level. Independent variable PS has a positive and significant effect on SMP. Table 6 result shows a significant effect of RQ on SMP in the case of global and high-income levels as the value of p is less than 0.1 and it has an inverse but significant effect on SMP in the case of middle-income level.

Moderating variable market competition along with GE has a positive effect on SMP in all subpanels as well as at the global level. Moreover, this table reveals that moderating variable market competition along with independent variable PS has an inverse but significant effect on SMP at the global level, middle-income level and low-income level. Market competition along with RQ has a positive and significant effect on SMP at the global level as P<0.1.

Comparison of Fixed Effect and Random Effect Model

Hausman Fe re

Table 7

|

|

Global |

High Income |

Middle Income |

Low income |

|

chi2(8) |

86.20 |

21.52 |

99.59 |

62.77 |

|

Prob>chi2 |

0.00 |

0.01 |

0.00 |

0.00 |

This table's results show that the fixed Effect Model is better as compared to the Random Effect Model. Wooldridge test is used where the p-value is less than .05 in panel data to evaluate the autocorrelation in results.

Modified Wald test Table 8

|

|

Global |

High Income |

Middle Income |

Low Income |

|

chi2 (111) |

7549.41 |

1897.43 |

2658.46 |

205.98 |

|

Prob>chi2 |

0.00 |

0.00 |

0.00 |

0.00 |

Prais-Winsten Regression Table 9

|

Global |

High Income |

Middle Income |

Low Income |

|||||

|

SMP |

Coef. |

P Value |

Coef. |

P Value |

Coef. |

P Value |

Coef. |

P Value |

|

GE |

0.00 |

0.03 |

0.00 |

0.76 |

0.01 |

0.00 |

0.01 |

0.16 |

|

PS |

0.00 |

0.62 |

0.00 |

0.90 |

0.00 |

0.87 |

0.00 |

0.30 |

|

RQ |

0.01 |

0.00 |

0.02 |

0.00 |

0.01 |

0.02 |

0.01 |

0.01 |

|

MC |

0.26 |

0.00 |

0.29 |

0.00 |

-0.78 |

0.17 |

0.03 |

0.79 |

|

GEMC |

0.05 |

0.16 |

0.02 |

0.64 |

0.07 |

0.01 |

-0.03 |

0.43 |

|

PSMC |

-0.04 |

0.06 |

0.00 |

0.97 |

-0.04 |

0.06 |

-0.06 |

0.26 |

|

RQMC |

0.01 |

0.80 |

0.02 |

0.57 |

-0.02 |

0.37 |

-0.01 |

0.85 |

|

GDP |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.36 |

0.00 |

0.60 |

|

MSIZE |

-0.01 |

0.62 |

-0.08 |

0.00 |

-0.03 |

0.38 |

0.09 |

0.18 |

|

_cons |

2.02 |

0.00 |

1.17 |

0.00 |

7.14 |

0.01 |

2.44 |

0.00 |

According to the results of Table 9 value of R-Square is 89% at the global level, 90% at the high-income level, 88% at the middle-income level and 88% at low low-income level. These values of R-Square show a strong relationship between the variables used in the data. This table results reveal that GE has a positive and significant effect on SMP at the global level and middle-income level because the value of P in both said cases is less than 0.03 and 0.00 with a beta value of 0.00 and 0.01 respectively. So this situation indicates that the countries having an effective government system have a good impact on the SMP. Independent variable RQ has a positive and significant effect on SMP as P<0.1 in all cases. This table's results show that RQ matters a lot because the sound rules of law strengthen the SMP. Therefore, this study reveals that RQ is the most important factor for financial market development. This study finding suggests that governance indicators such as GE, PS and RQ have a positive relationship with SMP. It implies that countries having an effective institutional environment can enhance their SMP because when institutions are effective they can play a vital role in minimizing the risk and this situation builds the confidence of investors. As a result, investors invest their funds in the stock market without any hesitation.

