Abstract:

This paper empirically analyzed the monetary policy transmission mechanism for wealth channels by applying Vector Auto Regressive (VAR) technique to time series data for the period of 1991Q1 to 2018Q4. Results are found significant. Variables included in the model follow the same direction as the theory suggests. Standard deviation shocks to each variable in variance decomposition results are bitterly transmitted. The performance of this channel on the biases of impulse responses and variance decomposition is better. Policy decisions related to high interest rates should be taken carefully. The level of savings is very poor. Low saving adversely affects investment and GDP. Therefore, better remedies are needed to capture the problem.

Key Words:

Wealth, Monetary Policy, Transmission Mechanism, Channels

Introduction

Ragner Frisch differentiates dynamic analysis of economic fluctuations into shocks and transmissions, in which shocks occur irregularly. Effects of shocks are distributed by the transmission process through the economic system. Where transmission process is, how the economy responds to the shocks. Views of economists are different regarding transmission mechanisms. Real variables have no relation to monetary policy decisions, as the viewers of the real business cycle give miner importance to monetary transmission shocks. Whereas Classical, Keynesian, Monetarist, neo-Keynesian, Neoclassical etc. are of the view that monetary shocks have temporary real effects (Meltzer 1995).

Monetary policy in Pakistan has two important objectives that are economic growth and price stability. For the achievement of these goals, the State Bank of Pakistan is targeting aggregate money supply along with reserves requirements. In the 1990s, SBP changed monetary policy to a conservative and flexible with market situations rather than based on the administration of financial authorities. Reserve ratios were changed, making credit availability and interest rate flexible according to the needs of the economy. Sectors and bank credit limits were abolished and policy was kept close to the discount rate for money and credit availability. SBP started indirect control of the money market (Akhtar 2008).

Researchers studied policy behavior for separate channels in our country. The role of wealth is very important for an economy. The existence of such a channel in our country is not studied till now. To analyze the transmission mechanism of monetary policy in order to know about the existence of wealth channels and their contributions through which the effect of monetary policy is transmitted or propagated into the economy along with the time period that will be taken in propagating monetary policy instruments into economy via different channels are the main objectives of this work.

The core problem is whether this channel is existed and performing better for the welfare of Pakistan's economy? How will the policy maker decide to allocate resources for this channel? This empirical analysis will diagnose the wealth channels of the monetary policy transmission mechanism in Pakistan. The way through which monetary policy instruments will affect the wealth and the significance of the instrument and their strength will observe. The study will also provide information whether monetary policy played the role of stabilization policies or not?

The impact of wealth on consumption, growth rate, investment, equity prices and other macroeconomic variables can be observed in the following literature.

Poterba (2000) paid attention to the direct impact of increasing stock market wealth on consumer spending. The possibility existed of changes in consumption due to fluctuations in asset prices of those consumers that did not have assets. The reason was the consumer's uncertainties about future economic circumstances. Dan (2013) revealed that companies and household wealth were affected by asset prices directly with an enormous effect on consumption and investment. Rahal (2016) found that policy shock in the form of an increase in assets affected house prices, mortgages and residential investment. House prices and investment gave a positive response to policy shock. A negative response was found for a mortgage rate.

Part of wealth diverted to consumption when wealth increases are observed by (Gale Sabelhaus and Hall 1999; Davis and Palumbo 2001; Kiley 2000) through marginal propensity to consume used US data. Iacoviello (2011) observed the wealth of households contains half housing wealth and consumption was 66 percent of GDP. Consumption and wealth were correlated in the same direction. Such a deepserd relationship compiled economic experts and policy decision maker to thought about wealth and consumption relationship. Case, Shiller and Quigley (2001) analyzed the wealth effect and found that wealth effect of stock market on consumption was poor and that of housing market were stronger. Steindel and Ludvigson (1999) revealed that present changes in stock market came into view to create changes in present consumption not tomorrow. It means that wealth fluctuation in present quarter did not sign of fluctuations in consumption after certain quarters. Maki and Palumbo (2001) investigated that saving rate in US reduced and net worth of households increased in 1990. The reason changed in wealth as more wealth leaded consumers to rise in consumption and reduce savings. Tracy, Schneider and Chan (1999) conducted a survey on consumer finance and found that household hold equities in any case. Many people invested in housing finance keeping 66 percent of their wealth in real estate. Consumption level was largely influenced by stock prices as compared to the changes in house prices. Meyer and Associates (1994) made an empirical analysis and found a positive relationship between wealth and consumption and their results were supported by Brayton and Bostic, Gabriel and Painter (2009) found that the effect of housing wealth was large with 0.06 housing wealth elasticity. The elasticity of consumption to financial wealth was 0.02. Differences between elasticity of home equities and values of houses were found small. From 1 to 4 percent decline were found in GDP due to 10 percent decline in housing wealth. Carroll, Otsuka and Slacalek (2011) found that the marginal propensity to consume with respect to change in house prices was 2 percent in short run and 4 to 10 percent in long run. Housing wealth effect was found to be larger than the wealth effect of stock. Dvornak and Kohler (2007) used panel data and found that consumption was significantly affected by stock market and housing wealth. In the long run one dollar increase in the stock market wealth of household raised consumption by 8 percent and an increase in housing wealth with the same ratio raised consumption by 3 percent. Financial wealth invested in housing assets was three times more than stock wealth. Dynan and Maki (2001) investigated that growth of consumption for those households having assets had an association with changes in stock prices. The wealth effect was found direct rather than indirect. Marginal propensity to consume for the wealth of the stock market was between 5 to 15 percent with a one dollar increase in capital growth.

