Abstract:

This research paper investigates the buffering role of financial literacy on the direct link between Herding Behavior and Investment Decisions. Using an anonymous survey, we collected data from a total of 514 individual investors based on a convenience sampling procedure in the Pakistan Stock Exchange. The hypothetical model of the study was evaluated using the PLS-SEM approach via SmartPLS 3.2. The data fitted well for the structural model and the R2 value of 65% supported the moderate level of the model predictive power. Further, we found a positive relationship of herding behavior and investment decisions, while financial literacy modifies this link in a way that persons with greater financial literacy are less likely to be influenced by herding behavior and vice versa. The study's findings provide practical insights for investors, policymakers, and regulators in the PSX, emphasizing the importance of financial literacy in mitigating positive herding behavior-investment decisions relationship

Key Words:

Herding Behavior, Financial Literacy and Investment Decisions

Introduction

Investment Decisions (ID) are a crucial aspect of finance, and the traditional theories of finance postulate that individuals make these decisions based on a rational evaluation of all available information in financial markets (Baker & Filbeck, 2013). On the contrary, numerous studies have challenged this perspective by highlighting the role of behavioral biases in causing sub-optimal ID (Barber & Odean, 2008). Which led to a new discipline, behavioral finance. which focuses on the psychological and emotional aspects of behavior that deviate from rational behavior in ID (Yoong & Ferreira, 2013).

Investors' propensity to follow the herd, which is referred to Herding Behaviour (HB), is one such divergence (Clements et al., 2017). HB is influenced by the social mood of the society and contradicts the principles of rationality and rational decision-making (Nofsinger, 2005; Prechter, 2016).

A strong grasp of Financial Literacy (FL) is essential for making informed investment decisions (Altman, 2012). According to Lusardi et al. (2009), Sezer and Demir (2015), and Son and Park (2019), individuals who lack FL are at risk of making poor IDs and accumulating debt. This research comes with an objective to study how HB affect individual investors in opting investment choices at Pakistan Stock Exchange (PSX). Secondly, to examine whether financial literacy could moderate this effect (Huston, 2010). This study can serve to deliver worthy insights into the investment tendencies of investors, which can be beneficial for policymakers, regulators, financial institutions, and investors.

Literature review and Hypotheses Formulation Investment Decisions

The financial theory posits that investors make ID based on rational decision-making processes to maximize their returns (Nozick, 1993). The traditional view of rational decision-making in finance, as outlined by Mintzberg et al. (1976), involves three steps: problem identification, development of alternative solutions, and selection of the optimal solution. These presumptions are, however, called into question by Kahneman and Tversky (1979), who looked at the fact that how persons make judgments when they are faced by uncertainty.

Thaler (1980) introduced “Prospect Theory”, originally given by Kahneman and Tversky (1979), to the field of finance, arguing that, the traditional assumptions of rationality may not hold in real-life scenarios. According to prospect theory, investors make decisions based on the perceived utility of returns rather than the expected outcomes (Kahneman & Tversky, 1979). Additionally, Tversky and Kahneman (1979) also proposed the idea of heuristics in decision-making, where individuals tend to rely on mental shortcuts or heuristics when making ID (Kahneman & Tversky, 1979).

An outline of behavioral finance is given by Shefrin and Statman (2000). This branch of finance examines how psychological variables affect financial decision-making. Similarly, the work of Kahneman and Tversky (1979) and Thaler (1980), also highlights the importance of considering both rational and behavioral factors in making IDs.

Researchers of behavioral Finance have found that people tend to view each investment decision as separate and distinct, rather than considering it in the context of their overall portfolio or investment strategy. This can lead to decision-making biases and irrational behavior. Additionally, investors may be influenced by their personal characteristics and preferences, which can result in suboptimal decision-making. As a result, awareness to these biases is crucial for investors and investors may attempt to avoid them. These attempts may include, diversifying their portfolio, setting clear investment goals, and following a disciplined investment approach. For instance, there are several studies and articles that have explored the mind-sets influencing the decision-making of investors.