According to this table results of moderating variable market competition along with GE has a positive but insignificant effect on SMP as P>0.1 at global and high-income level but in the middle-income level, it has a significant effect on SMP. In the case of the low-income level, it has a negative and insignificant effect on SMP. This result indicates that countries with highly effective governments and a high level of market competition improve and enhance the economic development of countries. In low-income level countries, we find the negative impact of market competition along with governance indicators because those countries have neither an effective governance system nor any competition among the organizations which is why the performance of the stock market is poor in such countries.

The moderating effect of market competition along with PS has a negative but significant effect on the performance of the stock market in the case of global as well as middle-income level because in both cases value of P<0.1. It has a positive but insignificant effect in the case of high-income level and in the case of low income level it has a negative and insignificant effect as P>0.1.

Market competition along with RQ has a positive but insignificant effect on SMP at the global level as well as at the high-income level but it has a negative and insignificant effect in the case of middle-income level and low income level.

These findings reveal that the countries with high-income levels have sound governance indicators and therefore, the performance of markets is better as compared to middle-income level and low-income levels because all variables have a positive impact on SMP in the case of high-income level. Whereas, mixed results of all the variables are found in the case of middle-income level and low income level.

Conclusion

This study has tested the moderating effect of market competition on the relationship between the SMP and governance indicators. From data analysis, we find that GE and RQ affect the SMP positively and have a significant effect on it. We also find that PS and GE have positive effects on SMP. While RQ at a high-income level has a positive and substantial impact on SMP. In the case of the middle-income level, GE and RQ have a positive and significant effect on SMP. GE and RQ along with market competition have a positive effect on SMP whereas PS along with market competition has a negative but significant effect on SMP at the global level. In the case of the high-income level, all independent variables along with market competition have positive but insignificant effects on SMP and in low low-income level all independent variables have negative and insignificant effects. GE along with market competition has a positive and significant effect while PS along with market competition has a negative but significant effect and RQ has a negative but significant effect on SMP in the case of middle income level.

Limitation of the Study

Through this study, we tried to explore the logical analysis of determinants of SMP and how much GE, PS and RQ affect the SMP at global, high-income, middle income and low-income levels. We also analyze the effect of these variables along with market competition as a moderating variable. Meanwhile, GDP and market size as control variables are also tested in this study to examine the SMP.

On the other hand, every study has some limitations. This study's limitation is as under it must be considered to find out the best result.

1. In this study, we have only considered 110 countries' data out of 195 because of the unavailability of data from other remaining countries.

2. This study has only tested the three governance indicators (GE, PS and RQ) along with market competition as moderating variables and GDP and market size as control variables to judge the performance of the stock market. Other governance indicators and some other variables like interest rate, inflation, exchange rates, trade openness, private Capital Flows and stock market integration have also significant effects on SMP.

3. In this study, we have not considered the endogeneity issue which may also affect the result.

Recommendation

For future study, this study suggests the following recommendations

1. Other variables like interest rate, inflation, exchange rates, trade openness, private Capital Flows and stock market integration must be considered to measure the stock market performance.

2. The data from the remaining countries should also be included to explain the result in a better way.

3. In this study we used only some specific regression models for panel data to find the realistic result; other regression models should also be tested.

4. 2LS and GMM models should also be tested for future studies to eliminate the endogeneity issues

Policy Implication

The investigation into the moderating impact of market competition on the connection between governance indicators (governance effectiveness, political stability, regulatory quality) and stock market performance has substantial significance for theoretical comprehension and practical decision-making in corporate and investment contexts. This research delves into the intricate interactions of these factors, potentially refining our understanding of how governance practices, political stability, and regulatory quality jointly affect a company's stock market performance amid differing levels of competition.

Theoretical implications encompass a deeper grasp of the complex dynamics between corporate governance, political stability, regulatory environment, and stock market performance. This study offers insight into how these indicators interact in competitive markets, shedding light on their combined influence. Uncovering the moderating role of market competition could unveil the ways governance and regulatory environments impact stock performance more profoundly in competitive settings, potentially leading to new theoretical frameworks for more precise modelling.