Research Methodology

Time series quarterly data for the period of 1991Q1 to 2018Q4 is used. Data on MMR and IPI is taken from International Financial Statistics. Data till 2010 on Consumption is taken from Hanif, Iqbal and Malik (2013) and the remaining gap is fulfilled by the Pakistan Bureau of Statistics. Data on Market capitalization and equity prices are collected from Karachi Stock Exchange 100 index (KSE). Industrial Production Index (IPI) is used as a proxy for output as quarterly data on GDP is not available. Consumption is taken as total consumption and credit to private sectors provided by scheduled banks is used as bank loans. The money market rate (MMR) is used as a proxy for the policy rate. MMR is also used by (Hussain 2009; Usman, Yasmeen, Javed and Rehman 2017; Malik 2011; Donnay and Degryse 2001) as the policy instrument. As data on wealth is not available so we use market capitalization as proxy for wealth. All share index are used as proxy for equity prices as Abubakar and Hassan (2015) also used All Share Index.

Econometric Modeling

Transmission mechanism of monetary policy can be examined by two approaches that is structural model and reduced form model. Structural model use a collection of equation that how the economy operates in many sectors and these equations shows different channels through which monetary policy affect macroeconomic activities. A model describes the transmission mechanism of monetary policy as the change in interest rate affects investment and investment affects aggregate demand as a result, the price level affects. The structural model describes the relationship between interest rate and inflation through the specific channels of investment and aggregate demand.

The reduced form model does not describe the specific ways in which interest rate affects price level, but it suggests how movement in interest rate affects price level. The working of change in interest rate cannot be seen. The economy can be seen as a black box. The structural model approach describes the mechanism of how unseen variables work, if the structure is correct.

This study is estimating the effects of the monetary policy transmission mechanism on macroeconomic activities in Pakistan for the wealth channel. Shocks to monetary policy are transmitted into the economy through various channels. These channels consist of different macroeconomic variables and these variables are endogenous which simultaneously affect each other. The dependent variables are explained by past values of dependent variables and lag values of endogenous variables. Therefore simultaneous equation model is better for empirically analyzing the policy effect. Vector autoregressive models (VARs) are used for such estimation purposes. For empirical analysis Vector, Auto-Regression (VAR) model of Sims (1980) is an important tool which is estimated through ordinary least square. In this technique, the reduced form VAR can be converted into structural equations on the bases of economic theories. Certain restrictions are needed to be held under the estimation process. For structural interpretations, structural VAR uses impulse responses and variance decompositions.

Considered a vector Xt which consist of four variables that is

Xt = [IPIt,Ct,Wt,EPt,MMRt]'

Where IPIt, is the industrial production index, Ct consumption, Wt represents wealth, EPt equity prices, and MMRt is the money market rate where t represents the time period. We want to study the combined behavior of these variables.

The benchmark VAR model can be expressed as follows:

Xt = A0 + A1Xt-I + ……………. + ApXt-p + et

[?(1 ?12 ?13 ?14 ?15 @?21 1 ?23 ?24 ?25@?31 ?32 1 ?34 ?35@?41 ?42 ?43 1 ?45@?51 ?52 ?53 ?54 1 )][?(IPIt@Ct@Wt@EPt@MMRt)]=[?(?10@?20@?30@?40@?50)]+[?(? ?11 ??12 ??13 ??14 ??15 @? ?21 ??22 ??23 ??24 ??25@? ?31 ??32 ??33 ??34 ??35@? ?41 ? ?42 ? ?43 ? ?44 ??45@??51 ??52 ??53 ??54 ??55)][?(IPIt-i@Ct-i@Wt-i@EPt-i@MMRt-i)]+[?(?IPIt@?Ct@?Wt@?EPt@?MMRt)]

BXt = B0 + ?? Xt-i + ?t

Or it can be written as

BXt = B0 + ?_(i=1)^p? ?? Xt-i + ?t (1)

B0 is a vector of constant, B is square matrixes whose diagonal elements are equal to one consists of structural parameters of the contemporaneous dependent variables, ?? is a square metric that shows the effects of lag variables on the dependent variable and also shows the transmission mechanism. The structural model contains four equations each for the above mentions variable. Each equation has its own structural shocks represented by ?t as

Vt= [VIPIt ,VCt ,VWt ,VEPt,VMMRt]'

Where VIPIt is the shock of output, VCt represents investment shock; VWt is the wealth shock, VEPt is the shock of equity prices and VMMRt is the policy rate shock. These structural disturbances have zero means, constant variance and they are serially uncorrelated. That is

E (?t) = 0

E (?t?t?) = ?? = I which is a diagonal matrix

The model can be converted into a reduced form.

Xt = A0 + ?_(i=1)^p??A i? Xt-i + et (2)

Where

A0 = B?¹B0,Ai = B?¹ ?? and et = B?¹Vt

Unexpected results in IPIt, Ct, Wt, EPt and MMRt are represented by vector et having zero means, constant variance and correlation coefficient equal to zero. Equation (2) which is the reduced form of structural VAR will be estimated. Results obtained or the parameters estimated from the reduced form will provide information about structural VAR. But it should be noted that existing total parameters in structural VAR exceeds the number of total equations.

et = B?¹Vt

Vt= Bet

In other words, the impacts of the reduced form shocks (et) on the explanatory variables will not completely identify the impact of Vt on the endogenous variables which is the interest of the study. The structure of the economy depends upon the response of B0 and ??. To obtain complete information about the structure of the economy, complete estimation of A0, Ai and et of reduced form is only possible when we estimate the elements of B?¹. Estimated elements of B?¹ will make possible to estimate A0, Ai and et as A0 = B?¹B0, Ai = B?¹ ?? and et = B?¹Vt.

Non recursive ordering based on Cholesky decomposition is used for identification. Theoretical restrictions will be imposed on matrix B to identify unknown structural parameters and reduce them so that they could be equal to the number of estimated parameters of the variance covariance matrix.

Restrictions

One of the essential tasks is to make a clear identification plan used in this study. The coefficients ?ij which are none zero in the upcoming matrices show that variable I is affected by variable j immediately. For instance, in this channel ?21 shows the impact of IPI on consumption. The zero coefficients represent no relation among the variables. The diagonal coefficients normalize to one.