“The Psychology of Investors” by Richard H. Thaler, in the Journal of Economic Perspectives (2005) this article describes behavioral finance, which studies the psychology of investors and how they make decisions, and how comes into practice in real-world investment management.

HB in making ID

Herding behavior, where individuals follow the actions of others instead of making independent decisions, is a deviation from the principles of rationality in making decisions is rooted in “Socionomics Theory” (Shiller, 2006). This theory argues that social activities are driven by social mood, which can influence financial behavior. Nofsinger (2005) and Prechter (2016) suggested that the overall social mood can lead to overreaction or under reaction in the stock market and result in herding behavior.

HB’s influence on ID has been extensively explored in the literature. Social interactions and interpersonal communication give rise to herding behavior, which can result in increased volatility and speculative bubbles (Luong & Thi Thu Ha, 2011; Lo, 2002). Researchers have detected evidence of HB in various stock markets, including the Amman Stock Exchange (Ramadan, 2015), the Turkish Stock Market (Cakan & Balagyozyan, 2016), and the Indian Stock Market (Garg & Gulati, 2013). Institutional investors are more prone to engage in HB than individual investors (Hirt & Block, 2006), resulting in overvalued investment opportunities (Wamae, 2013). However, the effect of HB on investors' evaluations may not always be significant (Lim, 2012).

During times of fear and uncertainty, individual investors may follow the advice of others, including institutional investors, due to perceived information advantages (Landberg, 2003; Persaud, 2000). Additionally, herding bias significantly influences investors' decisions (Malik & Elahi, 2014), and women are reported to be more prone to herding bias (Hon-Snir et al., 2012). Meanwhile, investors who lacks confidence tend to believe the sayings of others. (Durand et al., 2013), and institutional investors' HB has been examined in the literature (Clarke et al., 2014). Caparrelli et al., (2004) stated that "when markets are volatile, investors tend to express more herding bias in behavior". As per Lee et al., (2004), herding behavior is found more in individual investors than institutional investors. While institutional investors have showed a higher tendency of herding bias more than individual investors in an unpredictable market. Studies conducted by Dennis and Strickland, (2002) and Nofsinger and Sias (1999) concluded that stock prices are also affected by the herding behavior of institutional investors.

In summary, analyzing the effects of HB on rational decision-making is crucial in shedding light on the role of social interactions and behavioral factors in financial decision-making. However, further studies in this regard are indispensable to comprehend further the relationship of HB and investment decision-making. Consequently, we present our first hypothesis for this research, which shows that herding tendency has a considerable impact on investing choices.

H1: HB may positively relate to ID of Investors.

FL and ID

FL is an essential aspect of managing one's financial resources and making informed ID (PACFL, 2008; OECD, 2013). Previous research repeatedly demonstrates the idea that those having advanced level FL tends to make optimal ID as compared to those having average level FL. (Hilgert et al., 2003). For instance, Bucher-Koenen and Ziegelmeyer (2011) found that low FL is associated with the suboptimal ID, while Lusardi et al. (2014) observed that older adults with low FL have difficulties in making financial decisions. Improving FL can enhance investors' decision-making abilities by enabling them to effectively analyze and process information (Hayat and Anwar, 2016). These findings underscore the importance of FL in investment decision-making particularly in advanced countries. (Chen and Volpe, 2002) but also among students (Chen and Volpe, 1998) and different age groups

Guiso and Jappelli, (2008) contended that without FL it is not possible for investors to explains portfolio diversification. The ability to understand basic concepts of finance such as, compound and simple interest, returns on investments, dividends pay outs, inflation and assets management helps in better diversification (Hastings & Mitchell, 2011). People having basic FL comes with enhanced investment selections resultantly in higher returns (Jappelli & Padula,2011).

So based on the discussion above the 2nd Hypothesis of our research is:

H2: FL has a positive significant impact on the ID of investors

Moderating Role of FL

The effect of FL on making IDs is a topic of discussion in finance, especially in light of herding prejudice. The propensity of people to follow the judgements of others without performing an independent investigation is referred to as herding bias. This prejudice, which has been the focus of multiple research studies, may have a major impact on investing choices.