From a practical standpoint, this study's outcomes could guide decisions for diverse stakeholders. Companies in competitive industries could fine-tune governance practices based on the market, enhancing stock performance. Investors might adjust strategies, considering governance and regulatory aspects more closely in competitive markets. Regulators could adapt frameworks to support firms in varying competition levels. This research could also aid risk management, helping firms align practices with the competitive landscape. In essence, this study bridges theory and real-world choices in corporate governance and stock performance.

References

- AGUERREVERE, F. L. (2009). Real Options, Product Market Competition, and Asset Returns. The Journal of Finance, 64(2), 957–983.

- Ahmed, M. (2013). Fiscal Decentralisation and Political Economy of Poverty Reduction: Theory and Evidence from Pakistan (Doctoral dissertation, Durham University).

- Ali, H. (2014). Impact of Interest Rate on Stock Market; Evidence from Pakistani Market. IOSR Journal of Business and Management, 16(1), 64–69.

- Allen, F., & Gale, D. (1998). Optimal Financial Crises. The Journal of Finance, 53(4), 1245–1284.

- Allen, F., & Gale, D. (2000). Comparing financial systems. MIT Press.

- Al-Omiri, M., & Drury, C. (2007). A survey of factors influencing the choice of product costing systems in UK organizations. Management Accounting Research, 18(4), 399–424.

- Amendola, M., & Gaffard, J. L. (2006). The market way to riches. Books.

- Asongu, S. A. (2012). Government Quality Determinants of Stock Market Performance in African Countries. Journal of African Business, 13(3), 183–199.

- Bai, C.-E., Liu, Q., Lu, J., Song, F. M., & Zhang, J. (2004). Corporate governance and market valuation in China. Journal of Comparative Economics, 32(4), 599–616.

- Bailey, W., & Chung, Y. P. (1995). Exchange Rate Fluctuations, Political Risk, and Stock Returns: Some Evidence from an Emerging Market. The Journal of Financial and Quantitative Analysis, 30(4), 541.

- Baily, M. N., Gersbach, H., Scherer, F. M., & Lichtenberg, F. R. (1995). Efficiency in Manufacturing and the Need for Global Competition. Brookings Papers on Economic Activity. Microeconomics, 1995, 307-358.

- Balakrishnan, K., & Cohen, D. A. (2014). Competition and Financial Accounting Misreporting. SSRN Electronic Journal.

- Barasa, J. W. (2014). Macro-economic determinants of SMP in Kenya: case of Nairobi securities exchange. Unpublished Masters Research Project, University of Nairobi.

- Barberis, N., & Thaler, R. H. (2002). A Survey of Behavioral Finance. SSRN Electronic Journal, 1.

- Barnes, M. L. (1999). Inflation and returns revisited: a TAR approach. Journal of Multinational Financial Management, 9(3- 4), 233–245.

- BEKAERT, G., & HARVEY, C. R. (1995). Time- Varying World Market Integration. The Journal of Finance, 50(2), 403–444.

- Bekaert, G., & Harvey, C. R. (2000). Foreign Speculators and Emerging Equity Markets. The Journal of Finance, 55(2), 565–613.

- Bencivenga, V. R., Smith, B. D., & Starr, R. M. (1996). Liquidity of secondary capital markets: Allocative efficiency and the maturity composition of the capital stock. Economic Theory, 7(1), 19–50.

- ibi, S., Ahmad, S. T., & Rashid, H. (2014). Impact of Trade Openness, FDI, Exchange Rate and Inflation on Economic Growth: A Case Study of Pakistan. International Journal of Accounting and Financial Reporting, 1(1), 236.

- Bittencourt, M. (2011). Inflation and financial development: Evidence from Brazil. Economic Modelling, 28(1-2), 91– 99.