Xt = [IPIt,Ct,Wt,EPt,MMRt]'

Where Wt represent wealth

[?(?IPIt@?Ct@?Wt@?EPt@?MMRt)] =[?(1 0 0 0 0@?21 1 ?23 0 0@?31 0 1 ?34 0@?41 ?42 0 1 0@?51 ?52 ?53 ?54 1 )][?(eIPIt@eCt@eWt@eEPt@eMMRt)]

Policy rate plays an important role in macroeconomic development and has an impressive impact on income and consumption. But these variables are affected by changes in policy rate with one period lag (Bernanke and Blinder 1992). Therefore we assume that the policy rate has no immediate effect on industrial production index and consumption and place both variables first in the equation. Equity prices and change in policy behavior has no contemporaneous effect on consumption. This assumption is also consistent with (Giuliodori 2003). We assume that consumption is influenced by wealth rather wealth is influenced by consumption as theory urges that a change in policy rate brings

a change in wealth. As a result, consumption

changes. Therefore, ?32 is zero whereas consumption is allowed to respond to change in wealth so ?23 is left free. Same restrictions were imposed by (Lettau, Ludvigson and Steindel 2002) and (MacDonald, Mullineux and Sensarma 2011). Similarly, we assume that equity prices influence wealth but restrict wealth to bring changes in equity prices. Changes in policy rates bring change in equity prices; as a result of wealth change. Therefore, ?43 is equal to zero and ?34 is left free. This assumption is consistent with (Bernanke and Gertler 1999; Lettau, Ludvigson and Steindel 2002). Equity prices are assumed to react to output and consumption. The last equation is based on the assumption that all variables have a contemporaneous effect on the policy rate.

Econometric Modeling

Transmission mechanism of monetary policy can be examined by two approaches that is structural model and reduced form model. Structural model use a collection of equation that how the economy operates in many sectors and these equations shows different channels through which monetary policy affect macroeconomic activities. A model describes the transmission mechanism of monetary policy as the change in interest rate affects investment and investment affects aggregate demand as a result, the price level affects. The structural model describes the relationship between interest rate and inflation through the specific channels of investment and aggregate demand.

The reduced form model does not describe the specific ways in which interest rate affects price level, but it suggests how movement in interest rate affects price level. The working of change in interest rate cannot be seen. The economy can be seen as a black box. The structural model approach describes the mechanism of how unseen variables work, if the structure is correct.

This study is estimating the effects of the monetary policy transmission mechanism on macroeconomic activities in Pakistan for the wealth channel. Shocks to monetary policy are transmitted into the economy through various channels. These channels consist of different macroeconomic variables and these variables are endogenous which simultaneously affect each other. The dependent variables are explained by past values of dependent variables and lag values of endogenous variables. Therefore simultaneous equation model is better for empirically analyzing the policy effect. Vector autoregressive models (VARs) are used for such estimation purposes. For empirical analysis Vector, Auto-Regression (VAR) model of Sims (1980) is an important tool which is estimated through ordinary least square. In this technique, the reduced form VAR can be converted into structural equations on the bases of economic theories. Certain restrictions are needed to be held under the estimation process. For structural interpretations, structural VAR uses impulse responses and variance decompositions.

Considered a vector Xt which consist of four variables that is

Xt = [IPIt,Ct,Wt,EPt,MMRt]'

Where IPIt, is the industrial production index, Ct consumption, Wt represents wealth, EPt equity prices, and MMRt is the money market rate where t represents the time period. We want to study the combined behavior of these variables.

The benchmark VAR model can be expressed as follows:

Xt = A0 + A1Xt-I + ……………. + ApXt-p + et

[?(1 ?12 ?13 ?14 ?15 @?21 1 ?23 ?24 ?25@?31 ?32 1 ?34 ?35@?41 ?42 ?43 1 ?45@?51 ?52 ?53 ?54 1 )][?(IPIt@Ct@Wt@EPt@MMRt)]=[?(?10@?20@?30@?40@?50)]+[?(? ?11 ??12 ??13 ??14 ??15 @? ?21 ??22 ??23 ??24 ??25@? ?31 ??32 ??33 ??34 ??35@? ?41 ? ?42 ? ?43 ? ?44 ??45@??51 ??52 ??53 ??54 ??55)][?(IPIt-i@Ct-i@Wt-i@EPt-i@MMRt-i)]+[?(?IPIt@?Ct@?Wt@?EPt@?MMRt)]

BXt = B0 + ?? Xt-i + ?t

Or it can be written as

BXt = B0 + ?_(i=1)^p? ?? Xt-i + ?t (1)

B0 is a vector of constant, B is square matrixes whose diagonal elements are equal to one consists of structural parameters of the contemporaneous dependent variables, ?? is a square metric that shows the effects of lag variables on the dependent variable and also shows the transmission mechanism. The structural model contains four equations each for the above mentions variable. Each equation has its own structural shocks represented by ?t as

Vt= [VIPIt ,VCt ,VWt ,VEPt,VMMRt]'

Where VIPIt is the shock of output, VCt represents investment shock; VWt is the wealth shock, VEPt is the shock of equity prices and VMMRt is the policy rate shock. These structural disturbances have zero means, constant variance and they are serially uncorrelated. That is

E (?t) = 0

E (?t?t?) = ?? = I which is a diagonal matrix

The model can be converted into a reduced form.

Xt = A0 + ?_(i=1)^p??A i? Xt-i + et (2)

Where

A0 = B?¹B0,Ai = B?¹ ?? and et = B?¹Vt

Unexpected results in IPIt, Ct, Wt, EPt and MMRt are represented by vector et having zero means, constant variance and correlation coefficient equal to zero. Equation (2) which is the reduced form of structural VAR will be estimated. Results obtained or the parameters estimated from the reduced form will provide information about structural VAR. But it should be noted that existing total parameters in structural VAR exceeds the number of total equations.

et = B?¹Vt

Vt= Bet

In other words, the impacts of the reduced form shocks (et) on the explanatory variables will not completely identify the impact of Vt on the endogenous variables which is the interest of the study. The structure of the economy depends upon the response of B0 and ??. To obtain complete information about the structure of the economy, complete estimation of A0, Ai and et of reduced form is only possible when we estimate the elements of B?¹. Estimated elements of B?¹ will make possible to estimate A0, Ai and et as A0 = B?¹B0, Ai = B?¹ ?? and et = B?¹Vt.