Ates et al. (2016) have revealed a robust association between FL and herding bias. Biases in investment decision-making occur more among individuals with poor levels of FL (Bucher-Koenen and Ziegelmeyer, 2011). Moreover, FL has been found to have a mitigating effect on herding bias and the disposition effect, indicating that enhancing FL may alleviate these biases (Baker et al., 2019).

FL, according to Sabir et al. (2019), has a substantial impact in mitigating the link between herding bias and overconfidence bias. Hetling & Postmus (2014) have shown that herding biases are more prevalent among individuals with lower FL. Amirat & Bouri (2009) further support the hypothesis that increasing FL can reduce herding biases by allowing individuals to analyze and use private information more effectively.

In conclusion, there is widespread literature holding the idea that FL plays a crucial role in reducing herding biases and improving ID. The literature suggests that individuals having higher FL are less susceptible to herding bias and make a better ID.

H3: FL positively moderates herding behavior- investment decision-making relationship.

Conceptual Model

In this study, the conceptual model is developed on the basis of the findings of the previous recognized research from the literature that emphasizes on HB`s effects on investors while making IDs. The framework consists of three key variables: HB as an exogenous construct, investment decision-making as the endogenous factor, and FL as a moderating component. This framework illustrates the interplay between these variables and serves as a foundation for the study's hypotheses and empirical analysis.

Methodology

This study utilizes a research design that is cross-sectional in nature. We have employed a questionnaire for data collection. The questionnaire was composed of four sections. The first section of the questionnaire is intended to gather the demographic information of the study`s respondents, while the other sections were designed to capture the study variables. The next section serves to measure the independent variable of herding, and it consisted of four items adapted from the work of Jain, Walia and Gupta (2019). The third section measured FL, which served as the moderator, and it comprised of six items taken from Van Rooij et al., (2011). The final section measured the dependent variable of ID, and it included six items adapted from Pasewark and Riley (2010).

For the responses, a seven-point Likert scale was employed, excluding the demographic information section. Overall, this study design and questionnaire development strategy allowed for a comprehensive and rigorous investigation of the research variables, providing valuable insights into the relationships between herding behavior, FL, and ID.

To prevent the issue of common method variance, Podsakoff et al. (2003, 2012) recommend incorporating a set of items that measure different constructs in a randomized manner within the questionnaire.

By employing the Cochran's (1977) formula for the infinite population in light of the findings of the pilot study (SD) we got a sample size of 514 respondents for the representation of the population at a desired level of confidence.

For this study, data was collected through convenience sampling, resulting in a total of 547 responses. However, after the data screening process, 33 invalid questionnaires were excluded, leaving us with 514 valid questionnaires for further analysis. The structural equation modelling with partial least squares approach is employed in this study, using Smart PLS version 3.2, which has been suggested by Hair et al. (2017) as a suitable statistical technique and software for analyzing complex models.

To guarantee the accuracy and consistency of our results, we need to assess and confirm the validity and reliability of our findings. So we employed a three-step data analysis process. The first step involved running a measurement model to assess the validity and reliability of the scales used in a Pakistani organizational context. the, we estimated the structural model to determine if the data fit the overall study model. Prior to examining the structural connections of the theoretical model, this statistical analysis approach was used to verify the measures' validity and reliability, as suggested by Hair et al. (2017). In the third step, we examined the direct connections between variables in the measurement model before moving forward. As diligent researchers, we believe that this approach to data analysis is crucial in ensuring the accuracy and dependability of our results.

Analysis and Results Correlation Analysis

Before moving to test the model of the study, to determine the association between research variables that were measured on interval-based scales, thus the data was considered metric(Field, 2009) and the correlation analysis was apposite and according executed. The results are presented in Table 1. Which indicates a moderate level of correlations between the study variables.

