01 Pages : 1-11

Abstract:

Housing is the third most important necessity of a human being. Every human being needs a housing unit to live in. Recently, with globalization and urbanization, the demand for housing has increased manifold, whereas the supply has remained the same. Similarly, in Pakistan, the value of land and building in urban areas increased exponentially. The low-income class could not afford a housing unit as they did not have the resources to buy or construct a housing unit at once. With new trends, the low-income people would buy a piece of land on the urban periphery and construct the housing unit in increments. The availability of funds was the key factor in this approach. With the availability of microfinance services in the market, the availability of funds has increased for the low-income groups. The research aims to study the difference between the working of different financing institutes and banks and to formulate recommendations based on the collected data.

Key Words:

Conventional Banks, Incremental Housing, Informal Sector, Housing Finance, Microfinance

Introduction

Housing, after food and clothing, is the third most important necessity of human beings. Every human has been trying to get a livable housing unit since the creation of mankind. In the past, the conditions related to the housing sector were very satisfying, and almost everyone was able to get access to housing. Recently in urban areas, with globalization and urbanization, the demand for housing has increased drastically, but the supply side did not increase accordingly. As a result, a shortfall of housing started to appear, and the existing housing units became expensive. In the near past, the prices have gone so high that the majority of people cannot afford a house in urban areas. Similar changes occurred in Pakistan; the value of land and building in urban areas increased exponentially. The migration from rural areas to urban areas was a basic reason behind this increase. In urban areas, the land became scarce, and existing housing stock was not enough to meet the ever-increasing demand. In the above-stated conditions, the low-income class could not afford a housing unit as they did not have the resources to buy or construct a housing unit at once (Ferguson, 2010).

With time a new trend started, the low-income people would buy a piece of land on the urban periphery, and they would construct the housing unit in increments. Even currently, this approach has been used widely adopted not only in Pakistan but in the rest of developing countries as well. People build a basic shelter for themselves, either from savings or loans; later, they keep on adding and improving the shelter. This construction style is known as incremental housing and can be defined as a step-by-step process. Fundamentally, incremental housing is an integrated urban development process, it is not quick, immediate or complete, but the choice remains with the owner. It starts with a starter core shelter. The starter core maybe a kitchen/bathroom unit; owners control the expansion of their housing based on their needs and resources. The main force that keeps them going in this construction style is the availability of funds (Goethert, 2010). As soon as they have to manage funds, they will plan the increment in housing, if needed. Usually, the increase in family size is the basic reason behind the increments. Factors controlling incremental housing are usually increased family size and availability of finance.

Unfortunately, the low-income class generally face a lack of funds, or they fail to manage the funds needed. So households, usually, tend to get funds from any source, be it formal or informal. People belonging to the lower class are mostly hesitant to contact formal institutes like banks and other finance providers because of the bureaucratic and corporate environment of formal institutes. They are more likely to get the funds from informal sources like friends, relatives or community-based loans (Ferguson, 2010). Recently, the concept of microfinancing has spread widely throughout the world, especially in the developing world. They provide small loans with a short payback period on easy terms. These microfinance institutes are targeting the low-income class, and acceptability is increasing among people regarding these institutes.

The aim of this research is to study the difference in the operation of the microfinance institutes and the other formal sources and to evaluate the institutes based on the performance, i.e. the number of loans given, the rate of return and the feedback of the clients. For data collection, the portfolios of microfinance institutes and other sources were reviewed, and available data was utilized. Afterwards, results were drawn based on the collected data, and eventually, this paper puts forward the recommendations in order to make the process of housing finance more feasible for low-income groups.