Non recursive ordering based on Cholesky decomposition is used for identification. Theoretical restrictions will be imposed on matrix B to identify unknown structural parameters and reduce them so that they could be equal to the number of estimated parameters of the variance covariance matrix.

Restrictions

One of the essential tasks is to make a clear identification plan used in this study. The coefficients ?ij which are none zero in the upcoming matrices show that variable I is affected by variable j immediately. For instance, in this channel ?21 shows the impact of IPI on consumption. The zero coefficients represent no relation among the variables. The diagonal coefficients normalize to one.

Xt = [IPIt,Ct,Wt,EPt,MMRt]'

Where Wt represent wealth

[?(?IPIt@?Ct@?Wt@?EPt@?MMRt)] =[?(1 0 0 0 0@?21 1 ?23 0 0@?31 0 1 ?34 0@?41 ?42 0 1 0@?51 ?52 ?53 ?54 1 )][?(eIPIt@eCt@eWt@eEPt@eMMRt)]

Policy rate plays an important role in macroeconomic development and has an impressive impact on income and consumption. But these variables are affected by changes in policy rate with one period lag (Bernanke and Blinder 1992). Therefore we assume that the policy rate has no immediate effect on industrial production index and consumption and place both variables first in the equation. Equity prices and change in policy behavior has no contemporaneous effect on consumption. This assumption is also consistent with (Giuliodori 2003). We assume that consumption is influenced by wealth rather wealth is influenced by consumption as theory urges that a change in policy rate brings

a change in wealth. As a result, consumption

changes. Therefore, ?32 is zero whereas consumption is allowed to respond to change in wealth so ?23 is left free. Same restrictions were imposed by (Lettau, Ludvigson and Steindel 2002) and (MacDonald, Mullineux and Sensarma 2011). Similarly, we assume that equity prices influence wealth but restrict wealth to bring changes in equity prices. Changes in policy rates bring change in equity prices; as a result of wealth change. Therefore, ?43 is equal to zero and ?34 is left free. This assumption is consistent with (Bernanke and Gertler 1999; Lettau, Ludvigson and Steindel 2002). Equity prices are assumed to react to output and consumption. The last equation is based on the assumption that all variables have a contemporaneous effect on the policy rate.

Results and Discussion Unit root Test

The test is applied on the level and first difference variables. Variables have a unit root, which is the null hypothesis. Schwarz information criterion is selected by the system through automatic selection for choosing lag length for unit root test.

Table 1. Unit root test results at level and first difference

|

Variables |

Level |

First Difference |

Order of Integration |

|

P-Value |

P-Value |

||

|

LIPI |

0.8658 |

0.0000 |

I(1) |

|

LCONS |

0.8794 |

0.0035 |

I(1) |

|

LEP |

0.7522 |

0.0000 |

I(1) |

|

LMC |

0.2924 |

0.0000 |

I(1) |

|

MMR |

0.0690 |

0.0000 |

I(1) |

The results of the ADF test are reported in Table (1). All

variables are non stationary at log level on Intercept and trend. Values of P

for all variables are greater than 5 percent and the null hypothesis is

accepted. Whereas, all variables are stationary at thefirst difference and they

are integrated of order 1.

Lag Selection

For the selection of optimum lag length, it is necessary to conduct lag exclusion test and compare these results with the lag suggested by the selected criteria. The selection of lag for the estimation of wealth channel is based on the lag exclusion test. Results for the wealth channel of lag exclusion test in table 4 are significant for all variables on lag 1 and 4. The above selected lags for this channel do not contain the problems of serial correlation, hetroskedasticity and normality. Diagnostic tests on these lags are mentioned in appendix.

Test of Cointegration

After the decision whether the data is stationary at level or at first difference and determination of lag length, it is necessary to know whether the variables included in the model are correlated in the long run or not. Results of the unit root test give proper guidance for checking cointegration among the variables. If the unit root diagnoses the data stationary at the first difference, then it is rational to check cointegration among the variables. While testing long-run association among the variables, the claim of the null hypothesis is, that there is no cointegration among the variables. Both the hypothesis is tested using the maximum likely hood method mentioned by Johansen (1988) and Johansen and Juselius (1990) and the P- values of MacKinnon, Haug and Michelis (1999). Results of cointegration are noted in Appendix. From the table 5, it can be seen that there is no cointegrating equation at 0.05 level of significance among the variables.

Impulse Response

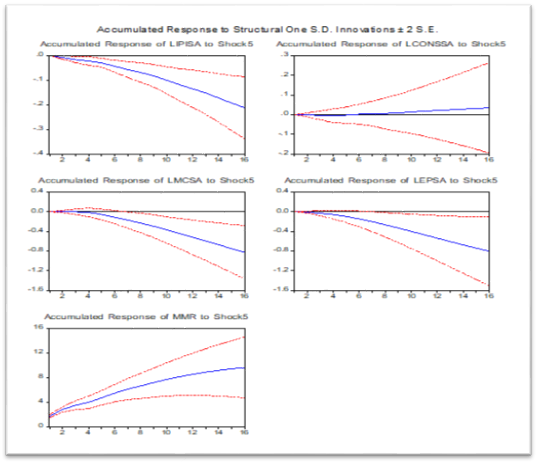

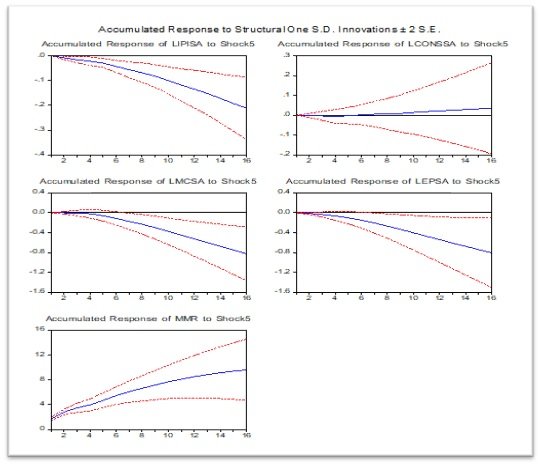

The impulse response is based on non recursive model. The order of variables is industrial production index, consumption, market capitalization, equity prices, and policy rate. A positive shock to policy rate as usual, has a negative and significant effect on the industrial production index.