Table 1. Correlation Analysis results.

|

|

Herding |

FL |

ID |

|

Herding |

- |

|

|

|

FL |

0.380** |

- |

|

|

ID |

0.470** |

0.455** |

- |

Profile of Respondents

The sample population was categorized based on demographics such as gender, age and education. The respondents were categorized as male (83%), and most of them were between the ages of 30 and 60 (78%). Education-wise, most of the respondents held a master's qualification (40.08%), then a bachelor's degree (31.91%), while some were also under graduation none of the respondents had a Ph.D.

Results of the Measurement Model

As all of our model’s variables were measured as reflectively, as per recommendations of Ringle et al. (2015) and Hair et al. (2017), we check the quality of measurement model on two major criteria of reliability and validity. For reliability, we estimated Cronbach's alpha as well as the composite reliability scores. For validity, we assessed two indices to ensure the convergent validity for instance scores of factor loadings that each item is loaded according to their respective construct and

average variance extracted (AVE). The results, presented in Table 2, showed that all the factors had factor loadings exceeding 0.7, AVE values higher than 0.5, Cronbach's alpha values above the cut-off value of 0.7, and composite reliability values above 0.7, indicating that our measures were valid and reliable.

To assess the discriminant validity, we used the hetero-trait-monotrait (HTMT) ratio of correlations (Hair et al., 2017), which is a newer and more reliable procedure. As shown in Table 2, all the HTMT values were below 0.90, indicating that the constructs had acceptable levels of discriminant validity.

Table 2. Reflective Measure Assessment

|

Measures |

Item Reliability |

Loading |

Composite

Reliability |

Cronbach’s

Alpha |

AVE |

|

Herding |

HB-1 |

0.899 |

0.933 |

0.91 |

0.737 |

|

HB-2 |

0.867 |

|

|

|

|

|

HB-3 |

0.886 |

|

|

|

|

|

HB-4 |

0.821 |

|

|

|

|

|

HB-5 |

0.81 |

|

|

|

|

|

FL |

FL-1 |

0.884 |

795 |

0.948 |

795 |

|

FL-2 |

0.882 |

|

|

|

|

|

FL-3 |

0.895 |

|

|

|

|

|

FL-4 |

0.901 |

|

|

|

|

|

FL-5 |

0.896 |

|

|

|

|

|

FL-6 |

0.893 |

|

|

|

Table 3. Discriminate validity HTMT ratios

|

|

Herding |

FL |

ID |

|

Herding |

1 |

|

|

|

FL |

0.408 |

1 |

|

|

ID |

0.507 |

0.589 |

1 |

Results of the Structural model

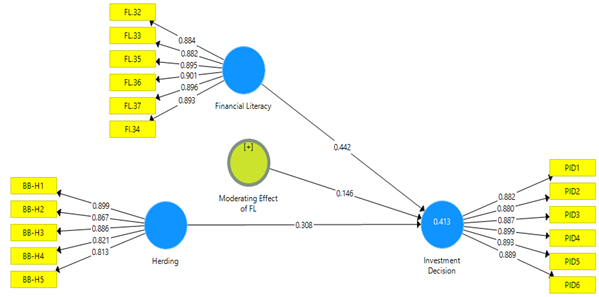

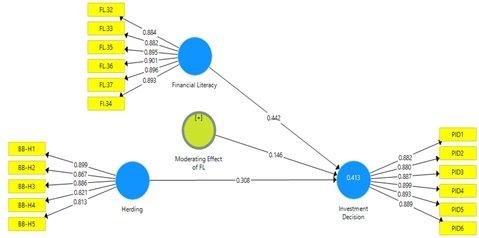

For assessing the explanatory power and predictive relevance of our study's model, we utilized Hair et al.'s (2017) criteria of R2, f2, and Q2, as well as path coefficients to determine the direct relationships among the different constructs. Our findings revealed a moderate level of R2 values (0.413), indicating that our model has good predictive power and can account for 41% of the variance between Herding and FL.

Furthermore, we evaluated the importance of each variable in the model by measuring the change in R2 value when a specific variable was omitted. This was done by calculating the f2 effect size, which revealed that the HB and FB had a substantial

Impact on the ID in the model, with respective f2 values of 0.137 and 0.284. Additionally, the f2 value for FL on Herding was 0.032. These findings indicate that each variable included in our model significantly contributes to the coefficient of determination and that the omission of any exogenous variable may result in a poor model fit. These recommended practices align with the works of Cohen (1988) and Kenny (2016).