Literature Review Housing Micro Finance in World

To understand the process of housing microfinance, four countries, India, Bangladesh, Chile and Guatemala, have been selected. This selection has been made based on two criteria. First, countries having nearly the same political and cultural scenarios have been focused on; India and Bangladesh fall into this category. Secondly, those countries were selected which are either developing or where access to housing finance is difficult and some new financing models are introduced to improve the access of lower segments of society towards housing finance opportunities. Housing finance models from developed countries are not studied based on the fact that housing finance institutes in developed countries basically function on the corporate or formal culture. Contrary, here in Pakistan, a major portion of society is hesitant to deal with the formal sector to have access to housing finance.

Throughout the world, many initiatives have been taken to make sure that low-income group has access to adequate quality housing. In the past, housing mortgage was offered by banks and other sources. But the loans offered by the bank were usually large in volume, and the payback period of loans was usually long. Apart from this, there was no security of tenure, so people did not feel much satisfied with these programs. Moreover, considerable interest was levied onto the customers, so the loans became expensive, and the low-income class was unable to utilize the loans. Consequently, these institutes failed to meet the needs of low-income groups, and low-income groups had to look forward to elsewhere to get finance for housing. After the advent of the incremental housing trend, to fulfil the needs of people, multiple sources appeared in the market providing housing finance to the people. There are many examples in the world where finances are available to the low-income group, some of which are explained below.

Bangladesh

In the 1970s, Bangladesh Bank started a program to provide housing to the poor. Continuing with the objective, the bank made only one effort to house the poor all over the country, but the bank could deliver only half of the promised units and failed to reach the poorest of the poor. The poor could not borrow funds from banks mainly due to a lack of collateral. So the poor class was forced to get loans from local informal sources at very high rates (Malhotra, 2003). In 1984 Grameen Bank introduced a housing loan to provide funds to its members to get a new housing unit or to rehabilitate the old one. Instead of asking for collateral security, the bank would prefer group responsibility. The whole community was involved in the process, a group of local people was formed, and they would deposit 2Tk in the group on a weekly basis. This fund was also used to spread loans. In the first year, the bank disbursed 317 loans, and in 1999 the number crossed 0.5 Million. An interest of 8% was charged on the disbursed loans, and a recovery rate of 98% was recorded, showing the affordability of low-income people towards the loan program (Tariq, Facilitating community development with housing microfinance: appraising housing solutions for Pakistan after disasters., 2011)

A mechanism was devised to disburse loans among low-income people. First of all, the applicant has to be a member of the local group formed by the community and must have a history of regularly attending the weekly meetings. Secondly, the applicant must have legal ownership of land. It usually took 3 to 4 weeks for the application to get approval; in some cases, if the applicant was in dire need of money, the loan was approved and distributed within 10 days. All the group members must be present at time of loan distribution, if the applicant was very poor the bank facilitated him by relaxing the policies.

India

Similar approach was practiced in the neighboring country India, where a bank named Self-Employed Women’s Association (SEWA) was established in 1972 in Ahmedabad city. Later on, this association formed a bank of their own, known as SEWA Bank. This association further went on, and with the help of some partners, they established Mahila Housing SEWA Trust (MHT). The main aim of this trust was to enable self-employed women to improve their shelter conditions. To get the loan, first of all, the applicant needs to open an account in the bank and needs to deposit his/her saving for a year regularly; this not only developed a habit of saving among its members but the same saving is used as a lien by the bank when the loan is given to account holders. The borrower needs to introduce two guarantors to sign the loan application; one of them must have a payslip or income certificate. The bank does not ask for collateral and uses the previous year savings as security, but the bank insists the loan and house must be in the name of the woman and not his husband. Bank offers a loan of 25,000 INR and charges an interest rate of 14.5%. The loan must be repaid in the period of 60 months (Todd, 1996).