- Bittlingmayer, G. (1998). Output, Stock Volatility, and Political Uncertainty in a Natural Experiment: Germany, 1880- 1940. The Journal of Finance, 53(6), 2243–2257.

- Boadi, I., & Amegbe, H. (2017). The link between quality of governance and SMP: International level evidence. European Journal of Government and Economics, 6(1), 78-101.

- Börsch-Supan, A., & Romer, P. (1998). Capital's Contribution to Productivity and the Nature of Competition. Brookings Papers on Economic Activity. Microeconomics, 1998, 205-248.

- Bozec, Y., & Bozec, R. (2011). Corporate governance quality and the cost of capital. International Journal of Corporate Governance, 2(3/4), 217.

- Buccirossi, P., Ciari, L., Duso, T., Spagnolo, G., & Vitale, C. (2011). MEASURING THE DETERRENCE PROPERTIES OF COMPETITION POLICY: THE COMPETITION POLICY INDEXES. Journal of Competition Law and Economics, 7(1), 165–204.

- ARTER, N., & GREER, P. (1993). EVALUATING AGENCIES: NEXT STEPS AND PERFORMANCE INDICATORS. Public Administration, 71(3), 407–416.

- Chakrabarty, R., & Sarkar, A. (2010). Efficiency of the Indian Commodity and Stock Market with Focus on Some Agricultural Product. Paradigm, 14(1), 85–96.

- Chakraborty, S., & Ray, T. (2007). The development and structure of financial systems. Journal of Economic Dynamics and Control, 31(9), 2920–2956.

- Chong, V. K., & Rundus, M. J. (2004). Total quality management, market competition and organizational performance. The British Accounting Review, 36(2), 155– 172.

- De Bondt, W., Mayoral, R. M., & Vallelado, E. (2013). Behavioral decision-making in finance: An overview and assessment of selected research. Spanish Journal of Finance and Accounting / Revista Española de Financiación Y Contabilidad, 42(157), 99–118.

- Demirguc-Kunt, A., & Levine, R. (1996). Stock Markets, Corporate Finance, and Economic Growth: An Overview. The World Bank Economic Review, 10(2), 223–239.

- Diamandis, P. F., & Drakos, A. A. (2011). Financial liberalization, exchange rates and stock prices: Exogenous shocks in four Latin America countries. Journal of Policy Modeling, 33(3), 381–394.

- Dimic, N., Orlov, V., & Piljak, V. (2015). The political risk factor in emerging, frontier, and developed stock markets. Finance Research Letters, 15, 239–245.

- Drobetz, W., Schillhofer, A., & Zimmermann, H. (2004). Corporate Governance and Expected Stock Returns: Evidence from Germany. European Financial Management, 10(2), 267–293.

- Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383– 417.

- Fama, E. F., & French, K. R. (2012). Size, value, and momentum in international stock returns. Journal of financial economics, 105(3), 457-472.

- Fielitz, B. D., & Rozelle, J. P. (1983). Stable Distributions and the Mixtures of Distributions Hypotheses for Common Stock Returns. Journal of the American Statistical Association, 78(381), 28–36.

- Fraj, S. H., Hamdaoui, M., & Maktouf, S. (2018). Governance and economic growth: The role of the exchange rate regime. International Economics, 156, 326–364.

- Gaspar, J.-M., Massa, M., & Matos, P. (2005). Shareholder investment horizons and the market for corporate control. Journal of Financial Economics, 76(1), 135–165.

- Gay, R. D. (2016). Effect of Macroeconomic Variables on Stock Market Returns for Four Emerging Economies: Brazil, Russia, India, and China. International Business & Economics Research Journal (IBER), 15(3), 119.

- Giroud, X., & Mueller, H. M. (2011). Corporate Governance, Product Market Competition, and Equity Prices. The Journal of Finance, 66(2), 563–600.

- Grewal, R., & Tansuhaj, P. (2001). Building Organizational Capabilities for Managing Economic Crisis: The Role of Market Orientation and Strategic Flexibility. Journal of Marketing, 65(2), 67–80.