In the case of tight monetary policy, we do not imagine output to increase, though we imagine a decrease or no change in output (Ivrendi and Yildirim, 2013). Impulse response results can be seen in figure 1. Response of consumption remains zero for the first four quarters and then become positive till the last quarter. Consumption results are inconsistent with theory and we can say it is a consumption puzzle. Adverse responses of consumption were also faced by Torres, Restrepo and Sanin, (2018) used a wealth consumption channel and found that positive policy rate shock increases consumptions in Poland, Brazil, Czech Republic and Israel. MacDonald, Mullineux and Sensarma, (2011) analyzed asymmetric effects of interest rate changes and suggested Duesenberry (1949) consumer behavior which revealed that increase in wealth followed steeper consumption while in the case of reduction in wealth it become flatter which is called Ratchet effect. It is rational to imagine that decrease in wealth may compel the consumer to take resources from past saving on alleviating the unfavorable shock of wealth decrease on consumption. Thus, this argument introduces the prospect of asymmetry in the wealth channel of monetary transmission. The role of interest rate in explaining consumption was found secondary. The policy rate was not a suitable instrument for limiting the level of consumption. Incomplete knowledge of households about their financial wealth leaded to no immediate response to changes in their wealth (Kennickell and Starr-McCluer 1997). Also the trend of consumption found by Hansen (1996) in long run was determined by other variables.

Interest rate and asset prices have a negative relationship. Response of equity prices is negative and become significant after the seventh quarter. Wealth is taken on the bases of market capitalization. Therefore, a positive policy shock adversely affects stock prices as a result, wealth decreases. Panel d shows the negative response of wealth for a short period as well as for a long period. Wealth response becomes significant after the fifth quarter. A negative response of wealth suggests lower consumption and vice versa as theory revealed. Barrell, Costantini and Meco (2015) founded that financial wealth had a positive impact on consumption in UK and Italy, but positive response of consumption along with a negative trend in weal ath may be due to different reasons. As according to Bertaut (2002) those countries where proportion of wealth to consumption is low or people hold less proportion of their financial wealth in the form of equities, will face weak response of consumption to wealth. Various studies like Pichette and Tremblay (2003) and Kishor (2007) recommended that richer people having greater financial wealth but their marginal propensity to consume is low that make their consumption less responsive to gains in financial wealth. Stock wealth effect may be negative (Coskun et al. 2018).

Variance Decomposition

The variance decomposition results of this channel are shown in table 2. Response of industrial production index in short run was not accountable. In long run it transmits54 percent of its total variations in other variables. Interest rate is the largest acceptable variable. Impact of output shock on consumption and wealth is 9 and 10 percent. Equity prices are not appropriately influence by industrial production index. Shocks to total consumption give poor response. 84 percent of its total variations are explained by its own shock. Equity prices accepted 6 percent of its total variations while output and wealth contribute 5 and 3 percent. Contribution of policy rate is very poor which means that consumption and interest rate does not have closed relationship. Behavior of consumption is also found different in literature like (Helander 2014; Kishor 2007; Pichette and Tremblay 2003). Rich people having financial wealth had less sensitive consumption to increase in financial wealth because their marginal propensity to consume of wealth is low. Also Fereidouni and Tajaddini (2017) noted that self-assurance of consumer changes trend of relationship between financial wealth and consumption and made the wealth positive and consumption negative.

Role of wealth is very appreciable. It can be seen from one standard deviation shock to wealth. Transmission of wealth dispersions to other variables in short run and long run is notable as compared to other variables. In short, run it transmitted 38 percent of its total variations to other variables in which asset price absorption is the highest, reflects strong relationship between the two variables. However, this relationship becomes weak in the long run and is captured by policy rate. The relationship of consumption and output with wealth is equal as compared to other variables in the short run as well as in the long run. The behavior of consumption analyzed by Fereidouni and Tajaddini (2017) and Bayoumi and Edison (2003) resulted positive relationship between wealth and consumption. Assets prices and policy rate explain 18 and 31 percent of total variations in wealth. Transmission of assets price shock to wealth is very low as wealth explains 1 percent of total variations in assets. It means that changes in wealth has an impact on assets demand as can be observe from shock to wealth. Assets price fluctuations do not properly affect wealth. However, interest rate and assets prices have close relationship as policy rate explain 21 percent of total variations in assets prices. Reaction of policy rate to assets price shock was also found by Chirinko, De Haan and Sterken (2008).