We also utilized the blindfolding procedure to determine the predictive relevance of our model, and found that the Q2 value was 0.320, which is greater than 0. This result aligns with the guidelines suggested by Hair et al. (2017) and indicates that the predictive relevance of our model is considered acceptable.

Direct Relationships

Our research findings indicate a positive and significant correlation between HB and ID (? = 0.308; p < 0.000), as well as between FL and ID (? = 0.442; p < 0.000), lending support to both H1 and H2 hypotheses. Specifically, the results suggest that investors' tendency to engage in HB has a direct and favourable impact on their investment decision-making process. Additionally, the findings reveal that FL is strongly associated with investment decision-making. Figure 1 provides a visual representation of these results.

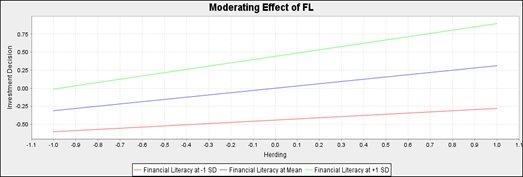

Similarly, the moderator effects of FL on the association of HB wih ID was also found to be

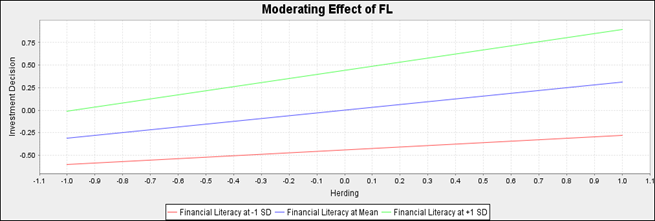

significant. The simple effect of EI on PID was ?=0.308 (p<0.000) at an average level of FL as moderator. As well as the intersectional effect was also significant at 0.146 (p<0.000), indicating that for every one standard deviation increase in FL will strengthen the relationship of EI and PID increased by 0.146. Which has confirmed the acceptance of our study`s hypothesis H3 i.e., FL moderates the relationship of HB and ID. Thus Our study uncovered a noteworthy and positive moderating effect of FL on the paths linking HB to ID. When Specifically, we observed that an escalation in FL value led to a corresponding increase in the potency of the association between HB and ID. These results are clearly demonstrated in Figure 2.

Figure 2. Simple slop of moderating effect of FL.

The simple slope graph presents these effects more clearly, with the middle blue line representing the relationship between HB and ID for an average level of the FL moderator. The upper green line, with a steeper slope, represents high levels of the moderator, while the lower red line, with a flatter slope, represents low levels of the moderator.

Findings

The results prove that the HB is positively associated with the investment decision, with a coefficient of 0.308 and significant at p<0.01. An increase of one unit in the herding leads to a 0.308 value improvement in the investment decision supporting the acceptance of hypothesis 1 that the HB variable influences the ID.

The FL has a positive coefficient value of 0.442 which is also significant p<0.01, indicating that an increase of one unit in FL results in a 0.422 value improvement in the investment decision. These findings support the acceptance of hypothesis 2, which posits that FL has a significant effect on ID.

In the present study, we employed FL as a moderator to investigate its impact on the association between HB and ID. Our findings indicated that FL had a coefficient value of 0.146, indicating that a one-unit increase in FL resulted in a 0.146 increase in the strength of the link between HB and ID. Additionally, our statistical analysis demonstrated that the FL variable as a moderator was highly significant (p < 0.000), underscoring the critical role played by FL in moderating the relationship between HB and ID.

These outcomes lend strong support to our H3 hypothesis and are of particular significance for policymakers and investors alike. Our findings highlight the importance of promoting FL among investors as a means of facilitating informed ID while also mitigating HBin financial markets. As such, these results are likely to have important implications for the development of policies aimed at enhancing the FL of investors and promoting more rational investment behavior in financial markets.