- Guasch, J. L., & Hahn, R. W. (1999). The costs and benefits of regulation: implications for developing countries. The World Bank.

- Hayat, A. (2016). Impact of Behavioral Biases on Investment Decision; Moderating Role of Financial Literacy. SSRN Electronic Journal.

- Henry, P. B. (2000). Do stock market liberalizations cause investment booms? Journal of Financial Economics, 58(1-2), 301–334.

- Hoberg, G., & Phillips, G. (2009). Competition and product market synergies in mergers and acquisitions: A text based analysis. Working Paper, University of Maryland.

- Hondroyiannis, G., & Papapetrou, E. (2001). Macroeconomic influences on the stock market. Journal of Economics and Finance, 25(1), 33–49.

- Hooper, V., Sim, A. B., & Uppal, A. (2009). Governance and SMP. Economic Systems, 33(2), 93-116.

- HOU, K., & ROBINSON, D. T. (2006). Industry Concentration and Average Stock Returns. The Journal of Finance, 61(4), 1927–1956.

- Humpe, A., & Macmillan, P. (2009). Can macroeconomic variables explain long- term stock market movements? A comparison of the US and Japan. Applied Financial Economics, 19(2), 111–119.

- lhan, E. G. E., & Bahadir, T. (2011). The relationship between insurance sector and economic growth: An econometric analysis. International Journal of Economic Research, 2(2), 1-9.

- Javed, A. Y., & Ahmed, A. (1999). The Response of Karachi Stock Exchange to Nuclear Detonation. The Pakistan Development Review, 38(4), 777–786.

- Jeffus, W. M. (2005). FDI and stock market development in selected Latin American countries. In Latin American financial markets: Developments in financial innovations (pp. 35-44). Emerald Group Publishing Limited.

- Jorion, P. (1991). The Pricing of Exchange Rate Risk in the Stock Market. The Journal of Financial and Quantitative Analysis, 26(3), 363–376.

- Kaufmann, D., Kraay, A., & Mastruzzi, M. (2009). Governance matters VIII: Aggregate and individual governance indicators 1996-2008. The World Bank.

- Kohli, A. K., Jaworski, B. J., & Kumar, A. (1993). MARKOR: A Measure of Market Orientation. Journal of Marketing Research, 30(4), 467–477.

- Kraay, A., & Dollar, D. (2001). Trade, growth, and poverty. The World Bank.

- Kubick, T. R., Lynch, D. P., Mayberry, M. A., & Omer, T. C. (2014). Product Market Power and Tax Avoidance: Market Leaders, Mimicking Strategies, and Stock Returns. The Accounting Review, 90(2), 675–702.

- Kyereboah-Coleman, A., & Agyire-Tettey, K. F. (2008). Impact of macroeconomic indicators on stock market performance. The Journal of Risk Finance, 9(4), 365–378.

- La Porta, R., Lopez de Silanes, F., Shleifer, A., & Vishny, R. W. (2000). Investor Protection and Corporate Governance. SSRN Electronic Journal.

- Law, S. H. (2009). Trade Openness, Capital Flows and Financial Development in Developing Economies. International Economic Journal, 23(3), 409–426. h

- Lehkonen, H., & Heimonen, K. (2015). Democracy, political risks and SMP. Journal of International Money and Finance, 59, 77-99.

- Lombardo, D., & Pagano, M. (2000). Law and Equity Markets: A Simple Model. SSRN Electronic Journal.

- Low, S.-W., Kew, S.-R., & Tee, L.-T. (2011). International Evidence on the Link between Quality of Governance and Stock Market Performance. Global Economic Review, 40(3), 361–384.

- McKinnon, R. I., & Pill, H. (1997). Credible Economic Liberalizations and Overborrowing. The American Economic Review, 87(2), 189–193.

- Mia, L., & Clarke, B. (2017). Market competition, management accounting systems and business unit performance. Management Accounting Research, 10(2), 137–158.