Chile

A different but very functional concept of housing finance was practised in Quinta Monroy, Chile, where the Government of Chile collaborated with an architectural group known as Elemental and delivered some incremental homes. In the developed area, there were plots of 72 square meters, and out of that total area, a housing unit of 36 square meters was designed and constructed by the government and the partner architectural group. The constructed units were distributed among the low-income class of Chile, and the residents were supposed to construct on the vacant portion in increments upon the availability of funds. All the constructed units had access to the public spaces and other public amenities. Moreover, constructed units were structurally sound to withstand any occasional earthquake or other disasters. Units also had proper ventilation and lighting arrangements. The overall arrangement took the 100 families living on the same land previously and redistributed them into 4 smaller communities, each arranged around a common public space. The units were basically designed as duplexes, and the initial space of each unit was about 36 square meters, which could be expanded up to 72 square meters (Vargas, 2014).

Guatemala

In 1998, a group named Genesis was established in Guatemala aimed at improving the living conditions for the rural poor of the area. The genesis group offered loans to the rural constituency groups which were formed under the program and also technical assistance programs for the micro-enterprises and infrastructure retrofits. A condition for participation in the program was that at least 90% of a community must approve the provision of infrastructure. Loans were usually distributed to be used for the provision of electric supply and water supply, and the organization managed the borrowers through a group of four to twelve families. Loans ranging from 800Q to 3,000Q (US$120 to 450) per household were offered to groups of four to twelve rural households from the same community having similar socio-economic characteristics (Tariq, Proposal for housing microfinance project in Pakistan- A project of UN Habitat, 2011).

In this model, every participating household is asked to present some proof of the land title to be detained by Genesis. Those documents will not be used by the Genesis as collateral; instead, the Genesis uses the group pressure as the collateral. The community as a whole makes sure that the borrower is depositing the instalments on time and also pressurizes the defaulter to pay the arrears. Member groups have to return the loan in terms that are adjusted to their income level. Maturity periods may vary from one to four years, depending upon the group’s capacity to repay. Individual repayments are also regulated according to the individual household’s needs. Normally repayments are monthly, but for agricultural workers, the choice of repaying after harvests is available.

From the above examples, it is evident that people belonging to lower-middle or lower-income groups are more comfortable when they are dealing with some information or community-based financing body. The reason is, these institutes usually don’t ask for a collateral guarantee, and a social guarantee is enough to obtain housing loans. Moreover, in some formal bodies, people are denied ownership of their unit until they have return the whole loan. While people are more confident towards those financing models where they have the ownership of their housing units.

Housing Finance in Pakistan

After the creation of Pakistan in the early decades, the government was directly involved in the housing sector and made an adequate supply of housing units while maintaining an equilibrium between supply and demand of housing. Moreover, in the development plans the issues related to housing were discussed. With passage of time government limited its role to just facilitator and the private sector got directly involved in housing developments. As a result the housing conditions in Pakistan worsened, the land became scarce and the majority of people, middle and low income class, could not afford a housing unit leading to a shortfall. In 2001, National Housing Policy was devised to address the housing issues but the policy lacked proper implementation and failed to bring substantial improvements.