Table 2. Variance Decomposition of Wealth Channel

|

Variance Decomposition

of IPI |

||||||||||||||||||||

|

Period |

S.E. |

IPI |

CONS |

MC |

EP |

MMR |

||||||||||||||

|

1 |

0.046944 |

100.0000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

||||||||||||||

|

4 |

0.051461 |

87.86980 |

2.536441 |

1.201791 |

1.938296 |

6.453673 |

||||||||||||||

|

8 |

0.069598 |

72.06934 |

4.685063 |

6.706410 |

1.343504 |

15.19568 |

||||||||||||||

|

12 |

0.086096 |

57.69841 |

6.940656 |

9.335243 |

1.071903 |

24.95379 |

||||||||||||||

|

16 |

0.102059 |

46.53821 |

9.454152 |

10.58204 |

1.408931 |

32.01667 |

||||||||||||||

|

Variance

Decomposition of CONS |

||||||||||||||||||||

|

1 |

0.069327 |

0.644824 |

99.32332 |

0.029631 |

0.002229 |

6.61E-29 |

||||||||||||||

|

4 |

0.092181 |

1.412761 |

97.98193 |

0.102593 |

0.324903 |

0.177812 |

||||||||||||||

|

8 |

0.117545 |

2.794661 |

92.68582 |

1.730326 |

2.336971 |

0.452225 |

||||||||||||||

|

12 |

0.136824 |

4.081288 |

87.90300 |

3.001506 |

4.353969 |

0.660232 |

||||||||||||||

|

16 |

0.153322 |

5.330251 |

84.05765 |

3.755628 |

6.138326 |

0.718142 |

||||||||||||||

|

Variance

Decomposition of MC |

||||||||||||||||||||

|

1 |

0.172158 |

0.248223 |

0.117801 |

92.66440 |

6.969572 |

4.20E-32 |

||||||||||||||

|

4 |

0.256022 |

1.099948 |

2.551921 |

62.75315 |

33.30418 |

0.290796 |

||||||||||||||

|

8 |

0.315427 |

7.625949 |

5.076508 |

42.71244 |

32.67505 |

11.91005 |

||||||||||||||

|

12 |

0.369461 |

10.76183 |

8.722411 |

31.70918 |

24.54386 |

24.26272 |

||||||||||||||

|

16 |

0.421598 |

11.23352 |

12.79532 |

25.46293 |

18.94640 |

31.56184 |

||||||||||||||

|

Variance

Decomposition of EP |

||||||||||||||||||||

|

1 |

0.139490 |

0.172612 |

1.659253 |

0.000495 |

98.16764 |

1.80E-28 |

||||||||||||||

|

4 |

0.274688 |

1.711533 |

3.596758 |

0.004940 |

92.75890 |

1.927867 |

||||||||||||||

|

8 |

0.370109 |

4.992036 |

7.686571 |

1.124478 |

77.12356 |

9.073359 |

||||||||||||||

|

12 |

0.427988 |

6.874188 |

13.14538 |

1.355619 |

61.75999 |

16.86482 |

||||||||||||||

|

16 |

0.473977 |

7.495247 |

19.03562 |

1.127357 |

50.78743 |

21.55435 |

||||||||||||||

|

Variance

Decomposition of MMR |

||||||||||||||||||||

|

1 |

1.732898 |

0.021467 |

0.185632 |

0.009566 |

1.700321 |

98.08301 |

||||||||||||||

|

4 |

2.268372 |

0.170879 |

2.957012 |

0.413802 |

2.571309 |

93.88700 |

||||||||||||||

|

8 |

2.710864 |

0.285160 |

6.423908 |

0.773292 |

1.834686 |

90.68295 |

||||||||||||||

|

12 |

2.952983 |

0.384500 |

10.17854 |

0.673402 |

1.984831 |

86.77873 |

||||||||||||||

|

16 |

3.085482 |

0.542804 |

13.79633 |

0.635475 |

2.295401 |

82.72999 |

||||||||||||||

Cholesky ordering: IPI CONS MC EP MMR

Assets price fluctuations directly affect consumption. 19

percent of variations are transmitted to consumption by equity prices.

Unexpected results are accompanied with economic situations as noted by Chirinko, Haan and Sterken (2004)

in analyzing the relationship between assets prices and economies of thirteen

industrial countries. They obtain no homogeneity in impact among these

countries with a positive asset price shock. The reason was different financial

structures among these countries. Chirinko, De

Haan and Sterken (2008) analyzed the assets price

channel and found that economy was affected in real terms by assets prices through

wealth and balance sheet channel. Shock to policy rate is properly absorbed by

consumption as it explains 13 percent of the total variations. Response of

other variables to policy rate shock is poor. Impact of interest rate on

consumption and output was investigated by Endut, Morley

and Tien (2018) and revealed that interest rate channel fluctuate

output all the way through consumption or investment in wealth.

Conclusions and Policy Recommendations

This research work empirically analyzed monetary policy transmission mechanism in Pakistan for wealth channel. Estimation is made for the period of 1991Q1 to 2018Q4 applying Vector Auto Regressive (VAR) technique on time series data. Models taken for estimation are based on Mishkin theoretical frame work. After taking log, adjusting data seasonally, make test of unit root and cointegration, both impulse response and variance decomposition are estimated for each channel. Wealth channel give more significant results but with an opposite behavior of consumption. Variables included in wealth channel follow the same direction as theory suggest but consumption response remain zero for two years and positively responded after that period. Standard deviation shocks to each variable in variance decomposition results are bitterly transmitted. Performance of wealth channel on the biases of impulse responses and variance decomposition was better.

Most of the variables have negative relationship with interest rate in Pakistan. Therefore, policy decision related to high interest rate should be taken carefully. Losses should be less than benefits from tight policy action. Better remedies are needed to capture the problem of low savings.

There is further need for future research that need special identification technique to be analyzed. These channels included debt market channel, trade credit channel, communication and expectations channel, government expenditure channel, housing price channel, and household liquidity effect. Moreover, the same channels can be analyzed with different combinations of macroeconomic variables and with changes in shocks rather than depending on policy rate shock for impulse responses. The transmission mechanism can also be analyzed by using more instruments of monetary policy adopted by the State Bank of Pakistan.