- Miller, D., & Friesen, P. H. (1986). Porter’s (1980) Generic Strategies and Performance: An Empirical Examination with American Data. Organization Studies, 7(3), 255–261.

- Mohsen, A. S. (2015). Effects of Trade Openness and Economic Growth on the Private Sector Investment in Syria. Journal of Applied Management and Investments, 4(3), 168-176.

- Mohtadi, H., & Agarwal, S. (2001). Stock market development and economic growth: evidence from developing countries.

- Munteanu, A., & Brezeanu, P. (2014). GE and value creation: the case of emerging European listed banks. Transylvanian Review of Administrative Sciences, 10(42), 140-155.

- Narayan, P. K., Sharma, S. S., & Thuraisamy, K. S. (2015). Can governance quality predict stock market returns? New global evidence. Pacific-Basin Finance Journal, 35, 367–380.

- Nickell, S., Nicolitsas, D., & Dryden, N. (1997). What makes firms perform well? European Economic Review, 41(3- 5), 783–796.

- Niroomand, F., Hajilee, M., & Al Nasser, O. M. (2014). Financial market development and trade openness: evidence from emerging economies. Applied Economics, 46(13), 1490–1498.

- Nowbutsing, B. M., & Odit, M. P. (2011). Stock Market Development and Economic Growth: The Case Of Mauritius. International Business & Economics Research Journal (IBER), 8(2), 77–88.

- Olweny, T., & Kimani, D. (2011). Stock market performance and economic growth Empirical Evidence from Kenya using Causality Test Approach. Advances in Management and Applied Economics, 1(3), 1–9.

- Panchenko, V., & Wu, E. (2009). Time-varying market integration and stock and bond return concordance in emerging markets. Journal of Banking & Finance, 33(6), 1014–1021.

- Ritter, J. R. (2003). Differences between European and American IPO Markets. European Financial Management, 9(4), 421–434.

- Ronald I. McKinnon. (1973). Money and capital in economic development. Brookings Institution Press.

- Rousseau, P. L., & Wachtel, P. (2002). Inflation thresholds and the finance–growth nexus. Journal of International Money and Finance, 21(6), 777–793.

- Sajid Nazir, M., Younus, H., Kaleem, A., & Anwar, Z. (2014). Impact of political events on stock market returns: empirical evidence from Pakistan. Journal of Economic and Administrative Sciences, 30(1), 60–78.

- Sanfey, A. G. (2003). The Neural Basis of Economic Decision-Making in the Ultimatum Game. Science, 300(5626), 1755–1758.

Cite this article

-

APA : Hussain, F., Ziaullah, M., & Hayyat, A. (2022). Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance. Global Economics Review, VII(II), 226-245. https://doi.org/10.31703/ger.2022(VII-II).20

-

CHICAGO : Hussain, Fahad, Muhammad Ziaullah, and Asghar Hayyat. 2022. "Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance." Global Economics Review, VII (II): 226-245 doi: 10.31703/ger.2022(VII-II).20

-

HARVARD : HUSSAIN, F., ZIAULLAH, M. & HAYYAT, A. 2022. Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance. Global Economics Review, VII, 226-245.

-

MHRA : Hussain, Fahad, Muhammad Ziaullah, and Asghar Hayyat. 2022. "Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance." Global Economics Review, VII: 226-245

-

MLA : Hussain, Fahad, Muhammad Ziaullah, and Asghar Hayyat. "Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance." Global Economics Review, VII.II (2022): 226-245 Print.

-

OXFORD : Hussain, Fahad, Ziaullah, Muhammad, and Hayyat, Asghar (2022), "Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance", Global Economics Review, VII (II), 226-245

-

TURABIAN : Hussain, Fahad, Muhammad Ziaullah, and Asghar Hayyat. "Examining the Impact of Market Competition on the Relationship between Governance Indicators and Stock Market Performance." Global Economics Review VII, no. II (2022): 226-245. https://doi.org/10.31703/ger.2022(VII-II).20