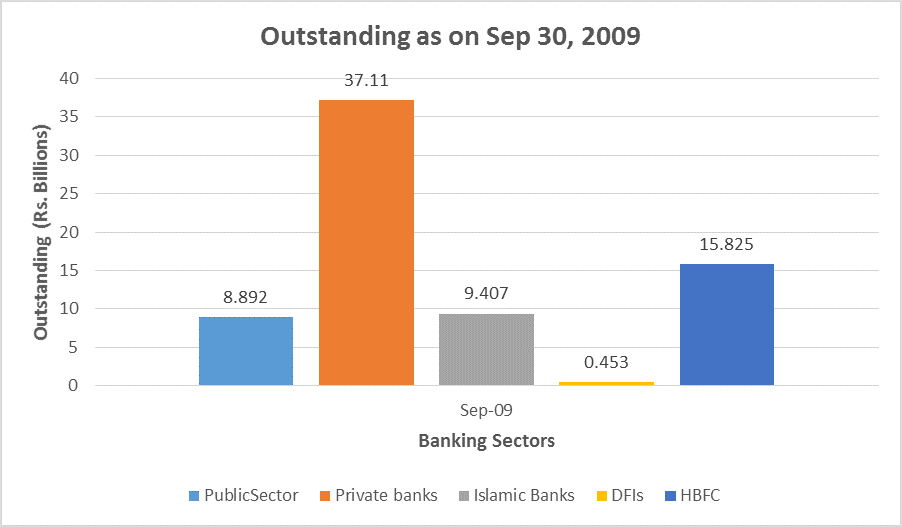

In Pakistan, the conventional banks and the government housing institution usually form a major share of the house financing portfolio of Pakistan. Public banks, Private Banks and House building Finance Corporation Limited are the main sources of getting funds. Figure 1 and 2 explain the performance of housing finance sector over the past years. As per the statistics of State Bank of Pakistan, in 2009 the private banks financed more than any other sector but in 2016 the share of private banks decreased and the Islamic banks stepped up and filled the gap (Infrastructure, Housing and SME Finance Department, 2016). The share of HBFCL remained almost the same. Similarly no significant change was recorded in the performance of the public sector banks. As far as the DFIs are concerned their share remained the same throughout these years and could not increase from zero percent. Below is the graphical representation of the financing done by different sectors in Pakistan over the years.

Role of Banks

To facilitate the low-income class to construct or renovate their houses, the banking sector in Pakistan has been offering housing loans for a long time. This banking sector can be broadly classified into the following categories:

• Public sector banks

• Private sector banks

• Islamic banks

Public sector banks are the oldest banks in terms of offering housing loans. Some of the banks have been offering loans since their establishment and have disbursed considerable loans to date. Usually, these banks offer loans that are very large in terms of volume, and the payback period is very long, in some cases up to 20 years (Bank of Punjab, 2018). Moreover, these public sector banks do require collateral or security, which is usually the ownership documents of the land or some other asset (National Bank of Pakistan, 2018). In addition to these, these public sector banks do levy a significant interest on the customers. As a result, the borrowers have to pay a handsome amount additionally other than the capital borrowed amount. These factors make the offered loans unaffordable for the low-income group. They, first of all, don’t have any collateral, and afterwards, they cannot afford the payback schedule. Moreover, the security of tenure is missing until all the instalments are paid, which is a period of 15 to 20 years. During all these years, the sense of ownership is missing. Therefore, keeping in mind all these factors, poor people feel hesitant to get these housing loans from banks.

The working model of almost all the banking sectors is the same. There are very few terms and conditions which vary from bank to bank. All of the above-said banks are disbursing loans that are profit-oriented, and they charge extra amounts from the borrowers. However, the portfolio of private banks is significantly larger than the public sector banks; the corporate culture can be a reason behind this difference. The private banks do charge a little less than the public banks, and they also offer smaller loans. This can be a reason that private banks have a major share in the housing finance sector.

In the last decade, with the introduction of Islamic banking in the market, the Islamic banks have shown reasonable progress in the housing finance portfolio. In 2009 Islamic banks formed 12 percent of the total portfolio, but this share reached 25 percent in 2016, showing a remarkable change in the last few years (Infrastructure, Housing and SME Finance Department, 2016). There are a couple of reasons; first of all, there is a religious sentiment attached to the Islamic banks. They negate the concept of interest and charge markup instead. Although both are the same in terms of functions, they attract many groups who do not tend to get loans from other banks as they don’t feel comfortable with the interest charged. Secondly, these Islamic banks charge less markup as compared to the interest charged by the conventional banking sector. However, these banks as well are offering loans that are larger for a long period.

In short, the banking sector is distributing loans that are profit-oriented, larger in volumes, and take a number of years to complete, making it impossible for the low-income class to apply for these loans. These loans are meant for high-income groups, and sometimes even they also fail to complete the loan instalments and are declared defaulters. These are the factors that lead to a considerable default rate in the house financing done by the banks.