Discussion and Conclusion

The study's results suggest that the HB of investors plays a significant role in shaping ID, with higher levels of herding bias associated with an increased tendency to invest. Our results are confirmatory to previous work conducted by Ghalandari and Ghahremanpour (2013), which also established a correlation between herding bias and ID. In this context, herding bias can be viewed as the investor's tendency to believe and accept the recommendations of acquaintances, family, or brokers when making ID (Bikhchandani & Sharma, 2000). This behavior can be mainly prevalent in circumstances where there is a dearth of information or uncertainty about the future direction of the market, leading investors to rely on the opinions of others as a shortcut to making decisions (Devenow & Welch, 1996). rephrase like guru expert researcher

Overall, these results have important implications for the development of effective investment strategies, highlighting the need for investors to remain vigilant and make informed decisions based on reliable information, rather than following the crowd. As such, it is crucial for individual investors to exercise sound judgment in making IDs. Try and attempt to avoid the potential negative consequences of herding bias. Similar findings are also concluded by Qasim et al., (2019). The conclusions of this study also suggest that financial education programs aimed at increasing the FL of investors could be particularly effective in mitigating the negative effects of herding behavior.

The study's outcomes indicate a noteworthy influence of FL on ID, with higher levels of FL associated with increased ID. These results align with previous research conducted by Novianggie and Asandimitra (2019), which found a positive correlation between the variables under investigation. This suggests that individuals with greater FL can utilize their knowledge to analyze investment-related information more effectively, allowing them to make more informed IDs. These findings are a reflection of the notion that FL is a critical component of financial decision-making, as it enables individuals to select the most suitable investment option (Wardani & Lutfi, 2019).

Finally, in our main model as shown in Table 4, we also found that with the application of our moderator FL, the results showed a positive and significant simple relationship between HBand ID, with a path coefficient of 0.308 and a p-value of 0.000. Similarly, FL as a moderator showed a positive and significant impact on the path of herding to ID, with a path coefficient of 0.146 and a p-value of 0.000, indicating that the relationship is significantly moderated and further improved by 0.146 degrees. These results are consistent with previous research that has highlighted the importance of FL in enhancing the quality of investment decision-making (Huston, 2010). Thus, FL programs and education initiatives aimed at increasing the financial knowledge and decision-making skills of investors may play a vital role in enhancing the effectiveness of investment strategies and reducing the negative effects of herding behavior.

Limitations and Direction for Research Future Studies

Although this study offers valuable insights, it is important to acknowledge its limitations and shortcomings for future research. Firstly, the study's sample size was limited to investors in the Pakistan stock exchange using non-probability convenience sampling, which may not be generalizable to other populations. Future studies should examine whether the findings hold true for other groups of investors. Secondly, the study relied on self-reported data, which could introduce bias and measurement errors. Future research should use objective measures to improve accuracy. Thirdly, the cross-sectional design limits the ability to establish causality, and future studies could utilize longitudinal research designs to understand the dynamic relationships between variables. Fourthly, the study was conducted soon after the pandemic COVID-19, which may have impacted the validity of responses. Future research should be conducted in a less stressful context. Fifthly, the study only considered Herding as an independent variable, and future research could examine a wider range of factors that may influence ID. Lastly, the study only examined only FL as moderating variables other moderating variables like income levels, market experience and risk tolerance may also be considered in future research. Other suitable mediating variables could also be considered for more comprehensive research. Despite these limitations, this study provides significant direction for future research and can inform the development of new investment strategies that take into account individual characteristics and FL

References

- Adiputra, I. et al. (2021). "Investors' behavioral biases in the Indonesian stock market." International Journal of Economics, Commerce, and Management, IX(2).

- Ahearne, A. G., Grieb, T. M., & Wei, L. (2004). Monetary policy and stock market booms. International Journal of Central Banking, 1, 51-78.

- Al-Tamimi, A. & Kalli, A. B. (No date). Financial literacy and investment decision making.

- Altman, M. (2012). Financial literacy and the limits of financial behavior modification. The Journal of Consumer Affairs, 46(3), 471-496.