Appendix Table 4. VAR lag Exclusion wald Tests

|

Chi-squared test Statistics for

Lag Exclusion |

||||||

|

|

IPI |

INV |

PSC |

BD |

MMR |

Joint |

|

Lag 1 |

30.91336 [ 9.74e-06] |

96.78487 [ 0.000000] |

166.2286 [ 0.000000] |

339.4033 [ 0.000000] |

91.79587 [ 0.000000] |

664.1959 [ 0.000000] |

|

Lag 4 |

116.8419 [ 0.000000] |

20.03587 [ 0.001231] |

13.90042 [ 0.016255] |

11.302183 [ 0.049119] |

17.99905 [ 0.002948] |

181.9030 [ 0.000000] |

|

df |

5 |

5 |

5 |

5 |

5 |

25 |

Table 5. Test of Cointegration

|

Trace Test Statistic |

||||

|

Hypothesized No. of CE(s) |

Eigenvalue |

Trace statistics |

0.05 Critical value |

Prob. ** |

|

None * |

0.283654 |

64.74362 |

69.81889 |

0.1188 |

|

At most 1 |

0.139135 |

29.04924 |

47.85613 |

0.7660 |

|

At most 2 |

0.075681 |

13.01879 |

29.79707 |

0.8907 |

|

At most 3 |

0.040045 |

4.598068 |

15.49471 |

0.8499 |

|

At most 4 |

0.002101 |

0.225083 |

3.841466 |

0.6352 |

|

Maximum Eigenvalue test Statistic |

||||

|

Hypothesized No. of CE(s) |

Eigenvalue |

Max-Eigen stat: |

0.05 Critical value |

Prob. ** |

|

None * |

0.183654 |

18.69438 |

29.87687 |

0.7300 |

|

At most 1 |

0.139135 |

16.03045 |

27.58434 |

0.6632 |

|

At most 2 |

0.075681 |

8.420726 |

21.13162 |

0.8762 |

|

At most 3 |

0.040045 |

4.372985 |

14.26460 |

0.8180 |

|

At most 4 |

0.002101 |

0.225083 |

3.841466 |

0.6352 |

Trace

test indicates no cointegration at the 0.05 level

*denotes rejection of the

hypothesis at 0.05 level

**MacKinnon-Haug-Michelis

(1999) p-values

Table 6. Serial Correlation LM Tests

|

Lags |

LM-Stat |

Prob |

|

1 |

29.61959 |

0.2388 |

|

2 |

28.12400 |

0.3022 |

|

3 |

20.19372 |

0.7366 |

|

4 |

31.95399 |

0.1450 |

Probs from chi-square with 25 df.

Table 7. Test of Hetroskedasticity

|

Channel |

Chi-square value |

Degree of freedom |

P-values |

|

Wealth |

891.7991 |

900 |

0.5707 |

References

- Akhtar, S. (2008). The effectiveness of monetary policy in Pakistan. Speech at the convocation of the Institute of Business Management, Karachi.

- Ascarya, A. (2012). Transmission channel and effectiveness of dual monetary policy in Indonesia. Buletin Ekonomi Moneter dan Perbankan, 14(3), 269-298

- Barrell, R., Costantini, M., & Meco, I. (2015). Housing wealth, financial wealth, and consumption: New evidence for Italy and the UK. International Review of Financial Analysis, 42, 316-323.

- Bayoumi, T., & Edison, H. (2003). Is wealth increasingly driving consumption? De Nederlandsche Bank.

- Bernanke, B. S., & Blinder, A. (1992). The federal funds rate and the channels of monetary transmission. American Economic Review, 82(4), 901-921.

- Bernanke, B. S., & Gertler, M. (1999). Monetary policy and asset price volatility. Federal Reserve Bank of Kansas City Economic Review, 4th Quarter.

- Bertaut, C. C. (2002). Equity prices, household wealth, and consumption growth in foreign industrial countries: wealth effects in the 1990s. FRB International Finance Discussion Paper

- Bostic, R., Gabriel, S., & Painter, G. (2009). Housing wealth, financial wealth, and consumption: New evidence from micro data. Regional Science and Urban Economics, 39(1), 79-89.

- Carroll, C. D., Otsuka, M., & Slacalek, J. (2011). How Large Are Housing and Financial Wealth Effects? A New Approach. Journal of Money, Credit and Banking, 43(1), 55-79.

- Case, K.E., Shiller, R.J., & Quigley, J. M. (2001).

- Chirinko, R.S., De Haan, L., & Sterken, E. (2008). Asset price shocks, real expenditures, and financial structure: a multi-Country Analysis CESifo.

- Chirinko, R.S., Haan, L.J., & Sterken, E. (2004). Asset price shocks, real expenditures, and financial structure: a multi-country analysis. University of Groningen.

- Coskun, Y., Sencer Atasoy, B., Morri, G., & Alp, E. (2018). Wealth effects on household final consumption: Stock and housing market channels. International Journal of Financial Studies, 6(2), 2-32.

- Dan, H. (2013). The asset price channel and its role in monetary policy transmission. The Annals of the University of Oradea, 36(1), 445-454.

- Davis, M.A., & Palumbo, M. G. (2001). A primer on the economics and time series econometrics of wealth effects. Washington, DC: Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board.

- Donnay, M., & Degryse, H. (2001). Bank lending rate pass-through and differences in the transmission of a single EMU monetary policy. Discussion Paper Series 01.17.

- Duesenberry, J. S. (1949). Income, saving and the theory of consumer behavior. Princeton University Press, Princeton

- Dvornak, N., & Kohler, M. (2007). Housing wealth, stock market wealth and consumption: a panel analysis for Australia. Economic Record, 83(261), 117-130.

- Dynan, K.E., & Maki, D. M. (2001). Does stock market wealth matter for consumption? .

- Endut, N., Morley, J., Tien, P. L. (2018). The changing transmission mechanism of US monetary policy. Empirical Economics, 54(3), 959-987.

- Fereidouni, H. G., & Tajaddini, R. (2017). Housing wealth, financial wealth and consumption expenditure: The role of consumer confidence. The Journal of Real Estate Finance and Economics, 54(2), 216-236.

- Frisch, R. (1933). Propagation Problems and Impulse Problems in Dynamic Economics. In Economic Essays in Honor of Gustav Cassel.