Role of HBFCL

House building finance corporation limited has been working in the field of housing finance for a couple of decades. HBFCL also disburses loans that are profit-oriented, and interest is charged other than the capital amount. HBFCL disburses loans for the renovation of the house or increment, but these loans are very large in volume and their volume can go up to 2.5 Million rupees. The return period of loans can vary from 2 years to 10 years. These terms make it difficult for people of low-income groups to get hold of these loans. In this model, HBFCL asks for collateral or a guarantee which cannot be fulfilled by the people of the low-income groups. The available data shows that a noteworthy default rate of 41 percent was recorded by the end of year 2010 (Dawn, 2010). Currently in 2018, as per Government statistics, this institute is on the verge of bankruptcy, which expresses the unaffordability of people towards these huge loans (Khan, 2018).

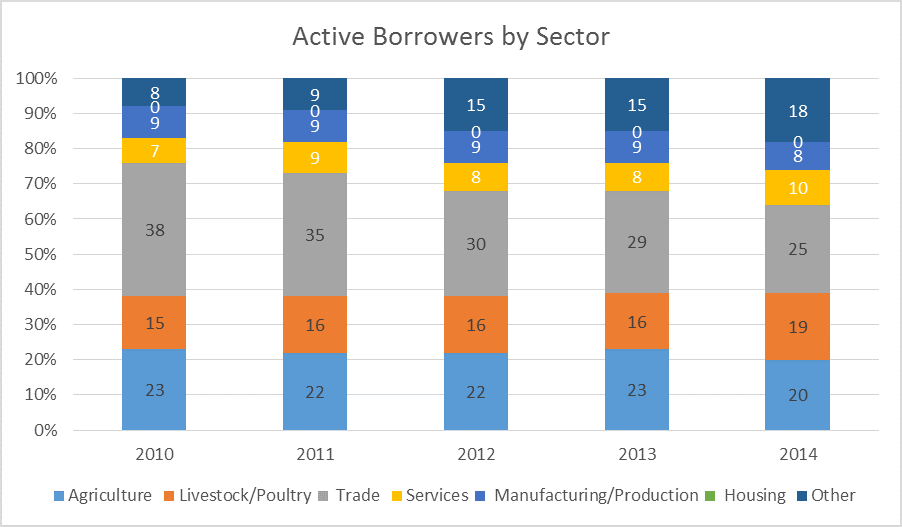

Microfinance services in different sectors (2010-2014), (Pakistan Microfinance Network, 2015)

Housing Micro Finance in Pakistan

Housing microfinance can be defined as the small loans, usually unsecured, distributed among the low-income class for the renovation of the house, land acquisition, construction of the house, addition to the existing structure and basic infrastructure (CGAP, 2004). Although in the recent past, the concept of microfinancing has advanced exponentially still the housing sector has been ignored over the years by the MFIs. Figure 3 show that from the year 2010 to the year 2014 shows the same statistics, the share of housing microfinance among the microfinance portfolio was very nominal, close to zero (Pakistan Microfinance Network, 2015).

In the recent past, an NGO named Akhuwat, known for interest-free micro-financing has also extended its operation to the housing sector. These loans are distributed without any discrimination; religious centres like mosques, churches or temples are used as a distribution centers, so the sentiments related to the religion are also involved in the practice.

In the start, Akhuwat distributed loans for business startups, business extension and purposes, but for a couple of years, the NGO has started to distribute loans to improve housing access among the low-income group. Akhuwat started housing loans in 2005; by the year 2010, in just 5 years, Akhuwat had disbursed 2995 loans among borrowers (Akhuwat, 2011). These loans actually support the incremental addition to the housing structure and the improvements of existing housing structures; some used these loans to get a piece of land, others added to the existing housing structure of their dwellings. Table 1 explains how these loans being small in volume, having a shorter payback period, and more importantly, zero interest, are more manageable for the low-income group. On the contrary, the conventional banks usually offer large loans for a long period, and the beneficiary has to pay the interest as well (Akhuwat, 2017) (Ahmad, 2017).