- Ateş, S., Coşkun, A., & Şahin, M. A. (2016). Impact of Financial Literacy on the Behavioral Biases of Individual Stock Investors: Evidence from Borsa Istanbul. Business and Economics Research Journal, 7(3), 1–1.

- Atkinson, A. B., & Messy, F. (2012). Financial literacy and the demand for financial advice. Journal of Pension Economics & Finance, 11(03), 401-429.

- Baker, H. K., & Filbeck, G. (Eds.). (2013). Portfolio theory and management. Oxford University Press.

- Baker, M., & Filbeck, G. (2013). Behavioral finance. South-Western College Pub.

- Barber, B. M., & Odean, T. (2000). Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors. SSRN Electronic Journal, 55(2), 773–806.

- Barber, B. M., & Odean, T. (2008). All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors. Review of Financial Studies, 21(2), 785–818.

- Braha, D. (2012). "HBin financial markets: A survey." Journal of Economic Surveys, 26(5), 772-808.

- Bucher-Koenen, T. & Ziegelmeyer, A. (2011). Does financial literacy improve financial behavior? Evidence from a large-scale natural field experiment. Journal of Business Economics, 81(7), 991-1019.

- Cakan, E., & Balagyozyan, A. (2016). Sectoral Herding: Evidence from an Emerging Market. Journal of Accounting and Finance, 16(4), 87.

- Chen, H. and Volpe, R. P. (2002). Financial literacy of the American elderly. Financial Services Review, 11(2), 121-145.

- Clements, K. et al. (2017). "HBin financial markets: A review." Journal of Behavioral Finance, 18(2), 99-110.

- Gallagher, D. G., Lopez, A. D., & Wilson, O. J. (2011). The financial literacy of the US population: Results from the 2009 National Financial Capability Study. FINRA Investor Education Foundation.

- Garg, A., & Gulati, R. (2013). Do investors herd in Indian market. DECISION, 40(3), 181– 196.

- Gudjonsson, G. (1988). The reasoning criminal. Rational choice perspectives on offending. Behaviour Research and Therapy, 26(3), 287.

- Hilgert, M. A., Hogarth, J. M., & Beverly, S. G. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 89(7), 309-322.

- Hirt, G. A., Block, S. B., (2006). Fundamentals of investment management. McGraw Hill.

- Hon-Snir, S., Kudryavtsev, A., & Cohen, G. (2012). Stock Market Investors: Who Is More Rational, and Who Relies on Intuition? International Journal of Economics and Finance, 4(5).

- Huston, S. J. (2010). Measuring Financial Literacy. Journal of Consumer Affairs, 44(2), 296–316.

- Jain, J., Walia, N., & Gupta, S. (2019). Evaluation of behavioral biases affecting investment decision making of individualequity investors by fuzzy analytic hierarchy process. Review of Behavioral Finance, ahead-of-print(ahead-of-print).

- Jr., J. F. H., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB- SEM: updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107.

- Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263–292.

- Kengatharan, K. and Kengatharan, C. (2014). "HBand investment decisions: Evidence from the Sri Lankan stock market." International Journal of Economics and Financial Issues, 4(1), 194-200.

- Komalasari, N. et al. (2020). "HB in stock market: Evidence from Indonesia." International Journal of Economics, Commerce and Management, VIII(8).

- Landberg, R. (2003). "Individual herding in financial markets." International Journal of Theoretical and Applied Finance, 6(1), 33-46.

- Lim, K. H. (2012). "HB and its impact on stock returns: Evidence from the Malaysian stock market." International Journal of Economics and Finance, 4(5), 160-167.

- Lo, A. W. (2004). The Adaptive Markets Hypothesis. The Journal of Portfolio Management, 30(5), 15–29.

- Lusardi, A., & Mitchell, O. S. (2007). Baby Boomer retirement security: The roles of planning, financial literacy, and housing wealth. Journal of Monetary Economics, 54(1), 205–224.

- Lusardi, A., & Mitchelli, O. S. (2007). Financial Literacy and Retirement Preparedness: Evidence and Implications for Financial Education. Business Economics, 42(1), 35–44.