- Gale, W. G., Sabelhaus, J., & Hall, R.E. (1999). Perspectives on the household saving rate. Brookings papers on economic activity, 1999(1), 181-224.

- Giuliodori, M. (2003). Essays on the transmission mechanism of monetary policy. Doctoral dissertation, University of Glasgow.

- Hanif, N., Iqbal, J., & Malik, J. (2013). Quarterisation of national income accounts of Pakistan. SBP Research Bulletin, 9(1), 23-45.

- Hansen, H. J. (1996). The impact of interest rates on private consumption in Germany. Economic Research Group of the Deutsche Bundesbank.

- Hassan, A. (2015). Transmission mechanism of monetary policy in Nigeria: Evidence from VAR approach, Master's thesis. Eastern Mediterranean University (EMU)- Doğu Akdeniz Üniversitesi (DAÜ).

- Helander, M. (2014). Estimating wealth effects on consumption in Finland. Statistics Finland-Working Papers.

- Hussain, K. (2009). Monetary policy channels of Pakistan and their impact on real GDP and inflation. Center for International Development at Harvard University.

- Iacoviello, M. (2011). Housing wealth and consumption. FRB International Finance Discussion Paper, (1027), Washington, DC: Federal Reserve Board.

- Ivrendi, M., & Yildirim, Z. (2013). Monetary policy shocks and macroeconomic variables: evidence from fast growing emerging economies Economics Discussion Papers (No. 2013-61), Kiel Institute for the World Economy (IfW), Kiel.

- Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of economic dynamics and control, 12(2-3), 231-254.

- Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration with appucations to the demand for money. Oxford Bulletin of Economics and statistics.

- Kennickell, A. B., & Starr-McCluer, M. (1997). Retrospective reporting of household wealth: Evidence from the 1983-1989 survey of consumer finances. Journal of Business & Economic Statistics, 15(4), 452-463.

- Kiley, M. T. (2000). Identifying the effect of stock market wealth on consumption: pitfalls and new evidence. Board of Governors of the Federal Reserve System.

- Kishor, N. K. (2007). Does consumption respond more to housing wealth than to financial market wealth? If so, why? The Journal of Real Estate Finance and Economics, 35(4), 427-448.

- Lettau, M., Ludvigson, S., & Steindel, C. (2002). Monetary policy transmission through the consumption-wealth channel. FRBNY Economic Policy Review, 5(1), 117-133.

- MacDonald, G., Mullineux, A., & Sensarma, R. (2011). Asymmetric effects of interest rate changes: the role of the consumption-wealth channel. Applied Economics, 43(16), 1991-2001.

- MacKinnon, J. G., Haug, A. A., & Michelis, L. (1999). Numerical distribution functions of likelihood ratio tests for cointegration. Journal of applied Econometrics, 14(5), 563-577.

- Maki, D. M., & Palumbo, M. (2001). Disentangling the wealth effect: a cohort analysis of household saving in the 1990s.

- Malik, W. (2011). A structural VAR (SVAR) approach to cost channel of monetary policy. University Library of Munich, Germany.

- Meltzer, A. H. (1995). Monetary, credit and (other) transmission processes: a monetarist perspective. Journal of economic perspectives, 9(4), 49-72.

- Meyer, L. H. (1994). Associates: The WUMM model book. St. Louis: LH Meyer and Associates.

- Mishkin, F. S. (2001). The transmission mechanism and the role of asset prices in monetary policy (No. w8617). National bureau of economic research.

- Pichette, L., & Tremblay, D. (2003). Are wealth effects important for Canada? Bank of Canada.

- Poterba, J. M. (2000). Stock market wealth and consumption. Journal of economic perspectives, 14(2), 99-118.

- Rahal, C. (2016). Housing markets and unconventional monetary policy. Journal of Housing Economics, 32(2), 67-80.

- Sims, C. A. (1980). Macroeconomics and reality. Econometrica: journal of the Econometric Society, 1-48.

- Steindel, C., & Ludvigson, S. C. (1999). How important is the stock market effect on consumption? Economic Policy Review, 5(2), 1-23.

- Torres, J.A.E., Restrepo, S.S., & Sanin- Restrepo, S. (2018). Unvealing monetary policy transmission on inflation targeting economies: the wealth-consumption channel. Pontificia Universidad Javeriana, Facultad de Ciencias Económicas y Administrativas, Departamento de EconomÃÂa.

- Tracy, J. S., Schneider, H. S., & Chan, S. (1999). Are stocks overtaking real estate in household portfolios? Current Issues in Economics and Finance, 5(5), 234-255.

- Usman, S., Yasmeen, R., Javed, I., & Rehman, A. (2017). Shocks to monetary policy and response of commodity prices in Pakistan: structural vector autoregressive approach. Pakistan Council for Science and Technology, 36(4), 239-248.

Cite this article

-

APA : Khan, H., & Amin, A. (2022). Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel). Global Economics Review, VII(II), 20 - 32. https://doi.org/10.31703/ger.2022(VII-II).03

-

CHICAGO : Khan, Haroon, and Amjad Amin. 2022. "Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel)." Global Economics Review, VII (II): 20 - 32 doi: 10.31703/ger.2022(VII-II).03

-

HARVARD : KHAN, H. & AMIN, A. 2022. Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel). Global Economics Review, VII, 20 - 32.

-

MHRA : Khan, Haroon, and Amjad Amin. 2022. "Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel)." Global Economics Review, VII: 20 - 32

-

MLA : Khan, Haroon, and Amjad Amin. "Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel)." Global Economics Review, VII.II (2022): 20 - 32 Print.

-

OXFORD : Khan, Haroon and Amin, Amjad (2022), "Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel)", Global Economics Review, VII (II), 20 - 32

-

TURABIAN : Khan, Haroon, and Amjad Amin. "Monetary Policy Transmission Mechanism in Macroeconomic Activities in Pakistan (Wealth Channel)." Global Economics Review VII, no. II (2022): 20 - 32. https://doi.org/10.31703/ger.2022(VII-II).03