Table 1

|

Akhuwat Housing Loan |

||

|

1 |

Amount of loan offered |

30000 PKR – 100000 PKR |

|

2 |

Target income group |

15000 PKR - 35000 PKR |

|

3 |

Payback period |

Up to 36 months |

|

4 |

Installment size |

Installment According to Loan amount |

|

5 |

Interest rate |

0% |

|

6 |

Mutual Support Fund (Optional) |

1% |

|

7 |

Recovery ratio |

99.96% |

Table 1

This micro-finance program has helped

people a lot in attaining better living conditions. The most important in this

program is that people get the loans in the locality where they live, and they

are not required to move to any other settlements. So they have the ownership

of the land, and they feel comfortable in getting the loans as no collateral is

needed and their tenure is not at stake. These interest-free loans having

smaller sizes and shorter payback periods make it even more affordable for

people to get loans. These loans basically support the incremental housing

style, so people get a loan, add a room to their house or improve the existing

structure and after the loan has been returned, they get a new loan and use it

accordingly. This scheme has enabled hundreds of families to improve their

housing and increased the affordability of people towards accessing better

housing units. The surprising return rate of 99.96% speaks for the success of

the project itself (Table 1).

Findings

From the above-mentioned details of all

the sectors working in house financing, it is obvious that the operational

model of all the banking sectors is profit-oriented; getting profit in the form

of interest or markup is a basic principle that these banking institutes have

adopted. The interest starts from 2% and may go up to 10% or even higher. The

borrower has to pay profit to the lending institution other than the capital

amount. The loans of banks are also larger in volume and longer payback period.

The amount of loan starts from 0.5 Million and may go up to 10 Million. These

factors make it difficult for the borrower to pay back the loan in a timely

manner; as a result, the default rate in the banking sector is high. The same is

the case for HBFCL; they offer large loans for longer periods with interest

levied onto customers and also ask for collateral. The default rate of 41%

shows the borrowing class failed to comply with the terms of the loan.

As per as microfinancing is concerned,

NGO Akhuwat is doing an excellent job, they are distributing loans based on social

responsibility, and no collateral is asked for. The loan is interest-free in

nature attracts more people from low-income groups, and they utilize the loan

in a better way to get better living conditions by undergoing incremental

construction. The astonishing recovery rate of 99.96% advocates for the

credibility of the operational model of Akhuwat, and it must be replicated in

its core essence at a broad level.

Recommendations

In the light of the above findings and other factors there is a need to come up with a model which supports the incremental construction style in its true meaning and to provide sources to low-income class of country so that they have the means to access adequate and quality housing for them. Keeping in mind the whole scenario, we need a model having following characteristics:

• Small loan values.

• Loan disbursement in instalments to ensure proper utilization of the loan.

• Shorter payback period of loans.

• Zero or nominal interest rate.

• No compulsion of collateral.

• Active community participation.

• Loans disbursement through community participation.

• Financing for building materials by government.

• Focus on present housing stock, mainly Katchi Abadis.

The model of Akhuwat, which is successful in its operations, can be utilized at a broader level with the support of the government to provide interest-free loans. The main focus should be on keeping the size of loans smaller so that household does not construct a house in a single loan. The smaller loans will make sure the construction is made in increments. A single loan policy should be enforced. Every household gets one loan at a time; after the complete and successful return of the loan, the household will be eligible for the next loan.

The involvement of the community at every stage is of vital importance; when the community is involved, the lender gets to know about the credibility of the borrower before the loan has been disbursed. Moreover, the community makes sure that the loans are being utilized for the said purpose, and the community also maintains pressure on the borrower and makes him pay back the return. The loans must be interest-free in nature; instead, a subscription fund can be generated, and the community will subscribe a nominal amount into the community fund on a weekly or fortnightly basis. The lender will have the control over subscription fund and will use the community fund for revenue generation. The funds can be withdrawn by households after they have paid the loan back with the profit.