- Mintzberg, H., Ahlstrand, B., & Lampel, J. (1976). Strategy Safari: A Guided TourThrough the Wilds of Strategic Management. Simon and Schuster.

- Mintzberg, H., Raisinghani, D., & Theoret, A. (1976). The Structure of “Unstructured†Decision Processes. Administrative Science Quarterly, 21(2), 246

- Nofsinger, J. R. (2005). Social Mood and Financial Economics. Journal of Behavioral Finance, 6(3), 144–160.

- Nozick, R. (1993). The Nature of Rationality. Princeton University Press.

- Pasewark, W. R., & Riley, M. E. (2009). It’s a Matter of Principle: The Role of Personal Values in Investment Decisions. Journal of Business Ethics, 93(2), 237–253.

- Persaud, A. (2000). Sending the Herd Off the Cliff Edge: The Disturbing Interaction Between Herding and Market-Sensitive Risk Management Practices. The Journal of Risk Finance, 2(1), 59–65.

- Postmus, J. L., hetling, A., & Hoge, G. (2014). Evaluating a Financial Education Curriculum as an Intervention to Improve Financial Behaviors and Financial Well- Being of Survivors of Domestic Violence: Results from a Longitudinal Randomized Controlled Study. Journal of Consumer Affairs, 49(1), 250–266.

- Prechter, R. R. (2016). The Socionomic Theory of Finance. Gainesville: Socionomics Institute Press.

- Ramadan, I. Z. (2014). Confidence Index Determinants of the Amman Stock Exchange Listed Companies. International Journal of Business and Management, 10(1).

- Shefrin, H., & Statman, M. (2000). Behavioral Portfolio Theory. The Journal of Financial and Quantitative Analysis, 35(2), 127– 151.

- Son, J., & Park, J. (2018). Effects of financial education on sound personal finance in Korea: Conceptualization of mediationeffects of financial literacy across income classes. International Journal of Consumer Studies, 43(1), 77–86.

- Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39–60.

- Tversky, A., & Kahneman, D. (1974). Judgment Under Uncertainty: Heuristics and Biases. Science, 185(4157), 1124–1131.

- Van Rooij, M., Lusardi, A., & Alessie, R. (2009). Financial Literacy and Stock Market Participation. SSRN Electronic Journal.

- Yoong, J., & Ferreira, V. R. D. M. (2013). Improving financial education effectiveness through behavioural economics: OECD key findings and way forward. OECD Publishing, 1, 1926-1982.

Cite this article

-

APA : Ullah, R., Hassan, F. S. U., & Saleem, K. (2022). The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions. Global Economics Review, VII(II), 201-212. https://doi.org/10.31703/ger.2022(VII-II).18

-

CHICAGO : Ullah, Roman, Faqir Sajjad Ul Hassan, and Kashif Saleem. 2022. "The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions." Global Economics Review, VII (II): 201-212 doi: 10.31703/ger.2022(VII-II).18

-

HARVARD : ULLAH, R., HASSAN, F. S. U. & SALEEM, K. 2022. The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions. Global Economics Review, VII, 201-212.

-

MHRA : Ullah, Roman, Faqir Sajjad Ul Hassan, and Kashif Saleem. 2022. "The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions." Global Economics Review, VII: 201-212

-

MLA : Ullah, Roman, Faqir Sajjad Ul Hassan, and Kashif Saleem. "The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions." Global Economics Review, VII.II (2022): 201-212 Print.

-

OXFORD : Ullah, Roman, Hassan, Faqir Sajjad Ul, and Saleem, Kashif (2022), "The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions", Global Economics Review, VII (II), 201-212

-

TURABIAN : Ullah, Roman, Faqir Sajjad Ul Hassan, and Kashif Saleem. "The Buffering role of Financial Literacy on the Relationship of Herding Behaviour and Investment Decisions." Global Economics Review VII, no. II (2022): 201-212. https://doi.org/10.31703/ger.2022(VII-II).18