The above-said model, upon proper and unbiased implementation, can greatly affect the housing conditions and will help the low-income group to have better living conditions after undergoing incremental construction style.

References

- Ahmad, H. (2017, April). Akhuwat housing loans. (M. Salman, Interviewer)

- Akhuwat. (2011). A decade of hope, Journey of Akhuwat 2001-2010. Lahore: University o Central Punjab.

- Akhuwat. (2017). Akhuwat.

- Akhuwat. (2018). Loan Products.

- Bank of Punjab. (2018, October 04). BOP Apna Ghar Scheme, Frequently Asked Questions (FAQs).

- Bruce Ferguson, P. S. (July 2010). Finance for incremental housing; current status and prospects for expansion. Habitat International, 34(3), 288-298.

- CGAP. (2004). Housing Microfinance, Helping to Improve Donor Effectiveness in Microfinance. CGAP Donor Information Resource Centre.

- Dawn. (2010). HBFC loan default rate reaches 41pc.

- Goethert, R. ( 2010, September). Incremental Housing, A proactive urban strategy.

- Infrastructure and Housing Finance Department. (2010). Housing Finance Quarterly Review (July-September 2010). State Bank of Pakistan.

- Khan, I. (2018, January 19). HBFC has become bankrupt on account of low recovery of loans: minister. The News:

- Malhotra, M. (2003). Financing her home, one wall at a time. Environment&Urbanization , 15(2), 217-228

- National Bank of Pakistan. (2018, October 04). NBP Saiban. www.nbp.com.pk:

- Pakistan Microfinance Network. (2015). Pakistan Microfinance Review 2015. Pakistan Microfinance Network.

- Tariq, F. (2011). Facilitating community development with housing microfinance: appraising housing solutions for Pakistan after disasters. WIT Transactions on Ecology and the Environment, 148, 645-655.

- Tariq, F. (2011). Proposal for housing microfinance project in Pakistan- A project of UN Habitat. UN- Habitat.

- Todd, H. (1996). Cloning Grameen Bank: Replicating a poverty reduction model in India, Nepal and Vietnam. London. IT Publications

- Vargas, A. C. (2014, December). Incremental User Built Housing: Elemental Project and Similar Housing in Santiago, Chile.

Cite this article

-

APA : Salman, M., Tariq, F., & Nawaz, M. (2021). Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market. Global Economics Review, VI(III), 1-11. https://doi.org/10.31703/ger.2021(VI-III).01

-

CHICAGO : Salman, Muhammad, Fariha Tariq, and Minahil Nawaz. 2021. "Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market." Global Economics Review, VI (III): 1-11 doi: 10.31703/ger.2021(VI-III).01

-

HARVARD : SALMAN, M., TARIQ, F. & NAWAZ, M. 2021. Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market. Global Economics Review, VI, 1-11.

-

MHRA : Salman, Muhammad, Fariha Tariq, and Minahil Nawaz. 2021. "Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market." Global Economics Review, VI: 1-11

-

MLA : Salman, Muhammad, Fariha Tariq, and Minahil Nawaz. "Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market." Global Economics Review, VI.III (2021): 1-11 Print.

-

OXFORD : Salman, Muhammad, Tariq, Fariha, and Nawaz, Minahil (2021), "Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market", Global Economics Review, VI (III), 1-11

-

TURABIAN : Salman, Muhammad, Fariha Tariq, and Minahil Nawaz. "Initiation of Housing Micro Finance in Pakistan: A New Paradigm Shift in Housing Market." Global Economics Review VI, no. III (2021): 1-11. https://doi.org/10.31703/ger.2021(VI-III).01